Get the free GIFT OF PUBLICLY TRADED SECURITIES FORM - Dog Guides

Show details

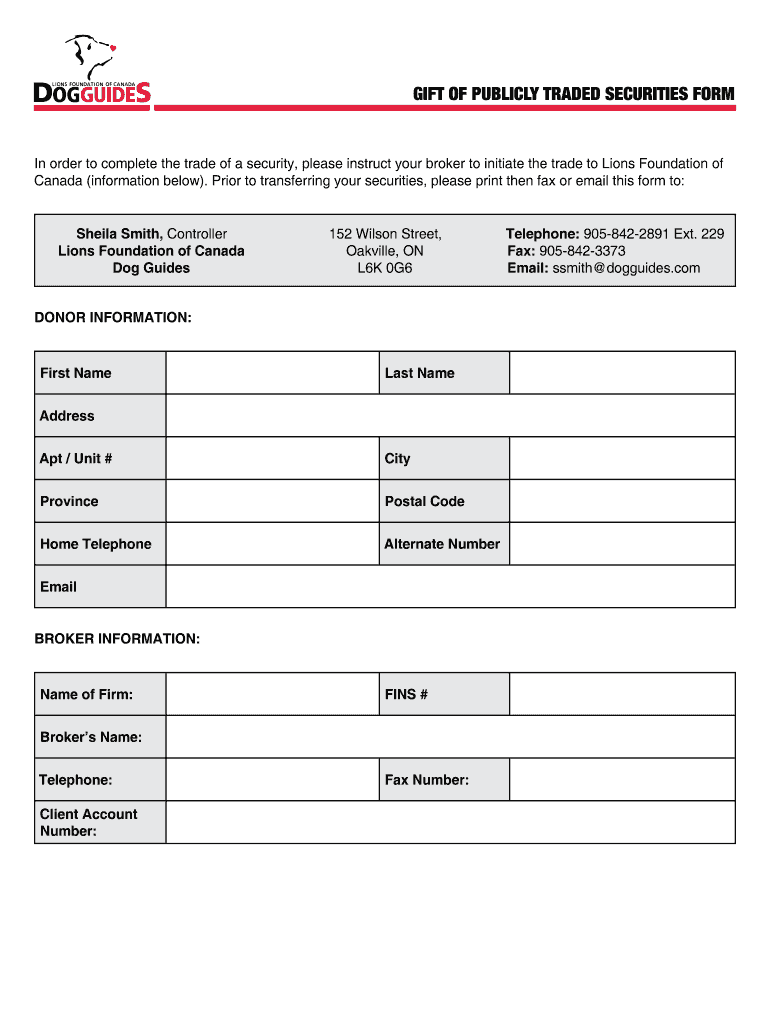

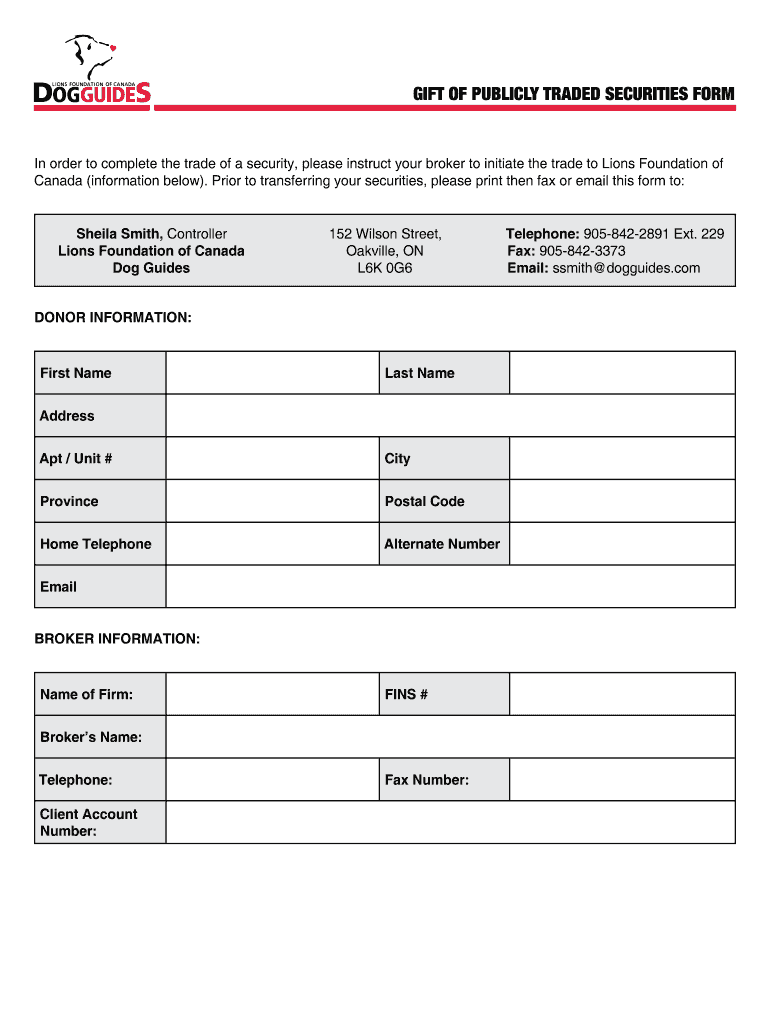

GIFT OF PUBLICLY TRADED SECURITIES FORM In order to complete the trade of a security, please instruct your broker to initiate the trade to Lions Foundation of Canada (information below). Prior to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift of publicly traded

Edit your gift of publicly traded form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift of publicly traded form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gift of publicly traded online

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gift of publicly traded. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift of publicly traded

How to fill out gift of publicly traded:

01

Gather the necessary information: Before filling out the gift of publicly traded form, gather all the relevant details such as the name of the donor, the date of the gift, the number of shares, and the fair market value of the stocks.

02

Obtain the appropriate form: Contact the organization or institution to which you wish to donate the publicly traded stocks and inquire about the specific form required for the gift. They may have their own unique form or provide a standardized one.

03

Fill out the donor information: Start by providing your personal information as the donor, including your full name, address, and contact details. This information is important for the organization to maintain a record of the gift and issue a receipt for tax purposes.

04

Provide the details of the publicly traded gift: In the form, indicate the specific details of the gift, such as the name of the company whose stocks you are donating, the number of shares, and the fair market value of the stocks. This information helps the organization properly acknowledge and process the donation.

05

Seek professional advice: While filling out the form, consult with a tax advisor or financial professional to ensure all the necessary information is accurately provided. They can guide you through any additional documentation or requirements specific to your situation.

06

Submit the completed form: Once you have filled out all the required information, double-check for any errors or missing details. Attach any supporting documents requested by the organization, such as a copy of the securities transfer form or a letter of authorization. Submit the completed form and accompanying documents to the designated department or individual within the organization.

Who needs gift of publicly traded:

01

Individuals wanting to support a charitable cause: A gift of publicly traded stocks is an option for individuals who wish to make a charitable donation while potentially receiving tax benefits. By donating appreciated stocks instead of cash, donors can often avoid capital gains taxes and still receive a tax deduction for the fair market value of the stocks.

