AT UniCredit Bank Austria Collection and/or Acceptance Order 2008 free printable template

Show details

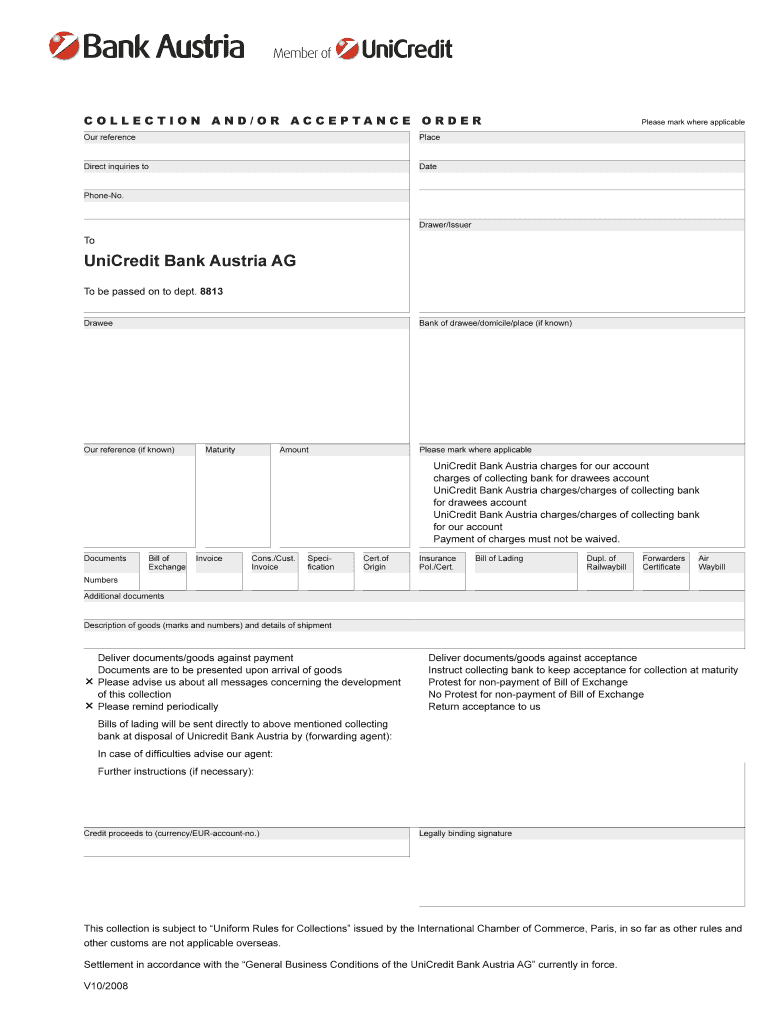

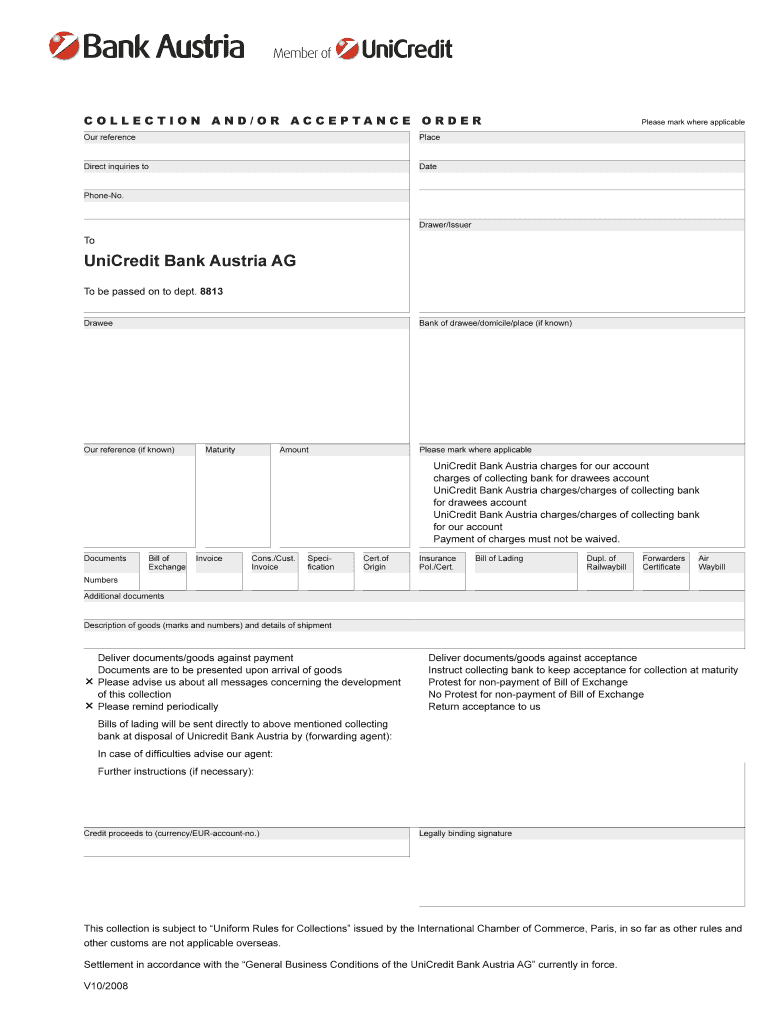

COLLECTION AND/OR ACCEPTANCE ORDER Our reference Direct inquiries to Please mark where applicable Place Date Phone No. Drawer/Issuer To Credit Bank Austria AG To be passed on to dept. 8813 Drawer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your unicredit bank austria ag form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unicredit bank austria ag form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit unicredit bank austria ag online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit unicredit bank austria ag. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

AT UniCredit Bank Austria Collection and/or Acceptance Order Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out unicredit bank austria ag

How to fill out Unicredit Bank Austria AG:

01

Gather all necessary documentation: Before filling out any forms, gather all the necessary documentation such as identification documents, proof of address, and any other required documents specified by the bank.

02

Visit the bank: Go to the nearest Unicredit Bank Austria AG branch and approach the customer service desk. Inform them that you would like to fill out the necessary forms to open an account with the bank.

03

Provide personal information: Be prepared to provide your personal information such as your full name, date of birth, contact details, and any other information required by the bank.

04

Choose an account type: Unicredit Bank Austria AG offers various types of accounts, such as savings accounts, current accounts, and investment accounts. Select the account type that suits your needs and inform the bank representative about your preference.

05

Fill out the application form: The bank representative will provide you with an application form. Carefully fill out all the required fields, providing accurate information. Double-check the form for any errors before submitting it.

06

Provide additional information: Depending on the type of account you are opening, you may need to provide additional information such as your occupation, source of income, and financial background. Have this information ready in case it is required.

07

Review terms and conditions: Before finalizing your application, carefully review the terms and conditions provided by the bank. Make sure you understand the fees, interest rates, and any other relevant information about the account.

08

Submit the application: Once you have completed the application form and reviewed the terms and conditions, submit the form to the bank representative. They will guide you through the next steps, which may include verifying your identity and completing any required documentation.

