Get the U.S. TREAS Form treas-irs-1040-schedule-d-1995. Free download

Show details

U.S. TREAS Form treas-irs-1040-schedule-d-1995 SCHEDULE D (Form 1040) Department of the Treasury (99) Internal Revenue Service OMB No. 1545-0074 Capital Gains and Losses ? Attach ? To Form 1040. ?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your us treas form treas-irs-1040-schedule-d-1995 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us treas form treas-irs-1040-schedule-d-1995 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit us treas form treas-irs-1040-schedule-d-1995 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit us treas form treas-irs-1040-schedule-d-1995. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out us treas form treas-irs-1040-schedule-d-1995

How to fill out us treas form treas-irs-1040-schedule-d-1995:

01

Gather all relevant financial information, including details about your capital gains and losses, dividends, and interest earned.

02

Calculate your total capital gains and losses for the year. This can be done by subtracting your total losses from your total gains.

03

Fill out Part I of the form, which requires you to report short-term capital gains and losses. Include details about each individual transaction, such as the purchase and sale dates, the cost basis, and the sale price.

04

Complete Part II of the form for reporting long-term capital gains and losses. Again, provide information about each transaction, including the dates, cost basis, and sale price.

05

Add up the totals from Part I and Part II and enter the grand total on line 6 of the form.

06

Answer the checkbox questions in Part III of the form, which determine whether or not you need to fill out the Qualified Dividends and Capital Gain Tax Worksheet.

07

Calculate your tax liability using the appropriate tax rate based on your income and filing status. This information can be found in the instructions for the form.

08

Transfer the calculated tax liability to line 15 of the form.

09

Complete the rest of the form by providing your personal information, such as your name, address, and social security number.

10

Double-check all your entries and ensure that you have signed and dated the form before submitting it to the IRS.

Who needs us treas form treas-irs-1040-schedule-d-1995:

01

Individuals who have realized capital gains or losses during the tax year.

02

Taxpayers who have received dividends or interest income.

03

Those who need to report their capital gains and losses to determine their tax liability.

04

Individuals who have engaged in taxable transactions such as selling stocks, bonds, or real estate.

05

Taxpayers who are required to report their capital gains and losses according to the IRS guidelines.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

