Get the free Guideline for Transfer of Mice to the 5th Richards bb - Penn Medicine - uphs upenn

Show details

University of PennsylvaniaRadiology Small Animal Imaging Facility Steering Committee Standard Operating Procedure Title: Guideline for Transfer of Mice to the 5th Richards Animal Imaging Holding Areas

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your guideline for transfer of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guideline for transfer of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

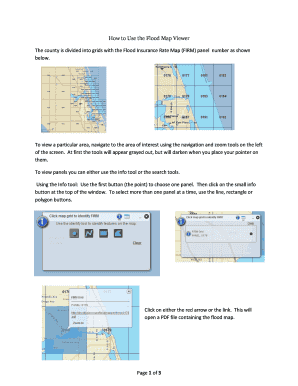

Editing guideline for transfer of online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit guideline for transfer of. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out guideline for transfer of

How to fill out a guideline for transfer of:

01

Begin by clearly stating the purpose of the transfer guideline. This includes explaining why the transfer is necessary and what it aims to achieve.

02

Provide step-by-step instructions on how to initiate the transfer process. Include any necessary forms, documents, or information that need to be filled out or gathered.

03

Outline the responsibilities and roles of each party involved in the transfer. This may include individuals or departments responsible for initiating, approving, and executing the transfer.

04

Include specific guidelines regarding the transfer timeline. Specify key milestones and deadlines to ensure a smooth and timely transfer process.

05

Clearly state any criteria or requirements that need to be met for a successful transfer. This could include compliance with legal regulations, obtaining necessary approvals, or meeting certain quality standards.

06

Provide instructions on how to address any potential risks or challenges that may arise during the transfer process. Include contingency plans and alternative approaches, if applicable.

07

Emphasize the importance of clear and effective communication throughout the transfer. Encourage regular updates, feedback, and collaboration among all parties involved.

08

Finally, make sure to review and revise the guideline periodically to keep it up to date with any changes in processes, regulations, or best practices.

Who needs guideline for transfer of:

01

Organizations undergoing structural changes or reorganization.

02

Companies merging or acquiring other businesses.

03

Government agencies transferring responsibilities or services to different departments or entities.

04

Educational institutions transferring students, faculty, or programs.

05

Non-profit organizations transferring assets, programs, or operations.

06

Any other individual or entity involved in a transfer process seeking guidance and best practices to ensure a successful and smooth transition.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is guideline for transfer of?

The guideline for transfer of is a set of instructions and regulations regarding the transfer of assets or ownership from one party to another.

Who is required to file guideline for transfer of?

The parties involved in the transfer, such as the seller and the buyer, are required to file the guideline for transfer of.

How to fill out guideline for transfer of?

The guideline for transfer of can be filled out by providing all necessary information about the transfer, including details about the parties involved and the assets being transferred.

What is the purpose of guideline for transfer of?

The purpose of the guideline for transfer of is to ensure that the transfer of assets or ownership is conducted in a legal and transparent manner.

What information must be reported on guideline for transfer of?

The guideline for transfer of must include information such as the names and contact details of the parties involved, details about the assets being transferred, and any relevant terms and conditions of the transfer.

When is the deadline to file guideline for transfer of in 2024?

The deadline to file guideline for transfer of in 2024 is December 31st.

What is the penalty for the late filing of guideline for transfer of?

The penalty for the late filing of guideline for transfer of may include fines or additional fees imposed by the relevant authorities.

Where do I find guideline for transfer of?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the guideline for transfer of in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the guideline for transfer of electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your guideline for transfer of in seconds.

How do I edit guideline for transfer of on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute guideline for transfer of from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your guideline for transfer of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.