Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 14157-a rev 5?

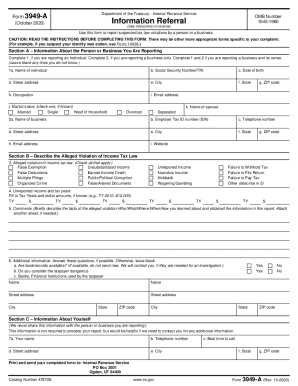

Form 14157-A Rev. 5 is a document used by the Internal Revenue Service (IRS) to report suspected tax fraud or abusive tax schemes by tax return preparers, tax professionals, or other individuals or entities. It is titled "Return Preparer Complaint: Report Tax Abusive Schemes and Preparers." This form is used by taxpayers or individuals who have knowledge of abusive tax practices or preparer misconduct to provide information and report such activities to the IRS.

Who is required to file form 14157-a rev 5?

Form 14157-A Rev 5, Tax Return Preparer Fraud or Misconduct Affidavit, is required to be filed by taxpayers who suspect that their tax return preparer has engaged in fraudulent or dishonest activities. This form allows taxpayers to report such incidents to the Internal Revenue Service (IRS) for further investigation.

How to fill out form 14157-a rev 5?

Form 14157-A (Rev. 5) is the Complaint Referral form used by the Internal Revenue Service (IRS) for reporting tax-related fraud or misconduct by tax return preparers. Here's a step-by-step guide on how to fill out this form:

1. Header Section: Fill out your personal information, including your name, address, city, state, zip code, email address, and telephone number. Provide your daytime telephone number as well.

2. Complaint Information: State the complete contact information of the preparer you are reporting, including their name, address, city, state, zip code, and telephone number. Also, include the preparer's PTIN (Preparer Tax Identification Number), if available.

3. Nature of Complaint: Briefly describe the complaint or issue you are reporting. Provide clear and concise details about the misconduct, fraud, or unprofessional behavior regarding the tax return preparer.

4. Supporting Documents: Attach any relevant supporting documents that you have to back up your complaint. This can include copies of tax returns, documentation of improper practices, or any other evidence that supports your claim. Ensure that all attachments are labeled and securely attached.

5. Tax Year(s): Indicate the tax year(s) that relate to your complaint, i.e., the years in which you encountered the preparer's misconduct.

6. Taxpayer Information: Fill in your social security number, individual taxpayer identification number (if applicable), and your date of birth. This section helps the IRS correctly identify you in relation to the complaint.

7. Signature: Review the form for accuracy, ensure that all necessary fields are complete, and sign and date the form. By signing, you are acknowledging that the information provided is true and accurate to the best of your knowledge.

8. Optional Complaint Updates: If you want to receive complaint status updates or potential contact from the IRS regarding your complaint, check the box in this section. Provide your preferred method of contact (phone or email) and provide the relevant contact details.

9. Submission: Once you have completed the form, make a copy for your records, and mail the original to the address provided in the form instructions. Keep in mind that the contact information may change, so always double-check the IRS website for the updated address.

Note: It is important to provide as much detail and evidence as possible when filing a complaint against a tax return preparer. The IRS takes these matters seriously and will investigate accordingly.

What is the purpose of form 14157-a rev 5?

Form 14157-A Rev 5 is a form used by the Internal Revenue Service (IRS) in the United States. Its purpose is to provide a whistleblower complaint against a tax return preparer or tax return preparer misconduct. The form allows individuals to report any improper activities committed by tax return preparers, such as fraudulent or illegal practices, in order to assist the IRS in investigating and taking appropriate actions against such preparers.

What information must be reported on form 14157-a rev 5?

Form 14157-A Rev 5 is used by individuals to report tax return preparers who engage in questionable or unethical practices. The form requires the following information to be reported:

1. Taxpayer Information:

- Taxpayer's name, address, and Social Security Number (SSN) or Employer Identification Number (EIN)

- Spouse's name, address, and SSN or EIN (if applicable)

- Daytime phone number and best time to call the taxpayer

2. Preparer Information:

- Preparer's name, address, and Preparer Tax Identification Number (PTIN)

- Preparer's business name, address, and phone number

- Previous reports filed against the tax return preparer

3. Description of Preparer Misconduct:

- Detailed description of the tax return preparer's questionable or unethical conduct, including specific acts or behaviors

4. Documentation:

- Any supporting documentation, such as copies of falsified documents or misleading advice provided by the preparer

5. Consent to Disclosure:

- Taxpayer's consent to the disclosure of their identity to the preparer

6. Additional Information:

- Any additional information that may assist the Internal Revenue Service (IRS) in its investigation

It's important to note that information provided on Form 14157-A Rev 5 should be accurate and complete to the best of the taxpayer's knowledge. Providing false information can result in penalties.

How can I send form 14157-a rev 5-2012 to be eSigned by others?

When you're ready to share your form 14157-a rev 5-2012, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in form 14157-a rev 5-2012?

The editing procedure is simple with pdfFiller. Open your form 14157-a rev 5-2012 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my form 14157-a rev 5-2012 in Gmail?

Create your eSignature using pdfFiller and then eSign your form 14157-a rev 5-2012 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.