Get the free FCPA & Anti-Corruption - Sidley Austin LLP

Show details

This document outlines the details of the 5th National Conference that focuses on FCPA compliance and anti-corruption strategies specifically tailored for the pharmaceutical, biotechnology, and medical

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fcpa amp anti-corruption

Edit your fcpa amp anti-corruption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fcpa amp anti-corruption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fcpa amp anti-corruption online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fcpa amp anti-corruption. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fcpa amp anti-corruption

01

First, gather all the necessary information related to your organization's activities, business partners, and potential risks associated with corruption and bribery.

02

Identify the specific requirements and guidelines outlined in the FCPA (Foreign Corrupt Practices Act) and any other relevant anti-corruption laws or regulations applicable to your business.

03

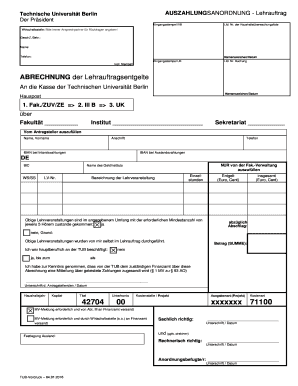

Review the FCPA amp anti-corruption form or template provided by your organization or legal department. Familiarize yourself with the sections and questions included in the form.

04

Begin filling out the form by providing accurate and complete information about your organization, including its name, address, industry sector, and contact information.

05

Proceed to enter details about your organization's ownership structure, including any subsidiaries or related entities.

06

Provide a comprehensive overview of your organization's operations, including the countries where you conduct business, the nature of your products or services, and any relevant industry certifications or memberships.

07

Evaluate and disclose any potential corruption risks that may exist within your organization's operations or business relationships. This can include identifying high-risk countries, sectors, or partners.

08

If applicable, describe the measures and procedures your organization has implemented to mitigate corruption risks. This can include anti-corruption policies, codes of conduct, training programs, or third-party due diligence processes.

09

Review and ensure the accuracy of all the provided information. Make any necessary corrections or amendments before submitting the form.

10

It's important to note that the need for FCPA amp anti-corruption compliance extends to any organization engaged in international business or with potential exposure to corruption risks.

Who needs fcpa amp anti-corruption?

01

Organizations engaged in international business operations.

02

Companies with subsidiaries or business relationships in countries with a high corruption risk.

03

Organizations seeking to maintain high ethical standards and compliance with anti-corruption laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fcpa amp anti-corruption in Gmail?

fcpa amp anti-corruption and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I fill out fcpa amp anti-corruption on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your fcpa amp anti-corruption. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit fcpa amp anti-corruption on an Android device?

The pdfFiller app for Android allows you to edit PDF files like fcpa amp anti-corruption. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is fcpa amp anti-corruption?

The Foreign Corrupt Practices Act (FCPA) is a United States federal law that prohibits the bribery of foreign officials to obtain or retain business. The purpose of the FCPA is to combat corruption and ensure fair business practices globally.

Who is required to file fcpa amp anti-corruption?

Companies and individuals subject to the jurisdiction of the United States, including US-based companies, foreign companies listed on US stock exchanges, and individuals acting on behalf of these entities, are required to comply with the FCPA and may be required to file related reports.

How to fill out fcpa amp anti-corruption?

Filling out the required reports for the FCPA and anti-corruption compliance typically involves providing relevant information related to any transactions, payments, or gifts made to foreign officials or through intermediaries. It is important to consult legal counsel or compliance experts for accurate guidance on specific reporting requirements.

What is the purpose of fcpa amp anti-corruption?

The purpose of the FCPA and anti-corruption measures is to deter and punish corruption in international business transactions. These regulations aim to promote transparency, integrity, and fair competition while preventing bribery and unethical conduct.

What information must be reported on fcpa amp anti-corruption?

The specific information required to be reported on FCPA and anti-corruption filings may vary depending on the circumstances, but typically includes details of payments, gifts, or benefits provided, identities of the parties involved, description of the transactions, and any relevant supporting documentation.

Fill out your fcpa amp anti-corruption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fcpa Amp Anti-Corruption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.