Get the free T r s x Gulf Coast Council Leader Recognition and Eagle Class - gulfcoastcouncil

Show details

2016 Gulf Coast Council Leader Recognition and Eagle Class Banquet When: Saturday, January 30, 2016, at 5:30 pm Where: First Baptist Church of Pensacola, Chile Hall 500 N. Paradox Street, Pensacola,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your t r s x form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t r s x form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit t r s x online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit t r s x. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out t r s x

How to fill out t r s x:

01

Start by gathering all the necessary information and documents required to fill out t r s x. This may include personal identification details, financial records, and any other relevant information.

02

Carefully read and understand the instructions or guidelines provided for filling out t r s x. This will help ensure that you provide accurate and complete information.

03

Begin by entering your personal details, such as your name, address, and contact information, in the designated fields.

04

Follow the prompts to provide any additional information or answer specific questions related to t r s x. Make sure to provide accurate information and double-check for any errors before proceeding.

05

If applicable, provide any financial information or statements as required by t r s x. This may include details about your income, expenses, assets, or debts. Ensure that all figures are accurate and up to date.

06

Review your completed t r s x form before submitting it. Check for any missing or incomplete information, and make any necessary corrections.

07

Sign and date the t r s x form in the designated areas. This is usually required to validate the information provided.

08

Keep a copy of the filled-out t r s x form for your records. It is recommended to make a photocopy or digital copy for future reference.

Who needs t r s x:

01

Individuals who have received income from various sources and are required to report it to the relevant tax authorities may need to fill out t r s x. This can include self-employed individuals, freelancers, or those with multiple sources of income.

02

Business owners or employers may also need to fill out t r s x if they are required to report payroll taxes or other tax-related information for their employees.

03

Anyone who has received certain government benefits or subsidies may also be required to fill out t r s x to report their income and determine their eligibility for these benefits.

04

Additionally, some individuals or businesses may need to fill out t r s x if they have certain financial transactions or investments that require reporting, such as capital gains or losses.

Overall, the specific need for t r s x can vary depending on individual circumstances and the applicable tax laws and regulations in a particular jurisdiction.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is t r s x?

t r s x stands for Report of Foreign Bank and Financial Accounts (FBAR), which is required to report foreign financial accounts.

Who is required to file t r s x?

United States persons, including citizens, residents, entities, and certain non-resident aliens, who have a financial interest in or signature authority over foreign financial accounts exceeding certain thresholds.

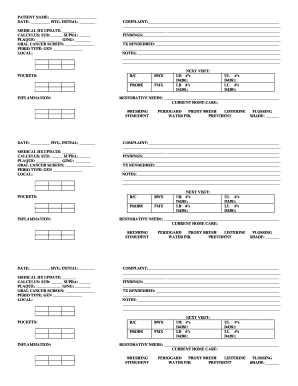

How to fill out t r s x?

The FBAR form can be filled out online through the Financial Crimes Enforcement Network (FinCEN) website. It requires information about the account, including the account number, name on the account, and maximum account value during the year.

What is the purpose of t r s x?

The purpose of the FBAR is to combat tax evasion by providing the U.S. government with information about foreign financial accounts held by U.S. persons.

What information must be reported on t r s x?

Information such as the account number, name on the account, the financial institution, account type, and maximum account value during the year must be reported on the FBAR.

When is the deadline to file t r s x in 2024?

The deadline to file the FBAR for the year 2024 is April 15, 2025.

What is the penalty for the late filing of t r s x?

The penalty for the late filing of the FBAR can be up to $12,921 per violation, with additional penalties possible for willful violations.

How do I complete t r s x online?

With pdfFiller, you may easily complete and sign t r s x online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my t r s x in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your t r s x right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit t r s x on an Android device?

The pdfFiller app for Android allows you to edit PDF files like t r s x. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your t r s x online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.