Get the free tsp or t

Show details

Basics at a Glances/No. 1

6

8

10

12

16

20

24

30

40

50

60

70

100Recipe Abbreviations Volume Equivalents approx. Approximate tsp or t teaspoons or T tablespoon sculptor Liquids

60 drops 1 tsp1 Tbsp

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your tsp or t form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tsp or t form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tsp or t online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tsp or t. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

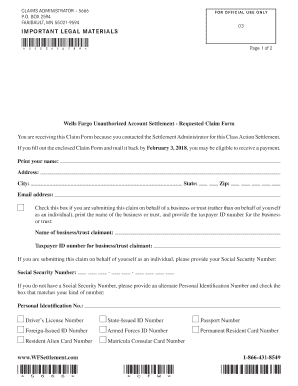

How to fill out tsp or t

How to fill out tsp or t:

01

Start by gathering all the necessary information, such as your name, social security number, and agency or service.

02

Next, decide on the type of TSP or T form you need to fill out, whether it's for a traditional or Roth TSP account, or a T form for a loan or withdrawal.

03

Carefully review the instructions and guidelines provided by the Thrift Savings Plan (TSP) or your employer. Ensure you understand the purpose of the form and any specific requirements.

04

Begin filling out the form by providing your personal information, including your full name, address, and contact details.

05

Follow the instructions to indicate your contribution amounts, whether it's a percentage or a specific dollar amount.

06

If you wish to make any changes to your investment strategy, review and update the relevant sections.

07

Complete any additional sections related to beneficiaries or tax withholding, if applicable.

08

Once you have filled out all the required fields, review the form for any errors or missing information.

09

Sign and date the form as required, and make a copy for your records.

10

Send the completed form to the appropriate recipient, whether it be the Thrift Savings Plan or your employer, following their specific instructions.

Who needs tsp or t:

01

Federal employees: The Thrift Savings Plan (TSP) is primarily available for federal employees, including civilian employees and members of the uniformed services.

02

Military personnel: TSP is also available to military members, including active duty, reserve, and National Guard.

03

Individuals seeking retirement savings options: The TSP is a retirement savings plan designed to help individuals build long-term wealth and financial security for their retirement.

04

Those planning for financial stability: TSP offers various investment options and tax advantages that can assist individuals in achieving their long-term financial goals.

05

Employees eligible for employer contributions: Some employers offer matching contributions to the TSP, which can provide additional financial benefits to participating employees.

06

Individuals considering loan or withdrawal options: TSP also provides loan and withdrawal options for those who may need to access their funds for certain approved reasons, such as home purchases or education expenses.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tsp or t?

TSP stands for Thrift Savings Plan and T stands for Tax Return.

Who is required to file tsp or t?

Federal employees, members of the uniformed services, and beneficiaries who have money in their Thrift Savings Plan accounts are required to file a TSP tax return.

How to fill out tsp or t?

You can fill out the TSP tax return online through the TSP website or by filling out a paper form and mailing it in.

What is the purpose of tsp or t?

The purpose of the TSP tax return is to report any withdrawals or distributions from your Thrift Savings Plan account.

What information must be reported on tsp or t?

You must report the total amount of withdrawals or distributions from your TSP account, as well as any taxes withheld.

When is the deadline to file tsp or t in 2024?

The deadline to file the TSP tax return in 2024 is April 15th.

What is the penalty for the late filing of tsp or t?

The penalty for late filing of the TSP tax return is a 5% penalty for each month the return is late, up to a maximum of 25%.

How can I modify tsp or t without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including tsp or t. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for the tsp or t in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your tsp or t in minutes.

How can I edit tsp or t on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing tsp or t.

Fill out your tsp or t online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.