Get the free United States Small Business Administration Office of

Show details

Cite as: NAILS Appeals of Heritage Health Solutions, Inc., SBA No. NAICS5650 (2015) United States Small Business Administration Office of Hearings and Appeals NAILS APPEALS OF: Heritage Health Solutions,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your united states small business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your united states small business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit united states small business online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit united states small business. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

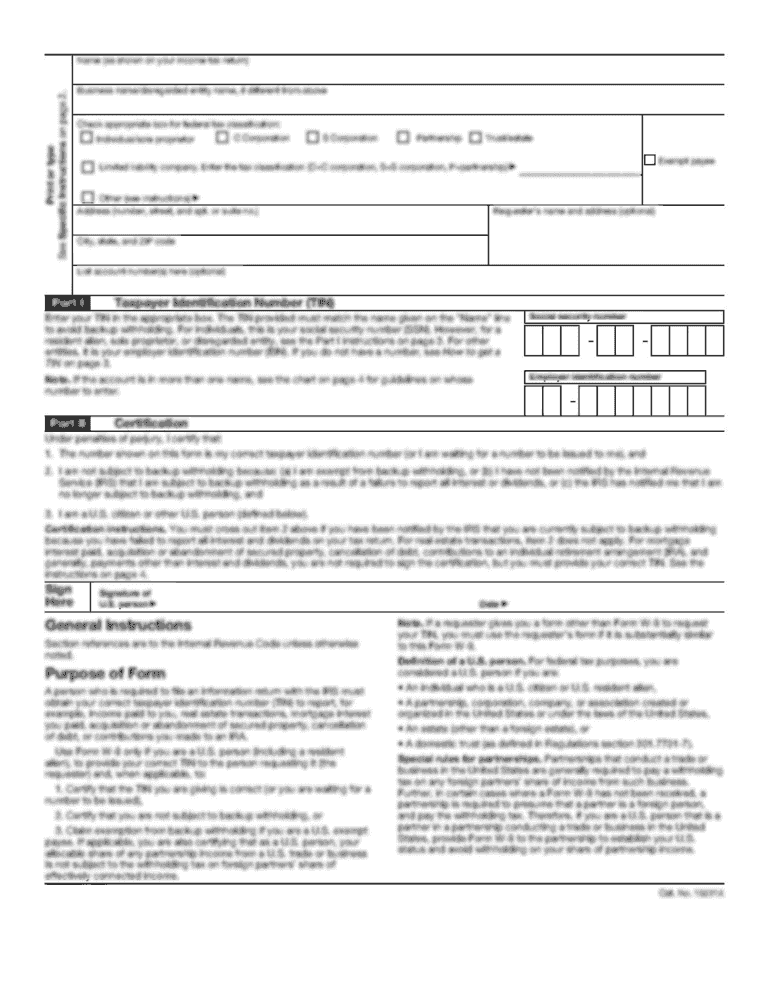

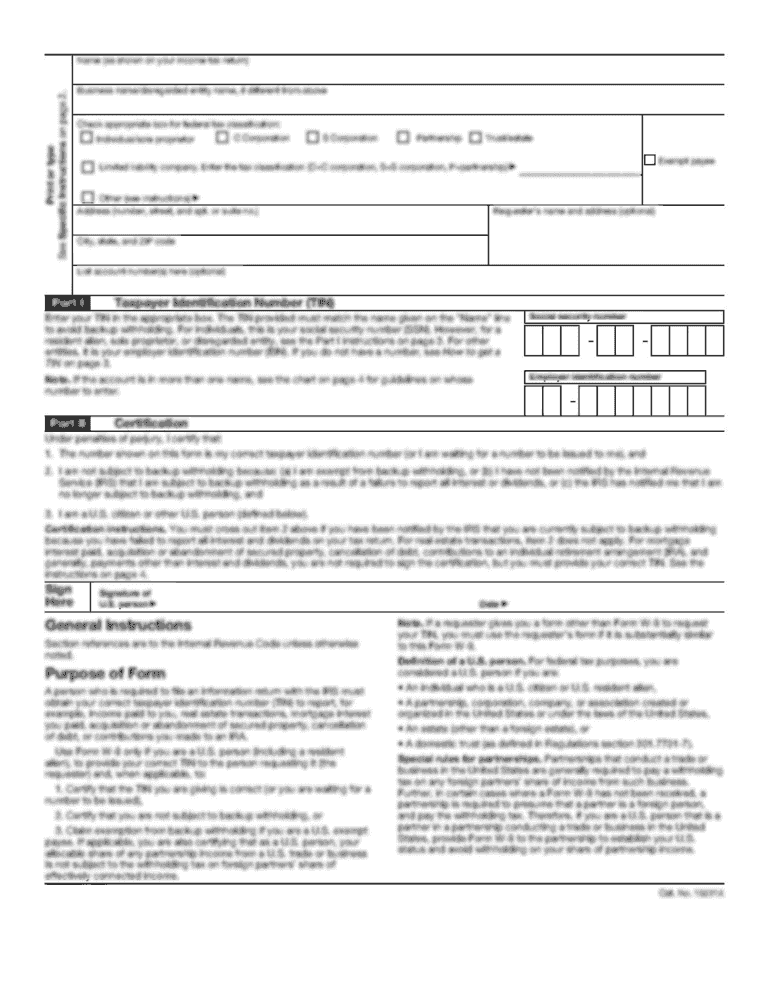

How to fill out united states small business

How to Fill out United States Small Business?

Start by gathering the necessary information:

01

Business name and contact information

02

Employer Identification Number (EIN)

03

Business structure (sole proprietorship, partnership, corporation, etc.)

04

Industry classification code (NAICS code)

05

Ownership and organizational structure details

Determine the legal requirements:

01

Check if you need any permits or licenses for your specific business activities

02

Identify any regulations or compliance obligations applicable to your industry

03

Research local, state, and federal tax requirements

Register your small business:

01

Choose a business name that complies with the legal requirements

02

Register it with the appropriate state agency

03

If your business is a corporation or LLC, file the necessary formation documents with the state

Obtain necessary permits and licenses:

01

Research and apply for any required permits or licenses specific to your industry and location

02

Consult with local government agencies or use online resources to identify the permits you need

Apply for an Employer Identification Number (EIN):

01

Visit the official website of the Internal Revenue Service (IRS) and complete the online application

02

Obtain an EIN, which is required for tax purposes and hiring employees

Understand and comply with tax obligations:

01

Determine the appropriate federal taxes you need to withhold from employees' wages

02

Register for state and local taxes, such as sales tax if applicable

03

Keep accurate records of your business's financial transactions for tax reporting purposes

Consider other registrations and requirements:

01

If you plan to hire employees, understand and fulfill your responsibilities as an employer

02

If you'll be selling products or services online, research and comply with e-commerce regulations

03

Explore any industry-specific registrations or certifications that can benefit your business

Who needs United States small business?

Aspiring Entrepreneurs:

01

