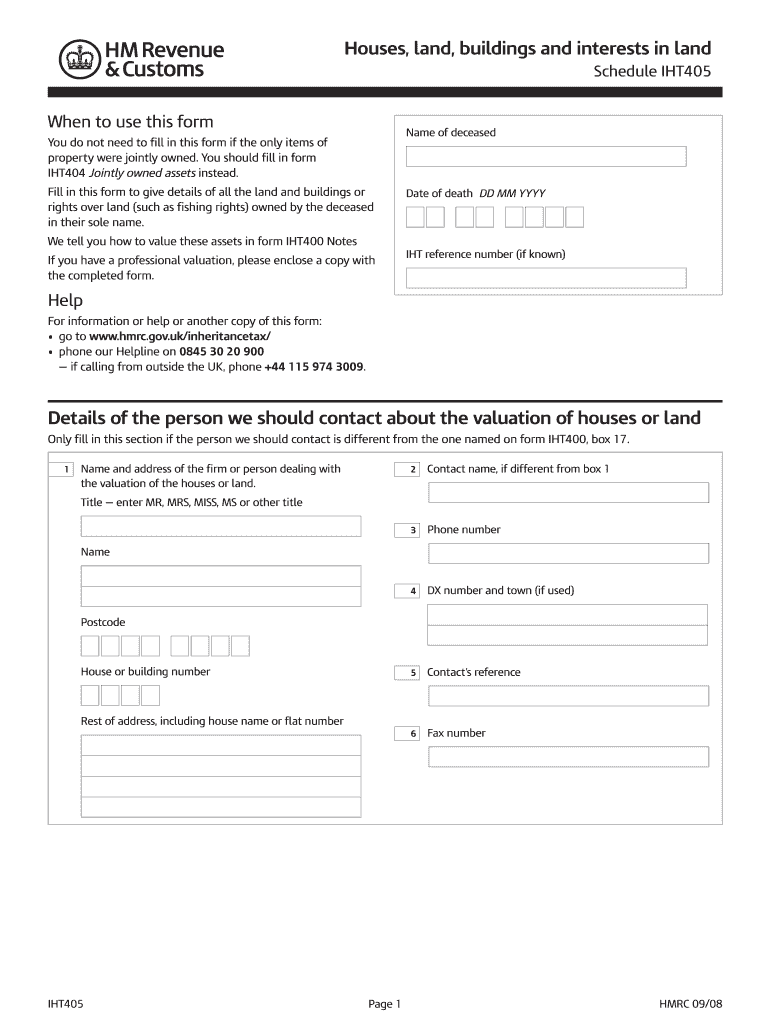

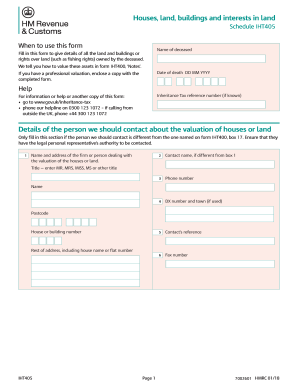

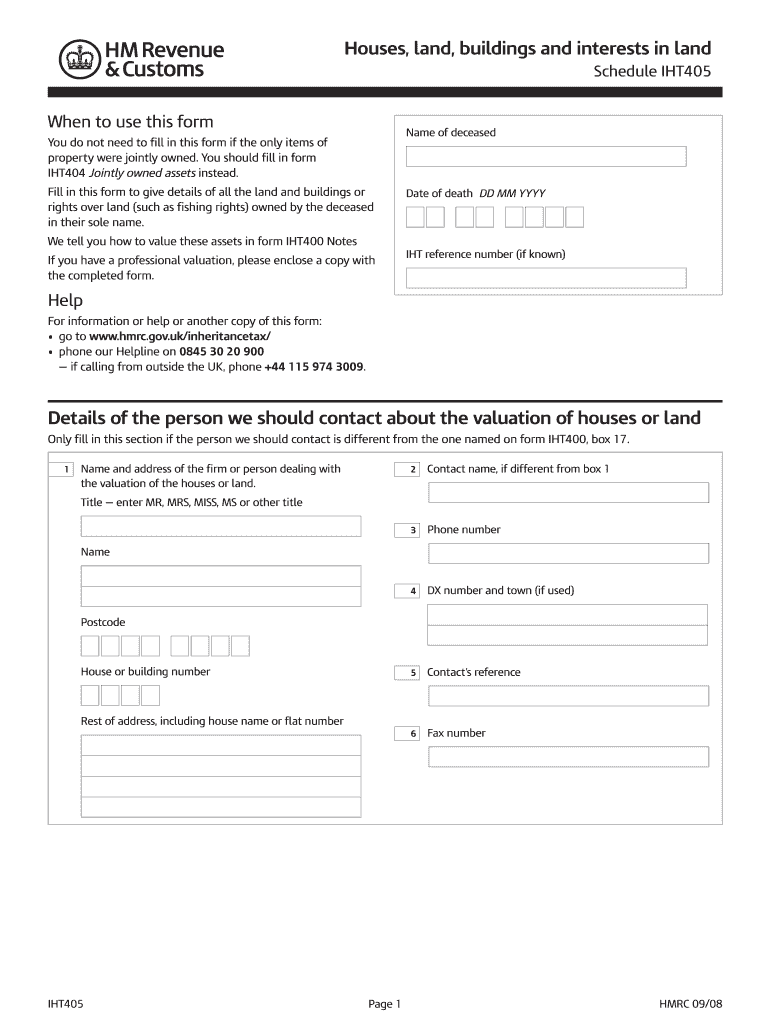

UK HMRC IHT405 2008 free printable template

Get, Create, Make and Sign

How to edit iht 405 form online

UK HMRC IHT405 Form Versions

How to fill out iht 405 form

How to fill out iht 405 form:

Who needs iht 405 form:

Instructions and Help about iht 405 form

Hello my name is Jacqueline Davies and×39’m a student at Saint Leo University here beside me, I have Cindy and I want to thank you, Cindy, for giving me the time to ask you a couple questions absolutely and IN×39’m going to start right now okay so what×39’s your full name I'Cindy Dhiraj breeze and entertainment productions of the name of our company and we×39’re located at 3711 swan avenue Tampa Florida what is your current position I kid and I say in×39’m chief p on, but I am the president of prisoner obtainment and productions we've been in business for 21 years proud to tell you that how long have you worked in the hospitality and tourism industry I'Veblen in the industry most of my life of my working career life, so I have to Sammy own business for 21 years previously to that I was a director of catering atone of the four-star hotels in Tampa freight years and then before that Worked at Busch Gardens in thefoodservice FIDA beverage department and previous to