Get the free inco check form

Show details

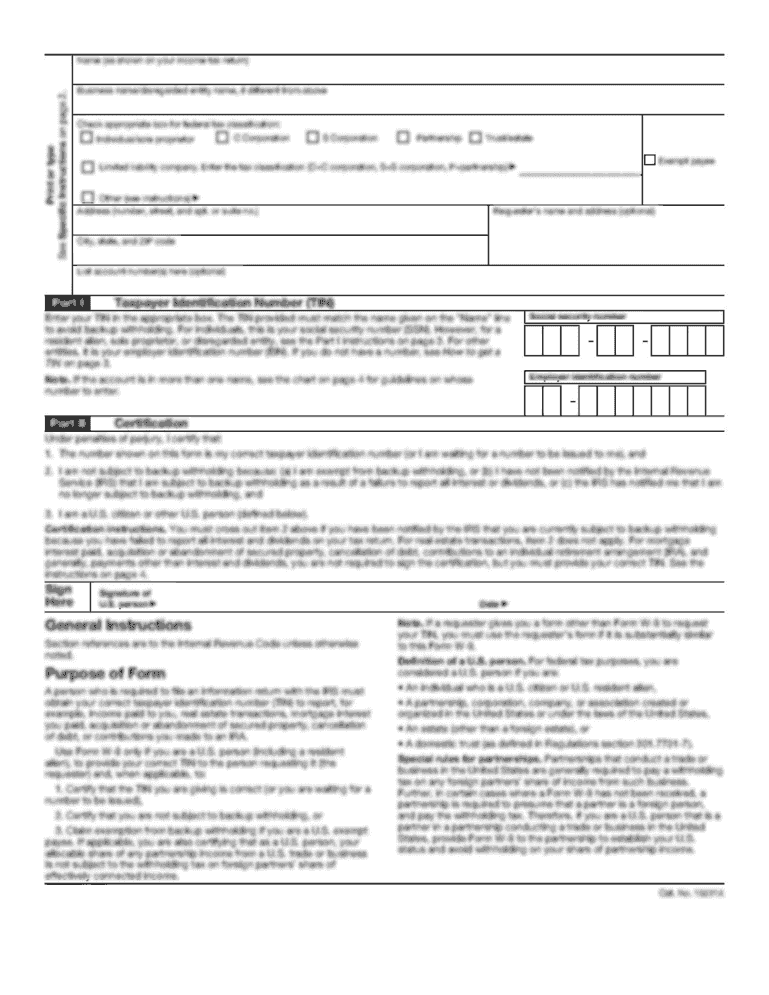

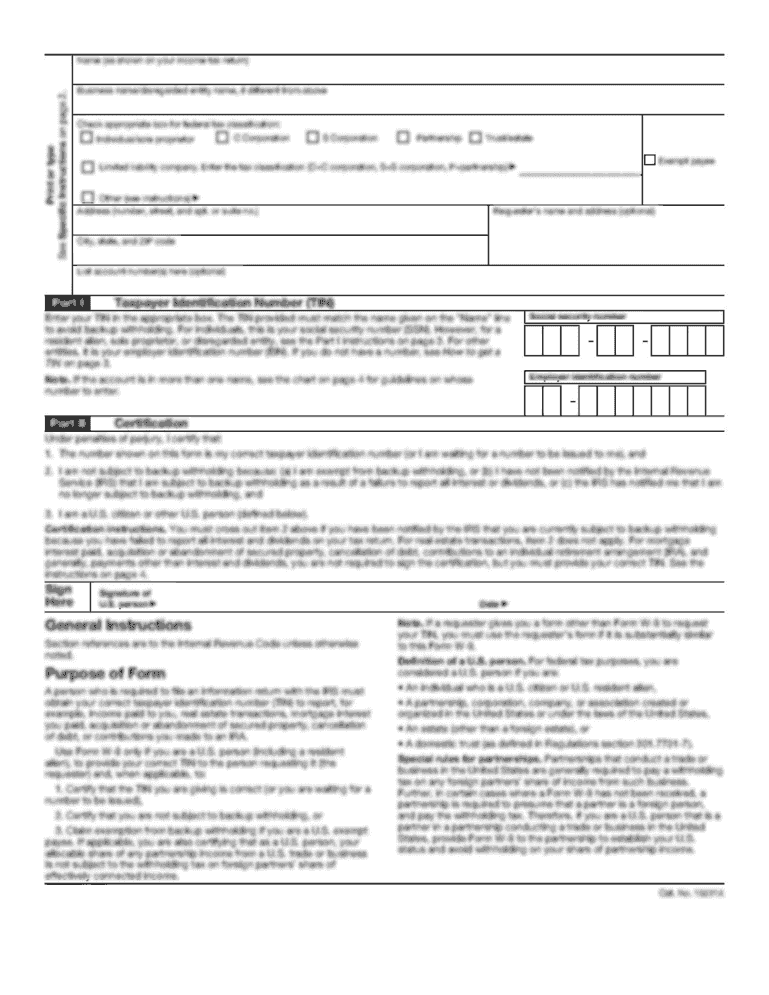

4506T Form (Rev. September 2013) Department of the Treasury Internal Revenue Service Request for Transcript of Tax Return Request may be rejected if the form is incomplete or illegible. OMB No. 15451872

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your inco check form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your inco check form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit inco check online

To use the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit inco check. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out inco check form

How to fill out an inco check:

01

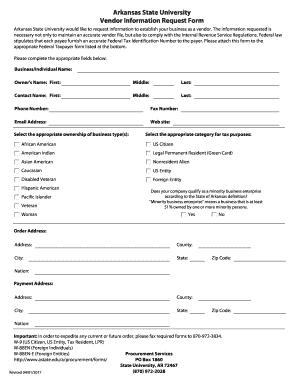

Start by obtaining an inco check form from the appropriate authority or organization. This form is typically used for income verification purposes.

02

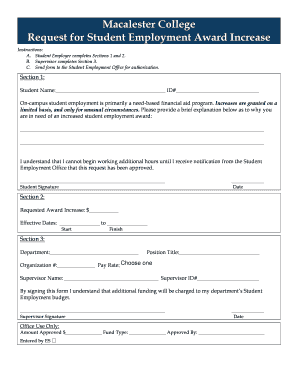

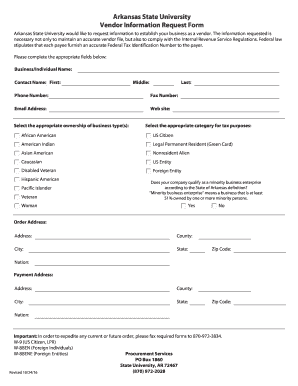

Fill in your personal information accurately and completely. This may include your full name, address, contact information, social security number or tax identification number, and any other relevant details requested on the form.

03

Provide accurate information about your income. This typically involves stating your annual or monthly income, as well as any additional sources of income, such as investments, rental properties, or self-employment earnings.

04

If required, attach supporting documentation to validate your income. This could include copies of pay stubs, income statements, bank statements, tax returns, or any other relevant document that confirms your income.

05

Review the completed form and ensure all the provided information is accurate and up-to-date. Double-check for any errors or omissions before submitting the form.

06

Sign and date the form as required. This certifies that the information provided is true and accurate to the best of your knowledge.

Who needs inco check:

01

Individuals seeking to verify their income for various purposes, such as loan applications, apartment rentals, government assistance programs, or scholarship applications, typically need an inco check.

02

Employers may request an inco check to verify the income of potential employees as part of the pre-employment screening process.

03

Landlords may require an inco check to assess the financial stability and income level of potential tenants before renting out a property.

04

Government agencies or social service organizations may use inco checks to verify eligibility for assistance programs or determine child or spousal support amounts.

In summary, the process of filling out an inco check involves accurately providing personal and income information, attaching any required supporting documentation, reviewing the form for accuracy, and signing and dating it. Various individuals and organizations may require an inco check for different purposes, such as income verification, employment screening, rental assessments, or government assistance programs.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in inco check?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your inco check to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit inco check straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing inco check, you need to install and log in to the app.

How do I fill out inco check on an Android device?

Complete inco check and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your inco check form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.