Get the free 990 Form Under section 501 (c), 527, or 4947( a)(1) of the Internal Revenue Code ( e...

Show details

990 Form Under section 501 (c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation) The organization may have to use a copy of this return to satisfy

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 990 form under section form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 990 form under section form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 990 form under section online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 990 form under section. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

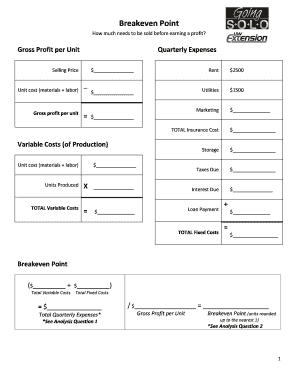

How to fill out 990 form under section

How to fill out 990 form under section:

01

Gather all the necessary information and documents such as your organization's name, address, EIN (Employer Identification Number), and financial statements.

02

Download the 990 form from the official IRS website or request a physical copy from the IRS.

03

Start with the identification area of the form, including your organization's name, address, EIN, and the tax year you are filing for.

04

Proceed to Part I, which asks for basic information about your organization's mission, activities, and accomplishments during the tax year.

05

Complete Part II, where you'll provide details about the organization's governance, including whether you have a board of directors, conflicts of interest policies, and compensation information for key individuals.

06

Move on to Part III, which focuses on your organization's program activities, detailing the different programs or services you offer, the number of individuals served, and the expenses related to each program.

07

In Part IV, you'll report on your organization's revenue and expenses, including contributions, grants, and revenue from program services. Make sure to carefully list each source of income and describe any unusual items or circumstances.

08

Complete Part V to demonstrate your organization's compliance with specific tax-exempt requirements, especially those related to public charity status, lobbying and political activities, and whether your organization operates internationally.

09

In Part VI, disclose information about your organization's governance, management, and certain financial transactions. This includes reporting on compensation, loans, leases, and business transactions involving interested persons.

10

Finally, sign and date the form and fill out the preparer information if applicable. Remember to attach any schedules or additional information required for specific sections.

Who needs 990 form under section?

01

Non-profit organizations recognized as tax-exempt under section 501(c)(3) of the Internal Revenue Code are required to file the 990 form annually. This includes charitable organizations, educational institutions, religious groups, scientific organizations, and certain other types of non-profits.

02

Organizations with gross receipts above a certain threshold (generally $200,000 or $50,000 for smaller non-profits) or with total assets above a certain amount (generally $500,000) must file Form 990. However, some smaller non-profit organizations may be eligible to file a shorter version of the form, like Form 990-EZ or Form 990-N (e-Postcard).

03

Failure to file the 990 form and meet the filing requirements can result in penalties, loss of tax-exempt status, and potential legal consequences. It is essential for organizations that meet the criteria to file the form accurately and on time to remain in compliance with IRS regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 990 form under section?

The 990 form is the annual information return filed by tax-exempt organizations under section 501(c) of the Internal Revenue Code.

Who is required to file 990 form under section?

Most tax-exempt organizations, including nonprofits and charities, are required to file the 990 form.

How to fill out 990 form under section?

The 990 form can be filled out electronically using tax preparation software or manually by completing the form available on the IRS website.

What is the purpose of 990 form under section?

The purpose of the 990 form is to provide the IRS and the public with financial information about tax-exempt organizations, ensuring transparency and accountability.

What information must be reported on 990 form under section?

The 990 form requires organizations to report on their income, expenses, assets, activities, governance, and more.

When is the deadline to file 990 form under section in 2024?

The deadline to file the 990 form in 2024 is typically on the 15th day of the 5th month after the end of the organization's fiscal year.

What is the penalty for the late filing of 990 form under section?

The penalty for the late filing of the 990 form can be $20 per day, up to a maximum of $10,000 or 5% of the organization's gross receipts, whichever is less.

Where do I find 990 form under section?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific 990 form under section and other forms. Find the template you need and change it using powerful tools.

How do I make changes in 990 form under section?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your 990 form under section to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit 990 form under section straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 990 form under section.

Fill out your 990 form under section online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.