Get the free LIFE & ACCIDENT INSURANCE

Show details

LIFE & ACCIDENT INSURANCE CERTIFICATE BOOKLET GROUP INSURANCE FOR NEWLY COUNTY REST SCHOOL NUMBER 955 TEACHERS WITHOUT HEALTH The benefits for which you are insured are set forth in the pages of this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your life amp accident insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life amp accident insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life amp accident insurance online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit life amp accident insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out life amp accident insurance

How to fill out life and accident insurance:

01

Gather personal information: Start by collecting your personal details such as your full name, date of birth, and contact information. You will also need to provide information about your occupation and any existing medical conditions.

02

Determine coverage needs: Evaluate your insurance needs by considering your financial responsibilities and dependents. Calculate the amount of coverage required to provide for your loved ones in case of an accident or loss of life. This may include factors such as outstanding debts, funeral expenses, and future financial obligations.

03

Research insurance providers: Look for reputable insurance companies that offer life and accident insurance policies. Compare the coverage options, premium rates, and customer reviews to ensure you select the most suitable provider for your needs.

04

Get quotes: Contact the insurance companies you have shortlisted and request quotes for their life and accident insurance policies. Provide them with the necessary information to receive accurate quotes that reflect your coverage requirements.

05

Review policy details: Carefully review the policy documents and understand the terms and conditions, coverage limits, exclusions, and payment options. Ensure that you comprehend all the policy features and ask questions if anything is unclear.

