Get the free Estate notices - PA Legal Ads Online

Show details

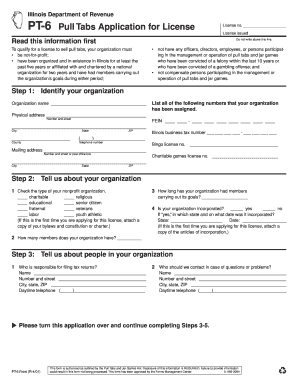

FAYETTE LEGAL JOURNAL ESTATE NOTICES Notice is hereby given that letters testamentary or of administration have been granted to the following estates. All persons indebted to said estates are required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate notices - pa

Edit your estate notices - pa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate notices - pa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate notices - pa online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit estate notices - pa. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate notices - pa

How to fill out estate notices - PA?

01

Start by obtaining the required forms from the local probate court in Pennsylvania. These forms can usually be found on the court's website or by visiting the courthouse in person.

02

Carefully read through the instructions provided with the forms to understand the specific requirements for filling them out. This will help ensure that you provide all the necessary information and avoid any potential mistakes.

03

Begin by filling out the basic information section, including the name and contact details of the deceased person, as well as your own contact information if you are the person filling out the notice.

04

Depending on the specific form, you may need to provide details about the deceased person's assets, such as real estate, bank accounts, investments, etc. Include all relevant information as requested on the form.

05

If there are any debts or liabilities associated with the estate, make sure to accurately list them on the form. This can include outstanding loans, mortgages, credit card debts, etc.

06

In some cases, you may also need to provide information about any beneficiaries or heirs of the estate, including their names, addresses, and relationship to the deceased person.

07

Double-check all the information you have entered on the form to ensure accuracy and completeness. Any mistakes or missing information could cause delays or complications in the probate process.

08

Once you are satisfied with the accuracy of the form, sign and date it as required. If there are any additional documents or attachments that need to be submitted along with the notice, make sure to include them as well.

09

Finally, submit the completed estate notice form to the probate court in the county where the deceased person resided. Follow any specific instructions provided by the court regarding the submission process.

Who needs estate notices - PA?

01

Executors or personal representatives of the estate: Estate notices are typically required to be filed by the person appointed as the executor or personal representative of the deceased person's estate. This individual is responsible for managing the estate's affairs and ensuring that all legal requirements are met.

02

Beneficiaries and heirs: In some cases, beneficiaries or heirs of the estate may also need to file estate notices in order to claim their rights to the assets or property left behind by the deceased person. This can help ensure that all interested parties are notified and given an opportunity to participate in the probate process.

03

Creditors and debtors: Estate notices are important for notifying creditors and debtors of the deceased person's estate about the probate proceedings. This allows them to file any claims or address any outstanding debts related to the estate.

04

Interested parties or potential claimants: Estate notices also serve to notify any other interested parties or potential claimants, such as other relatives or individuals who may have a legal right to the deceased person's property. This helps ensure transparency and fairness in the distribution of the estate.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send estate notices - pa to be eSigned by others?

When you're ready to share your estate notices - pa, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for signing my estate notices - pa in Gmail?

Create your eSignature using pdfFiller and then eSign your estate notices - pa immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete estate notices - pa on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your estate notices - pa, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is estate notices - pa?

Estate notices - pa are legal notifications that are required to be filed with the Pennsylvania Register of Wills to inform interested parties about a deceased person's estate.

Who is required to file estate notices - pa?

The personal representative of the deceased person's estate is required to file estate notices - pa.

How to fill out estate notices - pa?

Estate notices - pa can typically be filled out online or in person at the office of the Pennsylvania Register of Wills.

What is the purpose of estate notices - pa?

The purpose of estate notices - pa is to notify interested parties, such as creditors or beneficiaries, about the deceased person's estate.

What information must be reported on estate notices - pa?

Information such as the deceased person's name, date of death, and information about the personal representative must be reported on estate notices - pa.

Fill out your estate notices - pa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Notices - Pa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.