02

Non-profit organizations: Non-profit organizations, charities, and educational institutions are the recipients of the gift of publicly traded stocks. They rely on such donations to support their activities, programs, and initiatives. These organizations often have specific guidelines, procedures, and forms in place to facilitate the donation process and ensure compliance with legal and accounting requirements.

03

Financial and tax advisors: Professionals in the financial and tax field often advise their clients on the benefits and implications of making a gift of publicly traded stocks. They assist individuals in understanding the potential tax advantages, navigate the donation process, and ensure compliance with relevant laws and regulations. Seeking advice from these professionals can help donors make informed decisions and optimize the impact of their charitable giving.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find gift of publicly traded?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific gift of publicly traded and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make edits in gift of publicly traded without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing gift of publicly traded and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out gift of publicly traded on an Android device?

Use the pdfFiller app for Android to finish your gift of publicly traded. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is gift of publicly traded?

A gift of publicly traded refers to the donation of stocks, bonds, or other securities that are traded on public exchanges.

Who is required to file gift of publicly traded?

Individuals or organizations who receive a gift of publicly traded securities may be required to file the necessary documentation with the appropriate authorities.

How to fill out gift of publicly traded?

To fill out a gift of publicly traded, individuals or organizations must provide detailed information about the securities being donated, including their value and any relevant transaction details.

What is the purpose of gift of publicly traded?

The purpose of gift of publicly traded is to ensure transparency and accuracy in reporting the donation of publicly traded securities.

What information must be reported on gift of publicly traded?

Information such as the name of the donor, the type and quantity of securities donated, their value, and any relevant dates must be reported on gift of publicly traded.

Fill out your gift of publicly traded online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Of Publicly Traded is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.