Who needs Unicredit Bank Austria AG:

01

Individuals looking for banking services: Anyone who needs banking services, such as savings accounts, current accounts, investment options, loans, or mortgages, can consider Unicredit Bank Austria AG as an option.

02

Businesses and entrepreneurs: Unicredit Bank Austria AG also offers banking services tailored to the needs of businesses and entrepreneurs. They provide business accounts, financing options, cash management solutions, and various other services to support businesses.

03

Residents and citizens of Austria: Unicredit Bank Austria AG primarily operates in Austria and provides its services to residents and citizens of the country. If you are a resident or citizen of Austria and require banking services, Unicredit Bank Austria AG may be a suitable choice.

Fill form : Try Risk Free

People Also Ask about unicredit bank austria ag

What is the registration number for UniCredit bank AG?

What is international bank bank code?

What is the ag code for UniCredit bank austria?

What is bank code bank code?

What documents do I need to open a bank account in Austria?

What is the bank code for Bank Austria?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is unicredit bank austria ag?

UniCredit Bank Austria AG is the leading bank in Austria and a member of UniCredit, an international banking group. It provides a wide range of financial products and services to corporate and retail customers. UniCredit Bank Austria AG offers services such as banking, investment banking, asset management, leasing, and securities services. It operates a network of branches and ATMs throughout Austria and employs thousands of people in the country.

Who is required to file unicredit bank austria ag?

As per the official website of UniCredit Bank Austria AG, the bank is required to file various documents and reports to regulatory authorities, including the Austrian Financial Market Authority (FMA) and the European Central Bank (ECB). These filings typically include quarterly and annual financial statements, risk reports, corporate governance reports, and other regulatory disclosures.

How to fill out unicredit bank austria ag?

To fill out a UniCredit Bank Austria AG form, follow these steps:

1. Review the form: Read the instructions and any accompanying information carefully to understand the purpose and requirements of the form.

2. Gather the necessary information: Collect all the information and documents you'll need to complete the form. This may include personal details, financial information, account numbers, and supporting documents.

3. Provide personal details: Start by entering your personal information, such as your name, address, date of birth, phone number, and email address. Provide all the required information accurately and ensure it matches your official records.