06

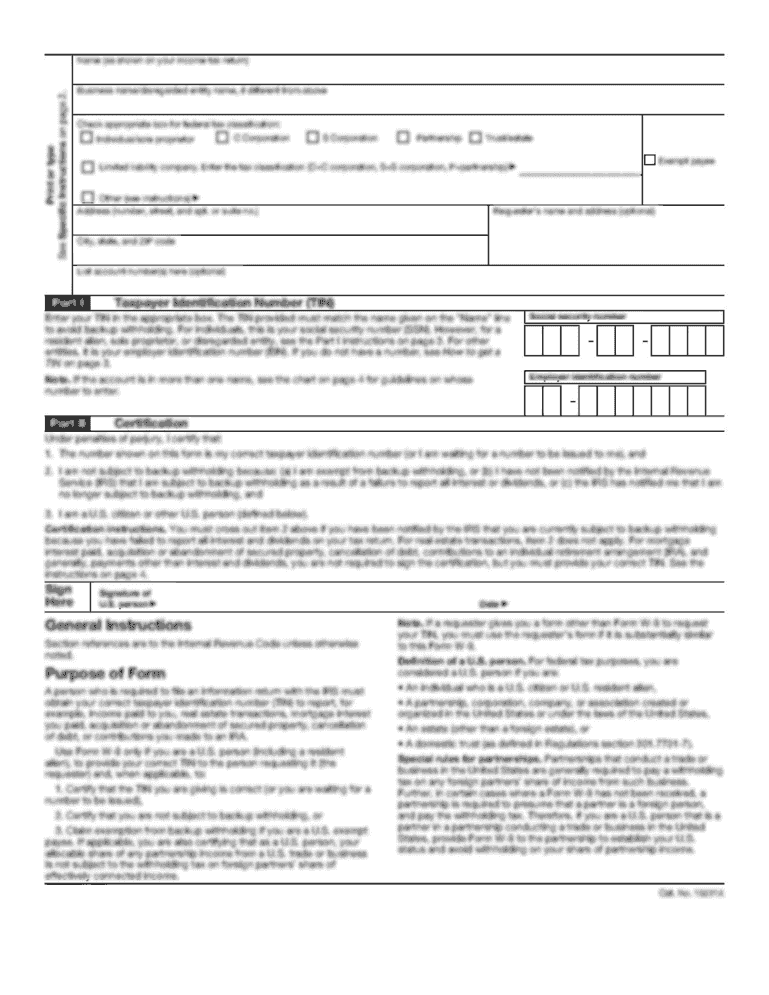

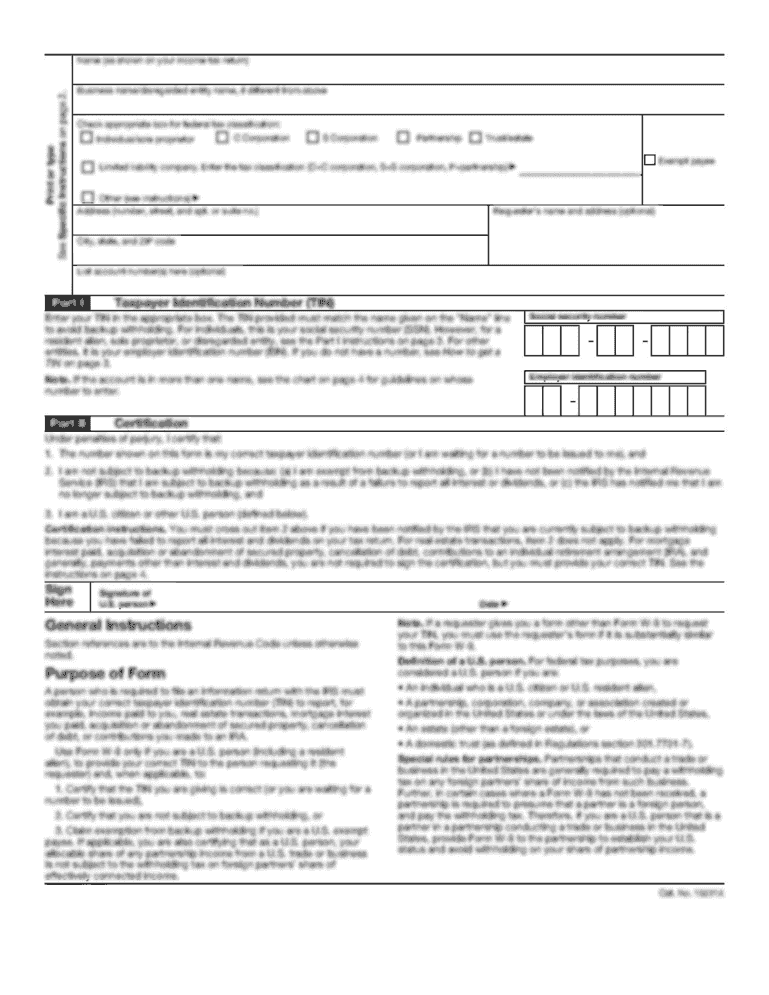

Complete the application: Fill out the insurance application form accurately and honestly. Double-check all the information provided to avoid any mistakes or omissions. Be prepared to disclose any relevant medical history or hazardous activities you engage in.

07

Submit required documents: Along with the application form, you may need to provide additional documents such as identification proofs, medical reports, or financial statements as per the insurance company's requirements. Ensure that all the required documents are correctly included with your application.

08

Pay premiums: Once you have reviewed the policy and submitted the application, you will be required to pay the initial premium amount. This can usually be done through various payment options such as online payment, bank transfer, or credit card.

Who needs life and accident insurance?

01

Individuals with dependents: If you have dependents who rely on your income, such as a spouse, children, or elderly parents, life and accident insurance can provide financial support in the event of your death or disability.

02

Breadwinners: If you are the primary or sole earner in your family, life and accident insurance can help ensure that your loved ones can maintain their financial stability and cover necessary expenses even if you are no longer able to provide for them.

03

Business owners: If you own a business, life and accident insurance can safeguard your company's financial future and protect against the loss of key employees. It can also be used for business continuation planning or covering outstanding debts or loans.

04

Individuals with financial obligations: If you have outstanding debts, such as mortgages, loans, or credit card balances, life and accident insurance can help cover those obligations, preventing your loved ones from being burdened by the financial responsibility.

05

Anyone concerned about covering medical expenses: Accident insurance can provide financial protection in the event of injuries or accidents, covering medical bills, hospitalization expenses, and rehabilitation costs.

Remember, it is always advisable to consult with a licensed insurance professional or financial advisor to determine the specific insurance coverage that best suits your individual needs and circumstances.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is life amp accident insurance?

Life and accident insurance is a type of insurance policy that provides coverage in the event of death or injury resulting from an accident.

Who is required to file life amp accident insurance?

Individuals who want to protect themselves and their loved ones from financial hardships caused by unexpected accidents or death are required to file for life and accident insurance.

How to fill out life amp accident insurance?

To fill out a life and accident insurance policy, individuals must provide personal information, select coverage options, and designate beneficiaries.

What is the purpose of life amp accident insurance?

The purpose of life and accident insurance is to provide financial protection and peace of mind to individuals and their families in the event of unexpected accidents or death.

What information must be reported on life amp accident insurance?

Information such as personal details, medical history, coverage options, and beneficiary information must be reported on a life and accident insurance policy.

When is the deadline to file life amp accident insurance in 2024?

The deadline to file for life and accident insurance in 2024 may vary depending on the insurance provider, but typically it is before the coverage start date.

What is the penalty for the late filing of life amp accident insurance?

The penalty for late filing of life and accident insurance may result in a lapse of coverage or additional fees, depending on the insurance provider's policies.

How do I make edits in life amp accident insurance without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing life amp accident insurance and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I sign the life amp accident insurance electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your life amp accident insurance in minutes.

How do I edit life amp accident insurance straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing life amp accident insurance right away.

Fill out your life amp accident insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.