that I helped my family run their own restaurant and bar and what was your first job in the hospitality and tourism industry I think my very first job was actually our own business we owned a pub called the 42ndStreet Station which was on forty-secondand bush, and we were way ahead of our time it was a sub shop during the Dayan a disco at night what was one of the biggest challenges you×39’ve had in your career honestly it's IN×39’m Dyslexic and SOI was very concerned about that and how would perceive to be able to be in the corporate world and I had a mentor in the business, and she shared with me that should surround myself with people that have strengths where my weaknesses are done you like your job I love what Do I don't call it a job Blessed to be doing something that Absolutely love to do what advice do you have for students wanted to get into this business whether it's this business or any business I really feel that you need to be passionate about what you choose honest integrity and follow your heart don't follow the money will come thank you so much Cindy Appreciate it

Fill form : Try Risk Free

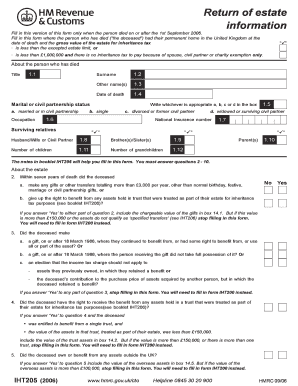

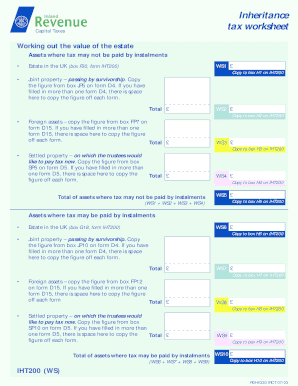

People Also Ask about iht 405 form

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your iht 405 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.