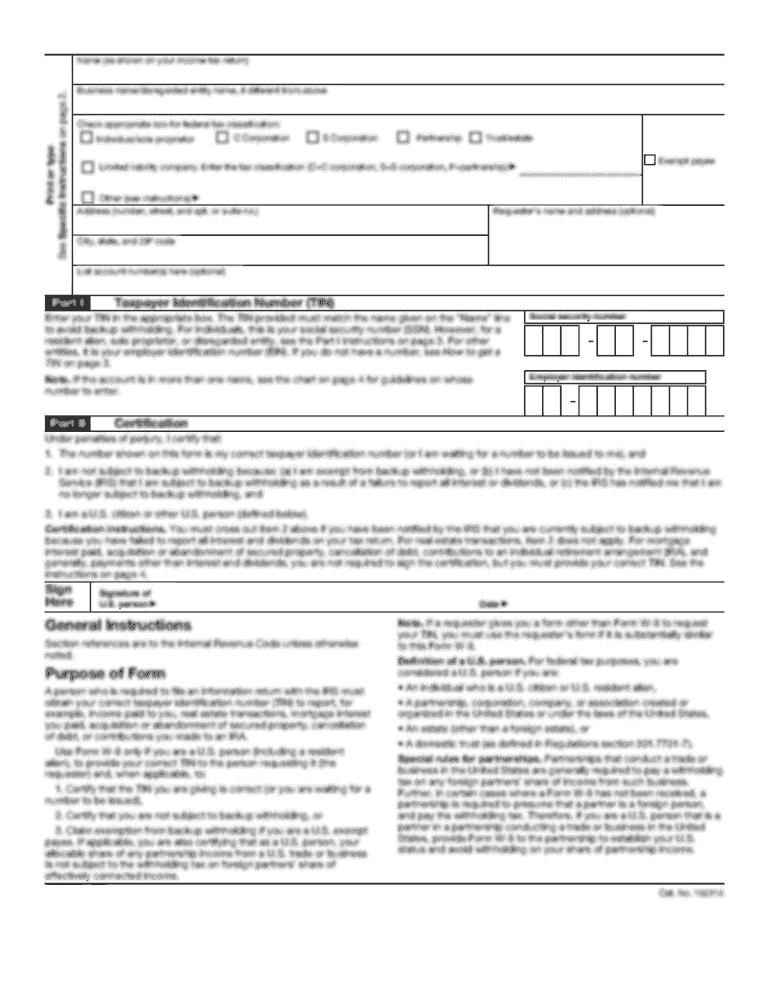

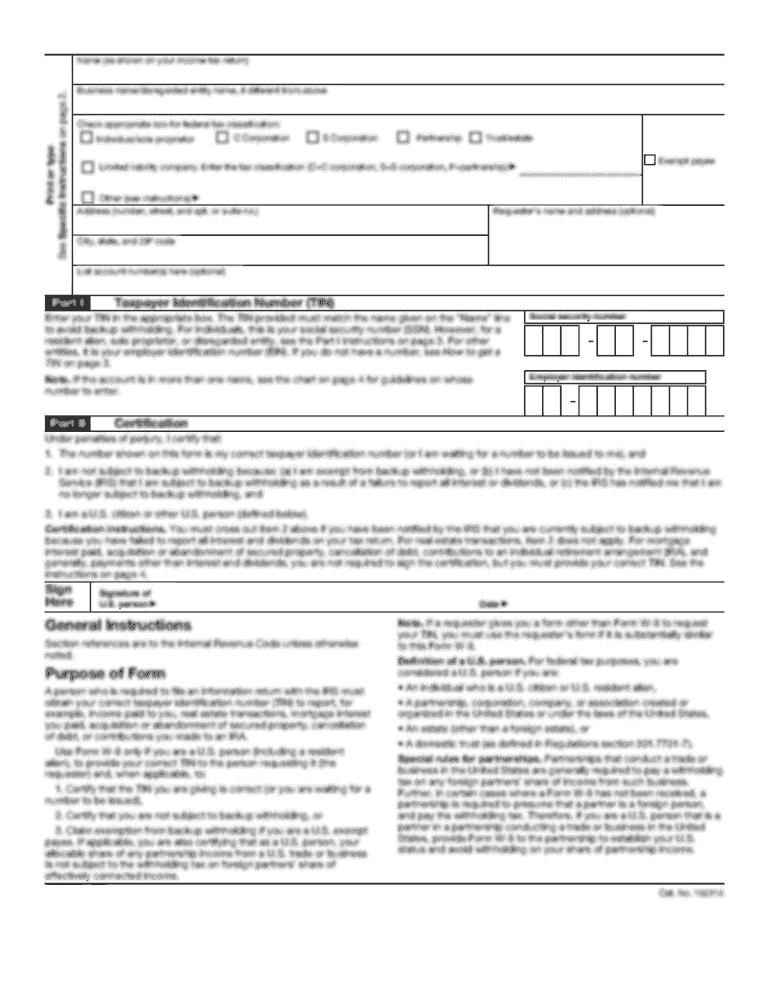

What is us treas form treas-irs-1040-schedule-d?

US Treas Form Treas-IRS-1040-Schedule-D is a tax form used by individuals to report capital gains and losses from the sale of assets, such as stocks, bonds, and real estate.

Who is required to file us treas form treas-irs-1040-schedule-d?

Individuals who have realized capital gains or losses from the sale of assets during the tax year are required to file US Treas Form Treas-IRS-1040-Schedule-D.

How to fill out us treas form treas-irs-1040-schedule-d?

To fill out US Treas Form Treas-IRS-1040-Schedule-D, you will need to provide details of each capital gain or loss transaction, including the date of sale, cost basis, and the amount of gain or loss.

What is the purpose of us treas form treas-irs-1040-schedule-d?

The purpose of US Treas Form Treas-IRS-1040-Schedule-D is to calculate and report the net capital gain or loss for the tax year, which is then used to determine the individual's tax liability.

What information must be reported on us treas form treas-irs-1040-schedule-d?

On US Treas Form Treas-IRS-1040-Schedule-D, you must report details of each capital gain or loss transaction, including the description of the asset, date of sale, cost basis, sales proceeds, and the amount of gain or loss.

When is the deadline to file us treas form treas-irs-1040-schedule-d in 2023?

The deadline to file US Treas Form Treas-IRS-1040-Schedule-D in 2023 is typically April 15th, unless the taxpayer qualifies for an extension.

What is the penalty for the late filing of us treas form treas-irs-1040-schedule-d?

The penalty for the late filing of US Treas Form Treas-IRS-1040-Schedule-D is generally calculated as a percentage of the unpaid tax amount and increases the longer the form is not filed.

How do I complete us treas form treas-irs-1040-schedule-d-1995 online?

Filling out and eSigning us treas form treas-irs-1040-schedule-d-1995 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the us treas form treas-irs-1040-schedule-d-1995 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your us treas form treas-irs-1040-schedule-d-1995 in seconds.

How do I fill out us treas form treas-irs-1040-schedule-d-1995 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign us treas form treas-irs-1040-schedule-d-1995 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your us treas form treas-irs-1040-schedule-d-1995 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.