Get the free j ul y

Show details

Voice of the Industry 64 j UL y 2012 ISSN 1948-3031 Regional Systems Edition In This Issue: In Cuba, Mystery Shrouds Fate Of Internet Cable U.S. Regulatory Update: FCC Proposes Extraordinary Increases

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your j ul y form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your j ul y form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing j ul y online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit j ul y. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out j ul y

How to fill out July:

01

Start by gathering all necessary documents and information such as personal identification, financial statements, and any relevant forms required for filling out July.

02

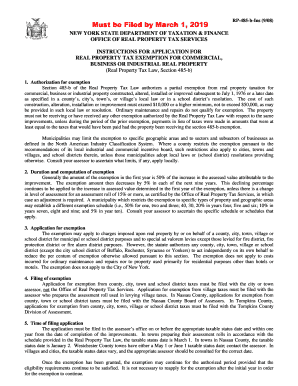

Review the guidelines and requirements for filling out July in your specific jurisdiction or organization. This will ensure that you provide all the necessary information and complete the process accurately.

03

Begin by carefully reading and understanding each section or question on the July form. Take your time to ensure that you comprehend what is being asked and how to provide the correct information.

04

Fill out each section of the July form accurately and truthfully. Double-check your responses before moving on to the next question to minimize errors or inconsistencies.

05

If you encounter any difficulties or have questions while filling out July, seek assistance from relevant authorities, professionals, or designated helplines. They can provide guidance and clarify any uncertainties.

Who needs July:

01

Individuals or households who have financial, legal, or administrative obligations that need to be fulfilled during July may need to fill out July. This can include filing income taxes, submitting financial reports, or updating personal records.

02

Employers and business owners often need to fill out July to comply with legal requirements such as payroll taxes, employee benefits, or business registrations.

03

Students or academic institutions may require the completion of July to enroll in courses, apply for financial aid, or fulfill other educational obligations.

Remember, the specific need and purpose for filling out July may vary depending on individual circumstances, geographical location, and organizational requirements. It is essential to understand and fulfill those requirements accurately and on time.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is July?

July is the seventh month of the year in the Gregorian calendar.

Who is required to file July?

Individuals and businesses may be required to file July tax returns depending on their specific tax situation.

How to fill out July?

To fill out July tax forms, individuals and businesses must gather all relevant financial information and follow the instructions provided by the tax authorities.

What is the purpose of July?

The purpose of July tax filings is to report taxable income and calculate the amount of tax owed to the government.

What information must be reported on July?

On July tax returns, individuals and businesses must report their income, deductions, credits, and any other relevant financial information.

When is the deadline to file July in 2024?

The deadline to file July tax returns in 2024 is typically April 15th, but it may vary depending on the specific tax laws and regulations.

What is the penalty for the late filing of July?

The penalty for the late filing of July tax returns may include fines, interest charges, and other financial penalties imposed by the tax authorities.

How can I modify j ul y without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your j ul y into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find j ul y?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific j ul y and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in j ul y?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your j ul y and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Fill out your j ul y online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.