FL CR2E041 2014-2024 free printable template

Show details

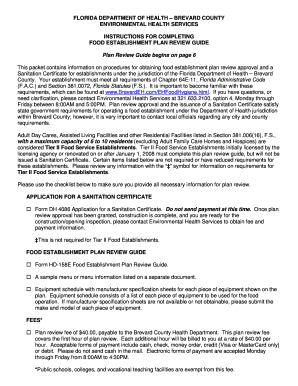

PLEASE READ ALL INSTRUCTIONS BEFORE COMPLETING THIS FORM. LIMITED LIABILITY COMPANY REINSTATEMENT FLORIDA DEPARTMENT OF STATE Secretary of State DIVISION OF CORPORATIONS DOCUMENT # 1. Limited Liability

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your florida limited liability company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your florida limited liability company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit florida limited liability company reinstatement online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fl reinstatement form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out florida limited liability company

How to fill out Florida limited liability company:

01

Determine the name of your LLC and ensure it complies with the state's naming requirements.

02

File the Articles of Organization with the Florida Secretary of State's office and pay the required filing fee.

03

Choose a registered agent who will receive important legal documents on behalf of your LLC.

04

Create an Operating Agreement that outlines the rights and responsibilities of the LLC members.

05

Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

06

Apply for any necessary state licenses and permits based on the nature of your LLC's activities.

07

Comply with ongoing requirements such as filing annual reports and paying any required fees.

Who needs Florida limited liability company:

01

Individuals or groups starting a new business in Florida may choose to form an LLC to take advantage of the liability protection it offers.

02

Existing businesses may want to convert to an LLC structure in order to protect their personal assets from business liabilities.

03

Professionals such as architects, engineers, and attorneys may form professional LLCs to provide their services while limiting personal liability.

Fill form : Try Risk Free

People Also Ask about florida limited liability company reinstatement

What does it mean when a business is inactive on Sunbiz?

How do I get my LLC back active in Florida?

Do you have to renew your LLC in Florida?

Do you have to renew your LLC Every year in Florida?

What happens if you dont renew your LLC Florida?

Can you use an inactive name on Sunbiz?

How do I restore my LLC in Florida?

Can I use an inactive LLC name in Florida?

What does it mean if an LLC is inactive?

How much does it cost to renew an LLC in Florida?

Can I use the same name as an inactive LLC?

Can I reactivate my LLC in Florida?

Do LLC expire Florida?

Does Florida require LLC return?

What happens if your LLC is dissolved in Florida?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is florida limited liability company?

A Florida limited liability company (LLC) is a type of legal business entity formed under the laws of the state of Florida. It provides limited liability protection to its owners, known as members, which means that the members' personal assets are generally protected from any business liabilities or debts.

LLCs in Florida are governed by the Florida Revised Limited Liability Company Act and are relatively flexible in terms of structure and management. They can be formed by one or more individuals, partnerships, corporations, or other LLCs and may engage in any lawful business activity.

To form a Florida LLC, the articles of organization must be filed with the Florida Department of State, Division of Corporations, and a filing fee must be paid. Additionally, an operating agreement, which outlines the management, operation, and distribution of profits and losses, is highly recommended but not required by law.

Overall, a Florida limited liability company offers a relatively simple and flexible business structure that combines the liability protection of a corporation with the tax advantages and flexibility of a partnership.

Who is required to file florida limited liability company?

In the state of Florida, the owners of a Limited Liability Company (LLC) are required to file the necessary documents to establish the company with the Florida Division of Corporations. The owners, also known as members, must submit the Articles of Organization, along with the required filing fee, to officially form the LLC in the state of Florida.

How to fill out florida limited liability company?

To fill out the forms for forming a limited liability company (LLC) in Florida, follow these steps:

1. Determine the name of your LLC: Choose a unique name and verify its availability through the Florida Division of Corporations website.

2. Choose a registered agent: A registered agent is a person or business entity responsible for receiving legal documents on behalf of the LLC. You can appoint yourself as the registered agent or hire a professional service.

3. Download or obtain the appropriate form: Visit the Florida Division of Corporations website and download the Articles of Organization form (Form CR2E047) or obtain a physical copy of the form from their office.

4. Complete the Articles of Organization form: Fill out the form with the necessary information, including the LLC name, registered agent's name and address, principal place of business, effective date, duration of the LLC, and the names and addresses of the LLC's managers or members.

5. Prepare the required fee: Florida requires a filing fee of $125 for LLC formation. Prepare a check or money order payable to the Florida Department of State. If submitting the form online, you can make the payment using a credit card.

6. File the form: You have the option to file the completed Articles of Organization form online, by mail, or in person. If filing online, visit the Florida Division of Corporations e-filing website and follow the instructions. If filing by mail or in person, send the completed form and payment to the Florida Division of Corporations address.

Note: The mailing address and instructions for filing may change, so it is always a good idea to check the official Florida Division of Corporations website for the most up-to-date information.

7. Wait for processing: After submitting the form, the Florida Division of Corporations will review and process it. The processing time may vary, but generally, it takes a few business days. Once processed, you will receive a Certificate of Organization as proof of your LLC's existence.

Remember to consult with a legal professional or a business attorney to ensure compliance with specific requirements and regulations throughout the LLC formation process.

What is the purpose of florida limited liability company?

The purpose of a Florida Limited Liability Company (LLC) is to provide the owners or members with limited liability protection while allowing flexibility in management and taxation. This business entity structure combines the liability protection of a corporation with the flexibility and simplified administration of a partnership. The primary purpose of forming an LLC in Florida is to shield the personal assets of the owners from potential business liabilities. Additionally, an LLC can be used for various business activities such as real estate investment, professional services, or small businesses.

What information must be reported on florida limited liability company?

In Florida, the following information must be reported when forming a Limited Liability Company (LLC) and in annual reports:

1. Name: The legal name of the LLC, which must include "LLC" or "Limited Liability Company."

2. Registered Agent: The name and street address of the LLC's registered agent, who is responsible for accepting legal documents and official mail on behalf of the company.

3. Principal Place of Business: The street address of the LLC's principal place of business, which can be the same as the registered agent's address.

4. Management: Indicate whether the LLC will be managed by member(s) or a manager(s). If manager-managed, provide the names and addresses of the managers.

5. Articles of Organization: The LLC's Articles of Organization, which include basic information about the company and its organizers.

6. Members or Managers: Names, addresses, and ownership percentages of all members or managers. This information is required in the annual report as well.

7. Effective Date: The date the LLC will become effective, which can be either immediately upon filing or a specific future date.

8. Signature: The signature of the person forming the LLC, acknowledging the accuracy of the provided information.

It is important to note that this is a general overview, and additional requirements or documentation may apply in specific cases. It is advisable to consult with a legal professional or the Florida Division of Corporations for precise and up-to-date information.

What is the penalty for the late filing of florida limited liability company?

The penalty for late filing of a Florida Limited Liability Company (LLC) varies depending on the specific circumstances and the length of time the filing is overdue. However, the standard penalty for late filing of the LLC annual report is $400. This penalty increases to $450 if the report remains overdue for more than five months. It is important to note that these penalties are subject to change, so it is advisable to consult the relevant Florida statutes or seek professional legal advice for accurate and up-to-date information.

Where do I find florida limited liability company reinstatement?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific fl reinstatement form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for the fl liability reinstatement in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I fill out pdf reinstatment sunbiz on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your reinstatement form sunbiz. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your florida limited liability company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fl Liability Reinstatement is not the form you're looking for?Search for another form here.

Keywords relevant to florida llc reinstatement form

Related to florida corporation reinstatement form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.