Get the free international american trade bill exchange form trial

Show details

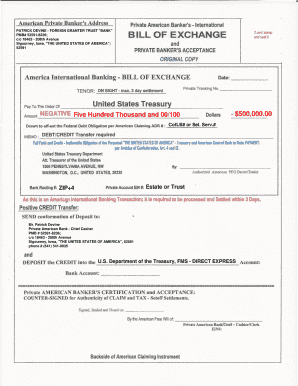

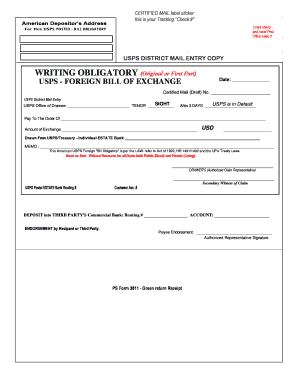

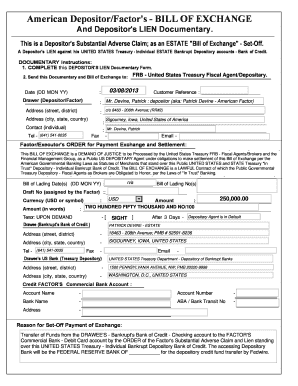

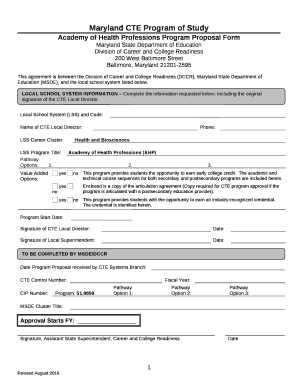

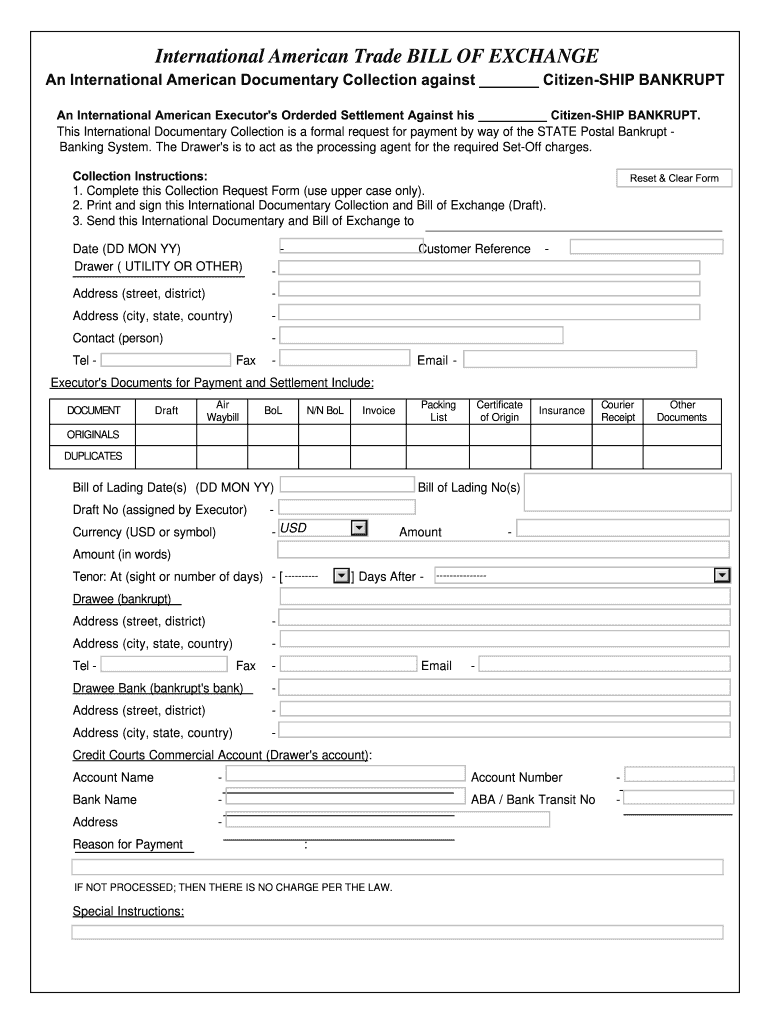

International American Trade BILL OF EXCHANGE An International American Documentary Collection against Citizenship BANKRUPT An International American Executor's Ordered Settlement Against his Citizenship

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your international american trade bill form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international american trade bill form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing international american trade bill exchange form trial online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit international american trade bill exchange form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

How to fill out international american trade bill

How to fill out international American trade bill:

01

Gather all necessary information and documents related to the trade transaction, including invoices, bill of lading, and any other relevant paperwork.

02

Begin by entering the date on the bill and filling out the personal details of the exporter, including their name, address, and contact information.

03

Next, provide the corresponding details of the importer, such as name, address, and contact information.

04

Identify the goods being traded by specifying their description, quantity, and value. Include any relevant codes or classifications, such as HS or tariff codes.

05

Indicate the origin and destination of the goods, including the respective country names and addresses.

06

Provide the necessary shipping and payment terms, including the method of transportation, port of loading, and port of discharge. Additionally, specify the currency and payment method being used.

07

Include any applicable trade agreements or preferences, such as free trade agreements or preferential treatment for certain countries.

08

Optionally, add any additional information or terms that may be relevant to the trade transaction.

09

Review the completed bill for accuracy and ensure that all required fields are filled out correctly.

10

Sign and date the bill to complete the process.

