Get the free comparing checking accounts worksheet form

Show details

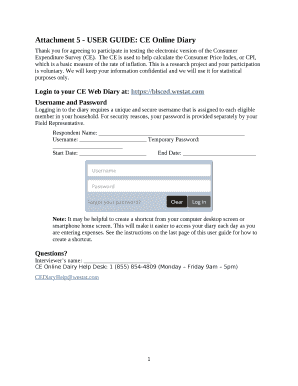

COMPARING CHECKING ACCOUNTS WORKSHEET Call or visit the websites of several nearby or convenient financial institutions to learn more about their checking accounts. From all this information, you

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your comparing checking accounts worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your comparing checking accounts worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit comparing checking accounts worksheet online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit comparing checking accounts worksheet. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

How to fill out comparing checking accounts worksheet

How to fill out comparing checking accounts worksheet?

01

Gather relevant information: Collect details about different checking account options such as fees, interest rates, minimum balance requirements, overdraft charges, and any other features that are important to you.

02

Create a worksheet: Design a comparison chart or use a pre-made template to create a worksheet. Include columns for the different checking accounts you are considering and rows for the various information you gathered.

03

Fill in the details: Enter the specific information for each checking account in the appropriate columns and rows of the worksheet. Make sure to accurately record all the relevant information for each account.

04

Compare the options: Once you have filled in all the details, review the worksheet to compare the different checking account options. Analyze the fees, interest rates, minimum balance requirements, and any other factors that are important to you. This will help you identify the account that best suits your needs.

05

Make a decision: Based on the information you have gathered and the comparisons made on the worksheet, make an informed decision on which checking account to choose. Consider your financial goals, transaction needs, and any other factors that are important to you.

Who needs comparing checking accounts worksheet?

01

Individuals looking to open a new checking account: A comparing checking accounts worksheet can help individuals evaluate different options and choose the account that best aligns with their financial needs.

02

People who want to switch checking accounts: If you are considering switching your current checking account to a different bank or financial institution, a comparing checking accounts worksheet can be useful in comparing the features and benefits of different accounts.

03

Those seeking to save money on fees and charges: By comparing checking accounts, you can identify accounts with lower fees and charges, helping you save money in the long run.

04

Individuals who want to maximize their savings: Some checking accounts offer interest rates on deposits. By comparing different accounts, you can find one that offers higher interest rates, helping you maximize your savings.

In summary, anyone who wants to find the best checking account option, whether they are opening a new account, switching accounts, looking to save money, or aiming to maximize their savings, can benefit from using a comparing checking accounts worksheet.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is comparing checking accounts worksheet?

A comparing checking accounts worksheet is a document or spreadsheet that allows individuals to compare the features, fees, and benefits of different checking accounts offered by various banks or financial institutions. It typically includes a list of criteria such as minimum balance requirements, monthly maintenance fees, overdraft fees, ATM access, online banking features, interest rates, and any additional perks or incentives. By using this worksheet, individuals can easily compare and evaluate the different checking account options available to them before making a decision.

Who is required to file comparing checking accounts worksheet?

Individuals who are actively comparing checking accounts in order to find the best option for their personal financial needs would be required to fill out a comparing checking accounts worksheet. This worksheet is typically used to list and compare various factors such as fees, interest rates, services offered, and other features of different checking accounts. It helps individuals make an informed decision before opening a checking account with a particular bank or financial institution. Additionally, financial advisors or professionals may also use such worksheets to assist their clients in comparing checking accounts.

How to fill out comparing checking accounts worksheet?

To fill out a comparing checking accounts worksheet, you can follow these steps:

1. Gather information: Collect information on different checking accounts you are considering. This information can be found on banks' websites, brochures, or by contacting the banks directly. Make sure to obtain details on fees, requirements, minimum balance, interest rates, and any additional features or benefits.

2. Create a worksheet: Create a spreadsheet or a table with columns and rows to compare different aspects of the checking accounts. The columns can include headings such as Bank Name, Monthly Fee, Minimum Balance, Interest Rate, ATM Access, Overdraft Protection, and any other factors that are important to you.

3. List the bank names: In the first column, list the names of the banks or financial institutions you are considering.

4. Fill in the details: Start filling in the other columns with the specific details of each checking account. For example, under Monthly Fee, enter the amount you would be charged for each account, or indicate if there is no monthly fee. For other aspects like Minimum Balance or Interest Rate, enter the specific figures or percentages associated with each account.

5. Add additional factors: If there are other specific features you are interested in, such as ATM access, mobile banking options, or rewards programs, create additional columns for these factors and fill them in accordingly.

6. Evaluate and compare: Once you have filled in all the necessary details, carefully review and compare the different accounts. Consider factors such as monthly fees, interest rates, minimum balance requirements, and additional services or benefits that align with your financial needs and preferences.

7. Make a decision: Based on your comparison, decide which checking account offers the best combination of features and benefits that fit your requirements. Choose the account that best suits your financial goals, and consider opening an account with that particular bank.

Remember, it's essential to take the time to thoroughly research and compare checking accounts to ensure you select the one that aligns with your financial needs and helps you achieve your goals.

What is the purpose of comparing checking accounts worksheet?

The purpose of comparing checking accounts worksheet is to compare the different features, benefits, fees, and terms associated with various checking accounts offered by different banks or financial institutions. This worksheet helps individuals or businesses make an informed decision about which checking account best suits their needs and preferences by comparing factors such as minimum balance requirements, monthly fees, overdraft charges, ATM access, online banking services, mobile banking features, and other perks. By using this worksheet, individuals can easily assess and compare the pros and cons of various checking accounts in order to select the one that provides the most suitable and cost-effective banking solution.

What information must be reported on comparing checking accounts worksheet?

When comparing checking accounts, the following information should be reported on the worksheet:

1. Account Name: The name of the checking account being compared.

2. Account Type: Whether the account is a basic checking account, interest-bearing checking account, or any other specialized type.

3. Minimum Balance Requirement: The minimum balance required to open and maintain the account.

4. Monthly Maintenance Fee: The fee charged by the bank for maintaining the account, if any.

5. Interest Rate (if applicable): The annual percentage yield (APY) or interest rate offered on the checking account balance, if the account is interest-bearing.

6. ATM Access: Whether the account provides free or limited ATM access, and if there are any associated fees.

7. Overdraft Fees: The fees charged for overdrawing the account balance, including any overdraft protection options available.

8. Debit Card Fees: Any fees associated with using a debit card linked to the checking account.

9. Check Writing Limitations: If there are any restrictions or limitations on the number of checks that can be written per month.

10. Online Banking: Whether online banking services are available, including features like bill pay, mobile banking, and transfer capabilities.

11. Additional Services and Benefits: Any additional services or benefits offered by the bank for holding the checking account, such as free checks, discounts, or rewards programs.

Comparing these factors will help individuals choose the checking account that best suits their needs and preferences.

What is the penalty for the late filing of comparing checking accounts worksheet?

The penalty for late filing of a comparing checking accounts worksheet would vary depending on the specific circumstances and the jurisdiction in which it is being filed. Generally, financial penalties or late fees may be imposed by the regulatory or governing authorities for tardy submissions. It is advisable to consult the relevant regulatory agency or review the applicable laws and regulations to determine the specific penalty for late filing of such a worksheet.

How do I modify my comparing checking accounts worksheet in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign comparing checking accounts worksheet and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit comparing checking accounts worksheet in Chrome?

comparing checking accounts worksheet can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I fill out comparing checking accounts worksheet on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your comparing checking accounts worksheet, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your comparing checking accounts worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.