Get the free eu tax on digitally delivered e commerce crs report for congress form - ipmall

Show details

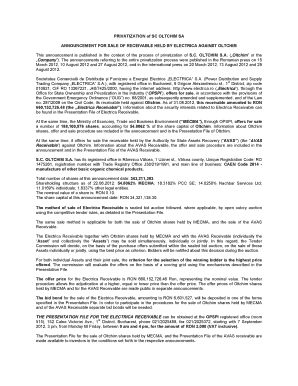

Order Code RS21596 Updated April 7, 2005, CRS Report for Congress Received through the CRS Web EU Tax on Digitally Delivered E-Commerce Martin A. Weiss Analyst in International Trade and Finance Foreign

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your eu tax on digitally form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eu tax on digitally form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit eu tax on digitally online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit eu tax on digitally. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out eu tax on digitally

How to fill out eu tax on digitally:

01

Gather all necessary information and documents related to your digital products or services.

02

Determine whether you are a taxable person for VAT purposes in the EU. If so, you may need to register for VAT in an EU member state.

03

Determine the VAT rates applicable to your digital products or services in each EU member state where you make sales.

04

Determine whether you are eligible to use the VAT Mini One Stop Shop (MOSS) scheme. If eligible, register for MOSS in an EU member state.

05

Complete the MOSS VAT return with the required information, including the total value of sales made in each member state and the applicable VAT rates.

06

Calculate the VAT due for each member state and ensure you have collected the correct VAT amounts from your customers.

07

Submit the MOSS VAT return and pay the VAT due to the relevant tax authority.

08

Keep thorough records of your sales, invoices, and VAT payments for at least 10 years.

Who needs eu tax on digitally:

01

Businesses and individuals that provide digital products or services to consumers in the European Union.

02

Non-EU businesses that exceed the EU's VAT registration thresholds for digital services.

03

Online platforms and marketplaces that facilitate the supply of digital products or services by non-EU businesses to EU consumers.

04

Foreign businesses that are not established in the EU but use VAT MOSS to report and pay VAT on sales made to EU consumers.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is eu tax on digitally?

The EU tax on digital services is a tax on revenue generated by certain digital services provided to customers within the European Union.

Who is required to file eu tax on digitally?

Companies or individuals who provide certain digital services to customers located within the European Union are required to file and pay the EU tax on digital services.

How to fill out eu tax on digitally?

To fill out the EU tax on digital services, businesses need to register for the tax, determine their taxable revenue, calculate the amount of tax due, and submit the necessary documentation and payment to the tax authority.

What is the purpose of eu tax on digitally?

The purpose of the EU tax on digital services is to ensure that companies providing digital services within the EU pay their fair share of taxes, regardless of their physical presence in the EU.

What information must be reported on eu tax on digitally?

The information that must be reported on the EU tax on digital services includes the revenue generated from taxable digital services provided to customers within the EU, as well as any applicable exemptions or deductions.

When is the deadline to file eu tax on digitally in 2023?

The deadline to file the EU tax on digital services in 2023 is currently not available. Please refer to the official tax authority or relevant documentation for the exact deadline.

What is the penalty for the late filing of eu tax on digitally?

The penalty for late filing of the EU tax on digital services may vary depending on the specific regulations of each EU country. It is recommended to consult the tax authority or relevant documentation for detailed information on the penalties and consequences of late filing.

How can I edit eu tax on digitally from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including eu tax on digitally, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for signing my eu tax on digitally in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your eu tax on digitally directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit eu tax on digitally on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing eu tax on digitally.

Fill out your eu tax on digitally online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.