Who needs international American trade bill:

01

Exporters engaging in international trade with American companies or individuals require the international American trade bill to outline the terms and details of the transaction.

02

Importers receiving goods from American exporters also need the international American trade bill to verify and track the imported goods, as well as to comply with customs regulations.

03

Customs officials and authorities responsible for monitoring international trade rely on the international American trade bill to validate the accuracy and legality of the trade transaction.

Fill form : Try Risk Free

People Also Ask about international american trade bill exchange form trial

How do you fill out a bill of exchange?

What is a bill of exchange with example?

What is the bill of exchange in import?

What are the essentials of the bill of exchange?

Why is the Bill of Exchange important in international trade?

What is the bill of exchange in international trade law?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file international american trade bill?

The International American Trade Bill is a piece of legislation proposed by the U.S. Congress. It has not been enacted yet, so there is no requirement to file the bill.

What is the purpose of international american trade bill?

The purpose of the International American Trade Bill is to promote and expand international trade between the United States and its global trading partners. This bill would establish a framework for trade agreements and reduce tariffs and other barriers to trade. It also seeks to ensure fair labor and environmental standards in trading agreements and promote economic growth and job creation in the United States.

What information must be reported on international american trade bill?

The information required to be reported on an international American trade bill includes:

• The total value of the goods traded

• The specific items being traded

• The names and addresses of the trading parties

• Payment terms and conditions

• The ports of entry and exit

• The origin and destination of the goods

• The applicable customs duties

• The applicable taxes and fees

• The applicable insurance costs

• The applicable shipping costs

• The applicable storage fees

• The applicable import and export licenses

• The applicable certification documentation

• The applicable quality control requirements

When is the deadline to file international american trade bill in 2023?

The deadline to file the International American Trade Bill in 2023 has not yet been determined.

What is international american trade bill?

There does not appear to be a specific term or legislation called the "international American trade bill" recognized or known globally. However, there have been bills and agreements in the past that have focused on international trade involving the United States. For instance, the United States-Mexico-Canada Agreement (USMCA) is a trade agreement between the three countries that replaced the North American Free Trade Agreement (NAFTA) in 2020. The Trans-Pacific Partnership (TPP) was also a trade agreement involving the United States and several Pacific Rim countries, but the US withdrew from it in 2017. It is important to note that the specific term "international American trade bill" might refer to an unofficial or localized legislation, so further clarification may be required.

How to fill out international american trade bill?

To fill out an international American trade bill, follow these steps:

1. Gather the required information: You will need details related to the international trade transaction, including import/export information, buyer/seller details, goods/service description, values, and any applicable shipping or insurance information.

2. Identify the type of trade bill: Determine the specific type of international American trade bill you need to fill out. This could be a customs invoice, commercial invoice, bill of lading, or any other relevant document. The type of bill will depend on your trade transaction and the applicable regulations.

3. Download the appropriate form: Visit reputable websites such as the U.S. Customs and Border Protection (CBP) or the International Chamber of Commerce (ICC) to download the necessary form. Ensure you select the correct form that corresponds to the specific trade bill you are filling out.

4. Fill in the relevant details: Carefully fill in all the required fields on the form. Provide accurate information about the parties involved, such as the buyer and seller, along with their contact details. Include a detailed description of the goods or services being traded, their quantities, values, and any associated charges (e.g., shipping, insurance, etc.). Use clear and specific terms to avoid any confusion or delay during the trade process.

5. Calculate the values accurately: Pay close attention to the valuation of the goods or services being traded. Ensure you calculate values correctly, including currency conversions, if necessary. Incorrect or fraudulent valuation can lead to customs problems or additional charges.

6. Include additional required documentation: Attach any necessary supporting documents to the trade bill, such as certificates of origin, packing lists, licenses, or permits specific to the traded goods. Ensure you have all the necessary paperwork ready to back up the information provided in your trade bill.

7. Review and verify: Double-check all the information filled out in the trade bill for accuracy and completeness. Verifying the information beforehand can help avoid mistakes or potential discrepancies that may slow down the trade process.

8. Sign and submit: Once you are satisfied with the accuracy of the trade bill, sign and date the document. Follow the instructions provided on the form for submission. It may require you to submit the document electronically, by mail, or through an online customs platform.

9. Keep copies for your records: Make copies of the completed trade bill, along with all the supporting documents, and keep them for your records. These copies will be useful for future reference, audit purposes, or in case any discrepancies arise during the trade process.

10. Seek professional assistance if needed: If you are unfamiliar with the trade documentation process or have complex trade transactions, consider consulting with an international trade expert or customs broker who can guide you through the filing process and provide necessary advice to ensure compliance with applicable regulations.

Remember, the specific requirements for international American trade bills may vary depending on the country, type of goods or services being traded, and any applicable trade agreements or regulations.

What is the penalty for the late filing of international american trade bill?

There is no specific penalty mentioned for the late filing of an international American trade bill. However, late filing may lead to additional costs and potential delays in the trade process. It is crucial to comply with the specified deadlines to avoid any adverse consequences and ensure smooth operations. It is advisable to refer to the specific guidelines provided by the relevant trade authorities or seek professional advice for accurate information regarding penalties and consequences of late filing.

How can I edit international american trade bill exchange form trial from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including international american trade bill exchange form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I edit bill of exchange form on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing bill of exchange form right away.

How do I fill out international bill of exchange form on an Android device?

On Android, use the pdfFiller mobile app to finish your international bill of exchange format. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your international american trade bill online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bill Of Exchange Form is not the form you're looking for?Search for another form here.

Keywords relevant to international bill of exchange example form

Related to bill of exchange form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.