Get the free GIFT ACCEPTANCE POLICY OF - cfectorg

Show details

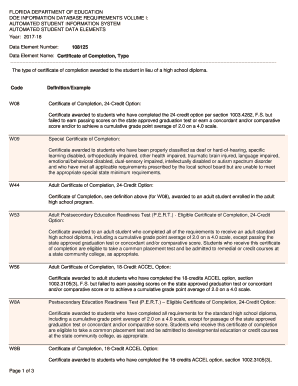

COMMUNITY FOUNDATION OF EASTERN CONNECTICUT GIFT ACCEPTANCE POLICY THE COMMUNITY FOUNDATION OF EASTERN CONNECTICUT (Foundation) will accept gifts subject to the following policies: Types of Gifts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gift acceptance policy of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift acceptance policy of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gift acceptance policy of online

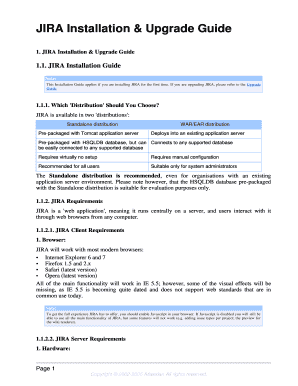

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift acceptance policy of. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out gift acceptance policy of

How to fill out gift acceptance policy:

01

Review the purpose: Start by understanding the purpose of the gift acceptance policy. Read through the policy document and familiarize yourself with its objectives and guidelines.

02

Gather necessary information: Collect all relevant information that is required to complete the policy form. This may include details about the donor, the gift being offered, any conditions or restrictions, and the intended use of the gift.

03

Evaluate the gift: Assess the potential risks and benefits associated with accepting the gift. Consider factors such as the nature of the gift, its value, the donor's intent, and any potential conflicts of interest. Evaluate if accepting the gift aligns with the organization's mission and values.

04

Consult legal or financial experts: If needed, seek advice from legal or financial professionals who can provide guidance on the legal implications, tax considerations, or any other relevant aspects of accepting the gift. Incorporate their recommendations into your policy, if applicable.

05

Customize the policy: Tailor the gift acceptance policy to meet the specific needs of your organization. Ensure that it aligns with your organization's mission, values, and legal requirements. Modify any sections or add new clauses as necessary.

06

Communicate the policy: Once the policy is filled out, share it with the relevant stakeholders within your organization. This may include board members, executive staff, legal teams, and fundraising teams. Ensure that everyone understands and agrees upon the policy guidelines.

Who needs gift acceptance policy:

01

Nonprofit organizations: Nonprofits often rely on donations and gifts from individuals, companies, or other organizations. Having a gift acceptance policy provides clear guidelines for accepting gifts and ensures compliance with legal and ethical standards.

02

Educational institutions: Schools, colleges, and universities often receive gifts in the form of endowments, scholarships, or sponsorships. A gift acceptance policy helps these institutions evaluate and accept gifts that align with their educational mission and community values.

03

Healthcare organizations: Hospitals, clinics, and healthcare foundations commonly receive donations and gifts from grateful patients, philanthropists, or corporate sponsors. A gift acceptance policy helps healthcare organizations evaluate potential gifts and ensure they meet any regulatory requirements.

04

Cultural institutions: Museums, libraries, and art galleries may receive valuable donations in the form of artwork, historical artifacts, or monetary contributions. Having a gift acceptance policy allows these institutions to manage and evaluate such gifts while accounting for their cultural and historical significance.

05

Religious organizations: Churches, temples, mosques, and other religious institutions often rely on donations and gifts to support their religious activities and community services. A gift acceptance policy helps them establish guidelines for accepting gifts while considering any religious or spiritual considerations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gift acceptance policy of?

A gift acceptance policy outlines the guidelines and procedures for accepting gifts in a specific organization.

Who is required to file gift acceptance policy of?

Non-profit organizations, charities, and other entities that receive donations or gifts are required to file a gift acceptance policy.

How to fill out gift acceptance policy of?

To fill out a gift acceptance policy, organizations should include information on types of gifts accepted, procedures for acceptance, and any limitations or restrictions.

What is the purpose of gift acceptance policy of?

The purpose of a gift acceptance policy is to ensure transparency, accountability, and ethical standards in the acceptance of gifts.

What information must be reported on gift acceptance policy of?

Information such as types of gifts accepted, approval process, confidentiality, conflicts of interest, and reporting requirements must be reported on a gift acceptance policy.

When is the deadline to file gift acceptance policy of in 2024?

The deadline to file a gift acceptance policy may vary depending on the organization's fiscal year, but it is typically filed annually.

What is the penalty for late filing of gift acceptance policy of?

The penalty for late filing of a gift acceptance policy may include fines, loss of tax-exempt status, or other repercussions depending on the jurisdiction.

How do I complete gift acceptance policy of online?

With pdfFiller, you may easily complete and sign gift acceptance policy of online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit gift acceptance policy of online?

With pdfFiller, the editing process is straightforward. Open your gift acceptance policy of in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit gift acceptance policy of in Chrome?

Install the pdfFiller Google Chrome Extension to edit gift acceptance policy of and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Fill out your gift acceptance policy of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.