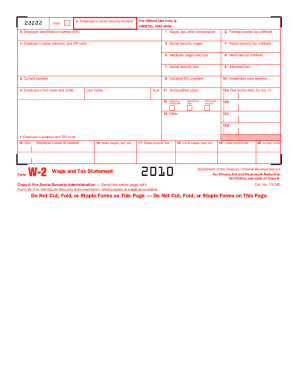

IRS Instruction W-2 & W-3 2009 free printable template

Show details

Userid PAGER/SGML Page 1 of 16 Fileid DTD INSTR04 Leadpct 0 Pt. size 9. 5. Instruct 2009 Cycle Year W-2 INST 09 W2 W3 INST 1-09-09 - 3. Use the name and taxpayer 1099-MISC. Example. Before Employee A s death on June 15 2009 A was employed by Employer X and received 10 000 in wages on which federal income tax of 1 500 was withheld. When A died X owed A 2 000 in wages and 1 000 in accrued vacation pay. The total of 3 000 less the social security and Medicare taxes withheld was paid to A s...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign 2009 w 3 form

Edit your 2009 w 3 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009 w 3 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2009 w 3 form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2009 w 3 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instruction W-2 & W-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2009 w 3 form

How to fill out IRS Instruction W-2 & W-3

01

Gather all necessary employee information including names, addresses, and Social Security numbers.

02

Obtain a blank Form W-2 and Form W-3 from the IRS website or local office.

03

Fill out the employee's personal information in the appropriate boxes on Form W-2.

04

Input the total wages, tips, and other compensation in Box 1 of Form W-2.

05

Complete all tax withholding sections, including federal income tax, Social Security tax, and Medicare tax.

06

Check the applicable boxes for retirement plan and third-party sick pay if necessary.

07

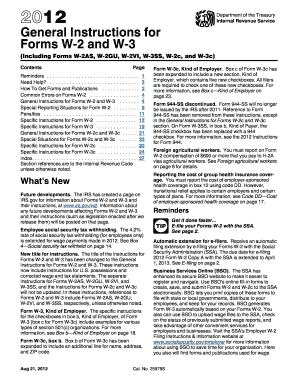

Complete Form W-3 by summarizing the information from all W-2 forms issued.

08

Verify that all information is accurate and correctly matches the employee's records.

09

Submit Form W-2 to the employee and send Form W-3 to the Social Security Administration by the deadline.

Who needs IRS Instruction W-2 & W-3?

01

Employers who pay wages to employees need IRS Instructions W-2 & W-3.

02

Payroll professionals responsible for preparing and filing employee wage reports.

03

Employees who need to understand their payroll information and tax withholdings.

04

Accountants and tax professionals assisting clients with payroll and tax filings.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to file a w3?

You must submit by mail or electronically Copy A of Form(s) W-2 to the SSA with the transmittal Form W-3, Transmittal of Wage and Tax Statements by the last day of January. Special due dates apply if you have terminated your business.

How do I fill out a w3 form?

What do you need to fill out Form W-3? Form W-3 Downloadable PDF. Your EIN number. The total amount paid in tips, and other compensation for the year. The total amount of federal, state, and local taxes withheld for the year. The total amount of Social Security and Medicare taxes withheld for the year.

Is a w3 the same as a W-2?

The key difference is that Form W-2 reports information like total wages and taxes withheld for each individual employee. A W-3 form, by contrast, reports the total employee wages, taxable wages, and tax withheld.

Is there a w3 form?

Form W-3 is a tax form used by employers to report combined employee income to the Internal Revenue Service (IRS) and the Social Security Administration. Employers who send out more than one Form W-2 to employees must complete and send this form to summarize their total salary payment and withholding amounts.

Do I need to fill out a w3?

Who Needs to File W-3 Form? Every employer required to file a Form W-2 must file Form W-3. This translates to most employers in the U.S., as Form W-2 is required after paying an employee more than $600 in wages in a given year, whether or not the employer withholds income or taxes from an employee's wages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2009 w 3 form online?

Completing and signing 2009 w 3 form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit 2009 w 3 form in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your 2009 w 3 form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit 2009 w 3 form on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as 2009 w 3 form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is IRS Instruction W-2 & W-3?

IRS Instruction W-2 provides guidance on how to report wages, tips, and other compensation paid to employees, while W-3 is the summary form that transmits all W-2 forms to the IRS.

Who is required to file IRS Instruction W-2 & W-3?

Employers who pay wages, tips, or other compensation to employees are required to file IRS Form W-2 and W-3.

How to fill out IRS Instruction W-2 & W-3?

To fill out W-2, employers must provide employee information like name, Social Security number, and wage data; W-3 requires summarizing all W-2s filed, including total wages and taxes withheld.

What is the purpose of IRS Instruction W-2 & W-3?

The purpose of W-2 is to report income and withholding for employees, while W-3 serves as a summary for the IRS, ensuring proper tax reporting and compliance.

What information must be reported on IRS Instruction W-2 & W-3?

W-2 must report employee's pay, Social Security wages, Medicare wages, and withheld taxes; W-3 must report total number of W-2 forms filed, total wages paid, and total taxes withheld.

Fill out your 2009 w 3 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2009 W 3 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.