Get the free PTAX-342 Application for Disabled Veterans ... - Lake County

Show details

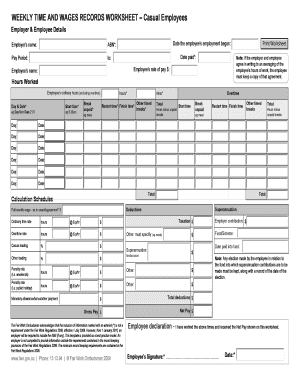

PTAX-342 Application for Disabled Veterans Standard Homestead Exemption (SHE) Step 1: Complete the following information 1 Property owner s name Street address of homestead property 6 Write the property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ptax-342 application for disabled form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ptax-342 application for disabled form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ptax-342 application for disabled online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ptax-342 application for disabled. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

How to fill out ptax-342 application for disabled

How to fill out ptax-342 application for disabled:

01

Gather all necessary personal and financial information, such as full name, contact details, social security number, and income details.

02

Consult the instructions provided with the application form to ensure you have a clear understanding of the requirements and information needed.

03

Begin filling out the application form by accurately entering the requested information in each section.

04

Pay close attention to any specific instructions or additional forms that may need to be submitted along with the application.

05

Double-check all the information you have entered before submitting the application to avoid any mistakes or omissions.

06

Sign and date the application form as required.

07

Review the submission process outlined in the instructions and follow it accordingly to submit your completed application.

Who needs ptax-342 application for disabled:

01

Individuals who are disabled and seeking tax exemptions or benefits related to their disability.

02

The ptax-342 application is specifically designed for disabled individuals who want to avail tax relief or exemptions based on their disability status.

03

Those who meet the eligibility criteria for disability-related tax benefits or exemptions may need to submit the ptax-342 application.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ptax-342 application for disabled?

The ptax-342 application for disabled is a form that disabled individuals can use to apply for property tax exemptions or reductions based on their disability.

Who is required to file ptax-342 application for disabled?

Any individual who is disabled and wishes to apply for property tax exemptions or reductions based on their disability is required to file the ptax-342 application for disabled.

How to fill out ptax-342 application for disabled?

To fill out the ptax-342 application for disabled, you need to provide personal and disability-related information, such as your name, address, disability status, medical documentation, and any other required details. The application form can be obtained from the local tax assessor's office or their website.

What is the purpose of ptax-342 application for disabled?

The purpose of the ptax-342 application for disabled is to allow disabled individuals to apply for property tax exemptions or reductions based on their disability, in order to alleviate their financial burden.

What information must be reported on ptax-342 application for disabled?

The ptax-342 application for disabled requires individuals to report their personal information (name, address), disability status, supporting medical documentation, and any other required details mentioned in the application form.

When is the deadline to file ptax-342 application for disabled in 2023?

The deadline to file the ptax-342 application for disabled in 2023 can vary depending on the specific jurisdiction and tax assessment calendar. It is recommended to contact your local tax assessor's office to determine the exact deadline.

What is the penalty for the late filing of ptax-342 application for disabled?

The penalty for the late filing of the ptax-342 application for disabled can vary depending on the jurisdiction and local tax rules. It is advisable to consult with your local tax assessor's office for information on specific penalties or late filing fees.

How do I modify my ptax-342 application for disabled in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your ptax-342 application for disabled and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit ptax-342 application for disabled in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing ptax-342 application for disabled and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I fill out ptax-342 application for disabled on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your ptax-342 application for disabled from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your ptax-342 application for disabled online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.