4. Fill in financial details: If the form requires financial information, provide details about your income, assets, and liabilities. This may include information about your employment, annual income, savings, and any outstanding debts.

5. Select the appropriate options: If the form contains checkboxes or multiple-choice questions, carefully select the appropriate options that apply to you. Double-check your selections to make sure they accurately reflect your situation.

6. Follow any specific instructions: If there are specific instructions or sections that require additional documentation or signatures, make sure to provide them as instructed. Attach any necessary supporting documents, such as identification proof, bank statements, or legal documents.

7. Review and proofread: Once you have completed all the required sections, review the form thoroughly for any errors or omissions. Check for spelling mistakes, missing information, or any inconsistencies. Correct any mistakes before submitting.

8. Sign and date: If your form requires a signature, sign and date it as per the instructions. Ensure that your signature matches the one on your identification documents.

9. Submit the form: Follow the submission instructions provided on the form. This may include mailing it to a specific address, submitting it online, or visiting a UniCredit Bank Austria AG branch in person. Keep copies of the completed form and any supporting documents for your records.

Note: The specific process and requirements may vary depending on the type of form and its purpose. It's always advisable to refer to the instructions provided with the form or seek assistance from UniCredit Bank Austria AG if you have any doubts or questions.

What is the purpose of unicredit bank austria ag?

The purpose of UniCredit Bank Austria AG is to provide a wide range of financial services to individuals, businesses, and corporate customers. As one of the largest banks in Austria, their main objectives include:

1) Offering banking products and services: UniCredit Bank Austria provides traditional retail banking services such as savings accounts, payment services, loans, mortgages, credit cards, and investments. They also cater to the needs of corporate clients by providing financing and advisory services.

2) Wealth management: The bank offers comprehensive wealth management solutions, including asset management, pension plans, private banking services, and investment advice.

3) International banking: UniCredit Bank Austria offers services for international business, including foreign currency exchange, trade finance, export and import financing, and international payment transactions.

4) Supporting the economy: The bank plays a vital role in supporting the Austrian economy by providing loans and investment products to businesses and individuals. They aim to promote economic growth, innovation, and employment.

5) Strengthening relationships: UniCredit Bank Austria aims to establish and maintain strong relationships with its customers, providing personalized and efficient service to meet their financial needs. Additionally, they strive to develop long-term partnerships with businesses and contribute to the growth of local communities.

Overall, UniCredit Bank Austria AG aims to be a trusted and reliable financial partner by offering a wide range of banking services, supporting economic growth, and fostering strong relationships with its customers.

What information must be reported on unicredit bank austria ag?

As a virtual assistant, I cannot report real-time information. However, I can provide general information on what is typically reported for UniCredit Bank Austria AG. Publicly traded companies like UniCredit Bank Austria AG typically disclose the following information in their financial reports and disclosures:

1. Financial Statements: The bank publishes its financial statements which include a balance sheet, income statement, and cash flow statement. These statements provide a snapshot of the bank's financial position, performance, and cash flow over a specific period.

2. Key Financial Ratios: UniCredit Bank Austria AG provides information on important financial ratios like return on equity (ROE), return on assets (ROA), loan quality ratio, capital adequacy ratio, and other relevant ratios. These ratios help to assess the bank's profitability, asset quality, liquidity, and solvency.

3. Risk Management: The bank reports on its risk management policies and procedures. This includes information on credit risk, market risk, liquidity risk, and operational risk, along with measures taken by the bank to mitigate these risks.

4. Regulatory Disclosures: UniCredit Bank Austria AG reports on its compliance with regulatory requirements, such as Basel III capital adequacy standards, stress testing results, and other supervisory requirements.

5. Corporate Governance: The bank provides information on its governance structure, board of directors, executive compensation, and disclosure of related-party transactions. This ensures transparency and accountability in the bank's management practices.

6. Social and Environmental Reporting: In recent years, many companies, including banks, have started reporting on their environmental, social, and governance (ESG) initiatives. UniCredit Bank Austria AG may also disclose its sustainability policies, environmental impact, community engagement, and other related information.

It is important to note that the specific information provided by UniCredit Bank Austria AG may vary depending on the reporting standards and regulations applicable to the bank's jurisdiction. Current and accurate information specific to UniCredit Bank Austria AG can be obtained from their official website or other reliable financial sources.

How can I edit unicredit bank austria ag from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like unicredit bank austria ag, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send unicredit bank austria ag to be eSigned by others?

Once you are ready to share your unicredit bank austria ag, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the unicredit bank austria ag in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your unicredit bank austria ag in seconds.

Fill out your unicredit bank austria ag online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.