Get the free Personal Financial Statement - StonehamBank

Show details

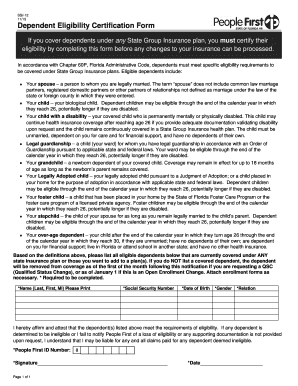

Personal Financial Statement DATE: Individual / / Spouse (If Joint Statement) Name Residence Address City State Zip Code Business Phone Residence Phone Cell Phone EMAIL Address Social Security Number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your personal financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal financial statement online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit personal financial statement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out personal financial statement

How to fill out personal financial statement:

01

Start by gathering all necessary financial documents such as bank statements, investment account statements, credit card statements, and loan statements.

02

Organize these documents by separating them into categories, such as assets, liabilities, income, and expenses.

03

Begin filling out the personal financial statement by listing all of your assets. This includes items such as real estate, vehicles, cash, investments, and valuable personal property.

04

For each asset, provide a description, estimated value, and any outstanding loan balance associated with it.

05

Move on to listing your liabilities. Include any mortgages, loans, credit card debt, or other outstanding financial obligations.

06

For each liability, provide the creditor's name, outstanding balance, interest rate, and minimum monthly payment.

07

Next, list your sources of income. Include your salary, rental income, dividends, interest, and any other forms of income you receive regularly.

08

For each source of income, specify the amount received and the frequency (monthly, quarterly, annually, etc.).

09

Finally, list your monthly expenses. This includes items such as rent or mortgage payments, utilities, insurance premiums, transportation costs, groceries, and entertainment expenses.

10

Calculate your total assets, total liabilities, and determine your net worth by subtracting your liabilities from your assets.

11

Review your personal financial statement for accuracy and make any necessary adjustments.

12

Sign and date the statement, certifying that the information provided is true and accurate to the best of your knowledge.

Who needs a personal financial statement?

01

Individuals who are applying for a loan, such as a mortgage or business loan, often need to submit a personal financial statement to the lender.

02

Entrepreneurs or business owners may need a personal financial statement when seeking funding or investment for their business.

03

Some employers may require a personal financial statement as part of the hiring or promotion process, especially for positions involving financial responsibility.

04

Accountants or financial advisors may request a personal financial statement from their clients to have a comprehensive understanding of their financial situation and provide appropriate advice.

05

Individuals who want to evaluate their own financial health and track their progress may choose to create a personal financial statement for personal record-keeping purposes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is personal financial statement?

A personal financial statement is a document that provides an overview of an individual's financial situation, including their assets, liabilities, income, and expenses.

Who is required to file personal financial statement?

Individuals who meet specific criteria, such as public officials, candidates for public office, or individuals serving in certain positions, may be required to file a personal financial statement.

How to fill out personal financial statement?

To fill out a personal financial statement, you typically need to gather information about your assets, liabilities, income, and expenses. This information is then used to complete the appropriate sections of the statement.

What is the purpose of personal financial statement?

The purpose of a personal financial statement is to provide a snapshot of an individual's financial health and to disclose any potential conflicts of interest or financial obligations.

What information must be reported on personal financial statement?

Information that is typically reported on a personal financial statement includes assets (such as real estate, investments, and personal property), liabilities (such as mortgages, loans, and credit card debt), income (such as salary and investment income), and expenses (such as rent, utilities, and transportation costs).

When is the deadline to file personal financial statement in 2023?

The deadline to file a personal financial statement in 2023 may vary depending on the specific requirements and regulations of the governing body or organization. It is recommended to consult the applicable guidelines or contact the relevant authority to determine the deadline.

What is the penalty for the late filing of personal financial statement?

The penalty for the late filing of a personal financial statement can also vary depending on the governing body or organization. In some cases, late filing may result in fines, adverse legal consequences, or other disciplinary actions. It is advisable to refer to the specific regulations or consult with the relevant authority to understand the penalties for late filing.

How can I send personal financial statement for eSignature?

personal financial statement is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an eSignature for the personal financial statement in Gmail?

Create your eSignature using pdfFiller and then eSign your personal financial statement immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out the personal financial statement form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign personal financial statement. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your personal financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.