This Operating Agreement is used in the formation of any Limited Liability Company. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

Get the free llc operating agreement georgia

Show details

This document outlines the operating agreement for a limited liability company in Georgia, detailing the formation, management, contributions, profits, and other legal provisions governing the LLC.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign georgia llc operating agreement form

Edit your operating agreement for llc georgia form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your operating agreement llc georgia form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit georgia llc form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit georgia llc operating agreement template form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

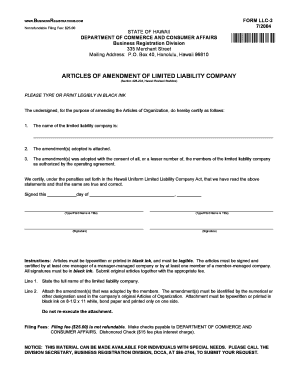

How to fill out articles of organization for llc in georgia form

How to fill out Georgia Limited Liability Company?

01

Research and choose a unique name for your LLC that complies with Georgia state laws.

02

Prepare and file Articles of Organization with the Georgia Secretary of State, including information such as the LLC's name, principal address, registered agent, and members' names and addresses.

03

Obtain any necessary business licenses or permits required for your specific industry or location in Georgia.

04

Create an Operating Agreement that outlines the internal operations and management structure of your LLC, including the rights and responsibilities of members and managers.

05

Apply for an Employer Identification Number (EIN) from the Internal Revenue Service (IRS), which is needed for tax purposes.

06

Register for state and local taxes, including sales tax and unemployment insurance, if applicable to your business.

07

Obtain necessary business insurance, such as general liability insurance or professional liability insurance, to protect your LLC from potential risks and liabilities.

08

Fulfill any additional requirements or obligations specific to your industry or profession, as required by Georgia state regulations.

Who needs Georgia Limited Liability Company?

01

Individuals or groups who plan to start a business in Georgia and want the added protection of personal liability protection that an LLC can provide.

02

Entrepreneurs who want to separate their personal assets from their business liabilities, ensuring that their personal finances are not at risk in the event of a lawsuit or bankruptcy.

03

Professionals, such as attorneys, accountants, or consultants, who want to form a legal business entity to offer their services while enjoying the tax benefits and liability protection of an LLC.

Fill

article of amendment form georgia

: Try Risk Free

People Also Ask about

What is an operating agreement for an LLC are operating agreements required for limited liability companies if not why might it be important to have one?

An operating agreement, sometimes called a company agreement, is a legal document that describes and outlines how an LLC will run, and is an essential document for owning and operating an LLC. Operating agreements are not required in most states; however, that should not dissuade you from creating one.

Is an operating agreement required for a limited liability company to exist?

Most states do not require that an LLC have an operating agreement. For example: In California, Corporations Code Section 17701.02(s) defines an operating agreement. However, the statutes that govern formation of LLCs do not require an operating agreement.

How do I get an operating agreement for an LLC in GA?

How to File (6 Steps) Step 1 – Choose an Entity Name. Step 2 – Select a Registered Agent. Step 3 – File with the Corporations Division. Step 4 – Draft an LLC Operating Agreement. Step 5 – Request an EIN. Step 6 – Annual Registration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my llc operating agreement georgia directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your llc operating agreement georgia along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit llc operating agreement georgia from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including llc operating agreement georgia, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an eSignature for the llc operating agreement georgia in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your llc operating agreement georgia directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is Georgia limited liability company?

A Georgia limited liability company (LLC) is a legal business structure that combines the liability protection of a corporation with the tax flexibility of a partnership. It allows owners, known as members, to limit their personal liability for business debts and obligations.

Who is required to file Georgia limited liability company?

Any individual or group of individuals who wish to operate a business in Georgia as a limited liability company must file for an LLC. This includes entrepreneurs, small business owners, and organizations looking to gain liability protection.

How to fill out Georgia limited liability company?

To fill out the Georgia LLC formation documents, you need to provide details such as the LLC's name, the registered agent's information, the principal office address, and the purpose of the business. This can be done through the Georgia Secretary of State's online portal or by mailing in the required forms.

What is the purpose of Georgia limited liability company?

The purpose of forming a Georgia limited liability company is to limit personal liability for business debts, provide a flexible management structure, and offer potential tax benefits. LLCs can engage in any lawful business activity.

What information must be reported on Georgia limited liability company?

When forming a Georgia LLC, certain information must be reported, including the name of the LLC, the registered agent's name and address, the business's principal office address, and the purpose of the LLC. Additionally, ongoing reports may require updates on management and financial status.

Fill out your llc operating agreement georgia online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Llc Operating Agreement Georgia is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.