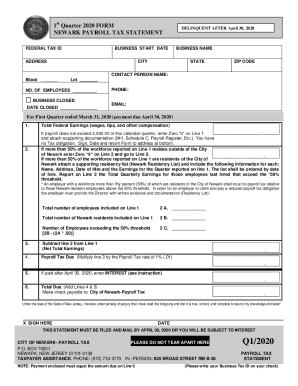

NJ 1st Quarter Payroll Tax Statement 2013 free printable template

Get, Create, Make and Sign

Editing 3rd quarter 2013 payroll online

NJ 1st Quarter Payroll Tax Statement Form Versions

How to fill out 3rd quarter 2013 payroll

How to fill out 3rd quarter 2013 payroll:

Who needs 3rd quarter 2013 payroll:

Instructions and Help about 3rd quarter 2013 payroll

Hi welcome to easy payroll guide my name is Karen Hutchinson and in this video I'm going to be showing you how to complete the IRS 941 form this is the employers quarterly federal tax return this form is due at the end of each quarter so for example quarter one ends on March 31st this would be due by April 30th so April 30th July 31st October 31st and January 31st are the due date for the IRS 941 form this form is going to detail all the tax liabilities for that quarter this is how the IRS reconciles your w3 forms, so you want to make sure that the information on this form is correct what I'm going to do is I'm going to give you a scenario of a small business who had three employees, and I've taken the information from their paychecks, and I've put them into an Excel spreadsheet and this is something that you could do as well for your record-keeping in order to help you to complete or just to check the 941 form, so I have three employees, and I've included their gross pay for each employee and then in the last column I've totaled the gross pay so my total four gross pay is twenty-five thousand four hundred sixty-five dollars and twenty-seven cents I've also included in the spreadsheet the taxes that were withheld from each employee's paycheck now this is just the employee portion of the taxes, so I've included the federal withholding that I've included from each paycheck the employee Medicare portion the employer employee Social Security portion, and I've included the state withholding the state withholding we're not going to need to use or the 941, but I wanted to point that out this is only federal taxes that are going to go on the 941 form, so we are going to be using this portion not the state portion in the 941 form okay now this is the federal withholding so Medicare and Social Security for the entire quarter, so this is what my employees have been paid for all of January all of February and all of March now I'm sorry we're doing fourth-quarter so all of October all of November all of December, so it doesn't matter for three months these are the totals now along with withholding and paying taxes for your employee you also must pay an employer share of those taxes so when you major deposits you would have multiplied the Medicare portion by two and the Social Security portion by two because the employee is paying half, but you're paying half as well so as you can see here in blue the Medicare portion for the employee and the employer are the same and the same for Social Security, so these taxes were paid as well and will be noted on the 941 form so in this red box here I've kind of just summarized what we're going to be using for the nine forty-one we're going to need the total gross pay that you've paid all three employees for all three months of the quarter you will also need to know the withholding total and the total Medicare and Social Security pain it will not be broken out by employee and employer on the nine forty-one form, but you...

Fill form : Try Risk Free

People Also Ask about 3rd quarter 2013 payroll

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 3rd quarter 2013 payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.