Get the free Volum e 109 N ew stand Price 50c tfi * Open Letter To The Citizens Of Santo Anna ' '...

Show details

. Volume 109 New stand Price 50c TDI * Open Letter To The Citizens Of Santa Anna '. Ft.* 'V 'V, RI ratio... Bonfire The bonfire will take place on Thursday evening, October. 13 at near the practice

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your volum e 109 n form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your volum e 109 n form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit volum e 109 n online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit volum e 109 n. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out volum e 109 n

How to fill out volume 109 n:

01

Start by gathering all necessary information and documents. This may include personal and financial details, such as your name, address, social security number, income statements, and any deductions or credits you may be eligible for.

02

Read the instructions carefully. Volume 109 n is typically associated with a specific form or tax-related document, like an IRS form or a financial statement. Make sure you understand the purpose and requirements of the form before filling it out.

03

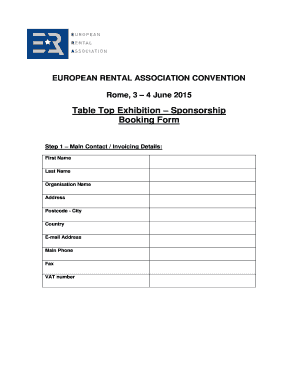

Begin with the top section of the form. This usually includes providing your personal information, such as your name, address, and social security number or taxpayer identification number. Follow the instructions on how to enter each piece of information accurately.

04

Proceed to the main body of the form. This is where you will provide specific details or answer questions related to your financial situation or the purpose of the form. Be sure to double-check your entries for accuracy, as errors or incorrect information may result in delays or penalties.

05

If there are any additional schedules or attachments required, make sure to complete them thoroughly and attach them to the main form as instructed. These additional schedules may be necessary to provide details or support specific claims or deductions.

06

Review your completed volume 109 n form thoroughly. Make sure you have answered all necessary questions, provided accurate information, and attached any required schedules or documentation. It is always a good idea to double-check your work to avoid mistakes or omissions.

07

Sign and date the form. Most of the time, your signature is required to certify the accuracy of the information provided. Failure to sign the form may render it invalid.

08

Make copies of the completed volume 109 n form for your records. It is a prudent practice to retain a copy of any tax-related documents or forms submitted to the relevant authority.

09

Submit the form according to the provided instructions. This typically involves mailing the form to the appropriate address or electronically filing it, depending on the specific requirements and options available.

10

Keep track of any communication or correspondence related to your submission. If there are any questions or issues, having a record of your submission and any supporting documentation will be helpful in resolving them efficiently.

Who needs volume 109 n:

01

Taxpayers: Volume 109 n is typically required for individuals or businesses who need to report certain financial information or meet specific tax obligations. It is important to check if this form applies to your particular situation.

02

Employers: Employers may need volume 109 n to report employee compensation, such as wages, salaries, and tips. This form ensures accurate reporting and compliance with tax laws and regulations.

03

Financial institutions: Certain financial institutions, such as banks or credit unions, may require volume 109 n for reporting interest income earned by their customers or account holders.

04

Investors: Individuals or entities investing in certain types of financial instruments, such as mutual funds or real estate investment trusts (REITs), may need to report dividends or capital gains using volume 109 n.

05

Independent contractors: If you work as an independent contractor or freelancer, you may need volume 109 n to report income earned from your self-employed activities.

06

Non-residents: Non-resident individuals or foreign entities with sources of income from within a particular country may need to complete volume 109 n to comply with tax obligations in that jurisdiction.

07

Other: There may be other individuals or entities who need volume 109 n based on specific circumstances or regulatory requirements. It is essential to consult with a tax professional or relevant authorities to determine if this form is required for your particular situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is volum e 109 n?

Volum e 109 n is a form used to report certain information to the IRS.

Who is required to file volum e 109 n?

Individuals, businesses, and organizations who meet certain criteria must file Volum e 109 n.

How to fill out volum e 109 n?

Volum e 109 n can be filled out manually or electronically, following the instructions provided by the IRS.

What is the purpose of volum e 109 n?

The purpose of Volum e 109 n is to report specific information to the IRS for tax purposes.

What information must be reported on volum e 109 n?

Volum e 109 n requires reporting of various types of income, expenses, and other financial data.

When is the deadline to file volum e 109 n in 2024?

The deadline to file Volum e 109 n in 2024 is April 15th.

What is the penalty for the late filing of volum e 109 n?

The penalty for late filing of Volum e 109 n is $50 per form, up to a maximum penalty of $545,500.

How can I edit volum e 109 n from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your volum e 109 n into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I sign the volum e 109 n electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your volum e 109 n in seconds.

How do I edit volum e 109 n straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing volum e 109 n, you can start right away.

Fill out your volum e 109 n online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.