Individuals starting their own business venture or pursuing their entrepreneurial dreams

02

Those seeking independence, flexibility, and the opportunity to shape their own future

Existing Business Owners:

01

Owners of small businesses looking to expand their operations to the United States

02

Foreign businesses wanting to establish a presence or tap into the American market

Job Seekers:

01

Individuals seeking employment or career opportunities within small businesses

02

Those attracted to the potential for growth, learning, and working in a dynamic environment

In conclusion, anyone interested in starting or expanding a small business in the United States can benefit from learning how to fill out the necessary paperwork and understanding the requirements and responsibilities that come with it. Whether you're an aspiring entrepreneur, an existing business owner, or a job seeker, the United States small business industry offers ample opportunities for success and growth.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is united states small business?

A small business in the United States is typically defined as a company with fewer than 500 employees.

Who is required to file united states small business?

Small businesses in the United States are required to file their taxes annually with the Internal Revenue Service.

How to fill out united states small business?

To fill out a small business tax return in the United States, business owners can use tax preparation software or hire an accountant.

What is the purpose of united states small business?

The purpose of filing a tax return for a small business in the United States is to report income and expenses accurately to the IRS.

What information must be reported on united states small business?

Information that must be reported on a small business tax return includes gross income, deductions, credits, and employee wages.

When is the deadline to file united states small business in 2024?

The deadline to file small business taxes in the United States for 2024 is typically April 15th.

What is the penalty for the late filing of united states small business?

The penalty for late filing of small business taxes in the United States can be up to 5% of the unpaid tax amount for each month the return is late, up to a maximum of 25%.

How can I modify united states small business without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your united states small business into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for the united states small business in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your united states small business in seconds.

How do I complete united states small business on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your united states small business, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your united states small business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.