Get the free Choice of super fund request - HESTA Sup

Show details

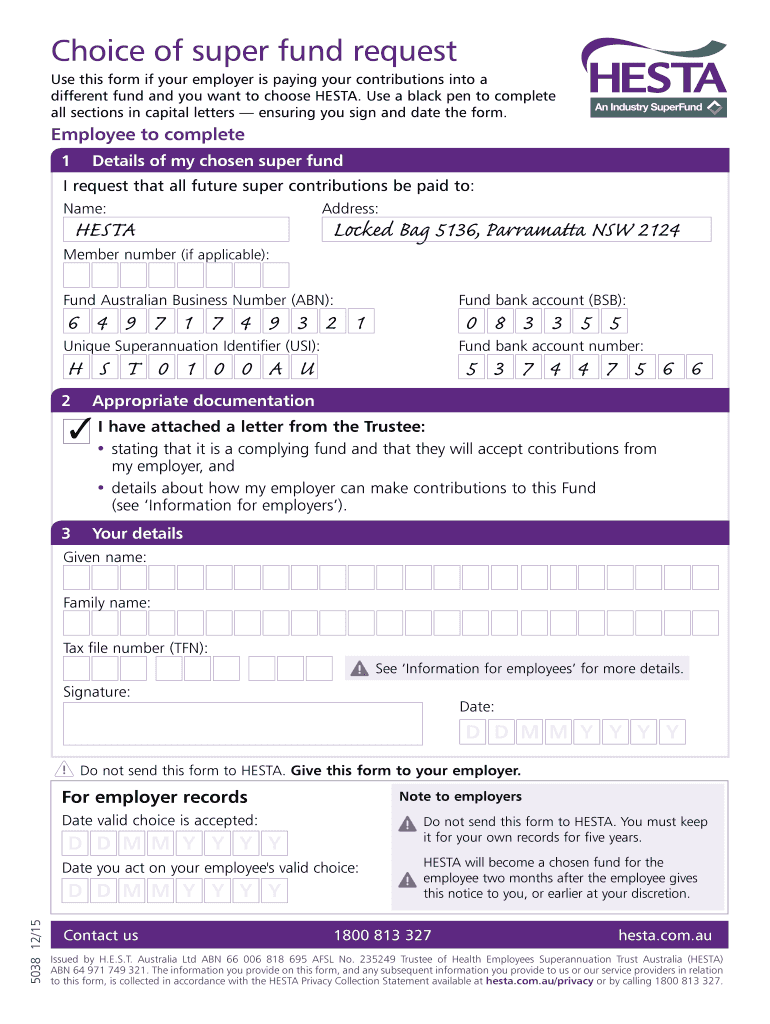

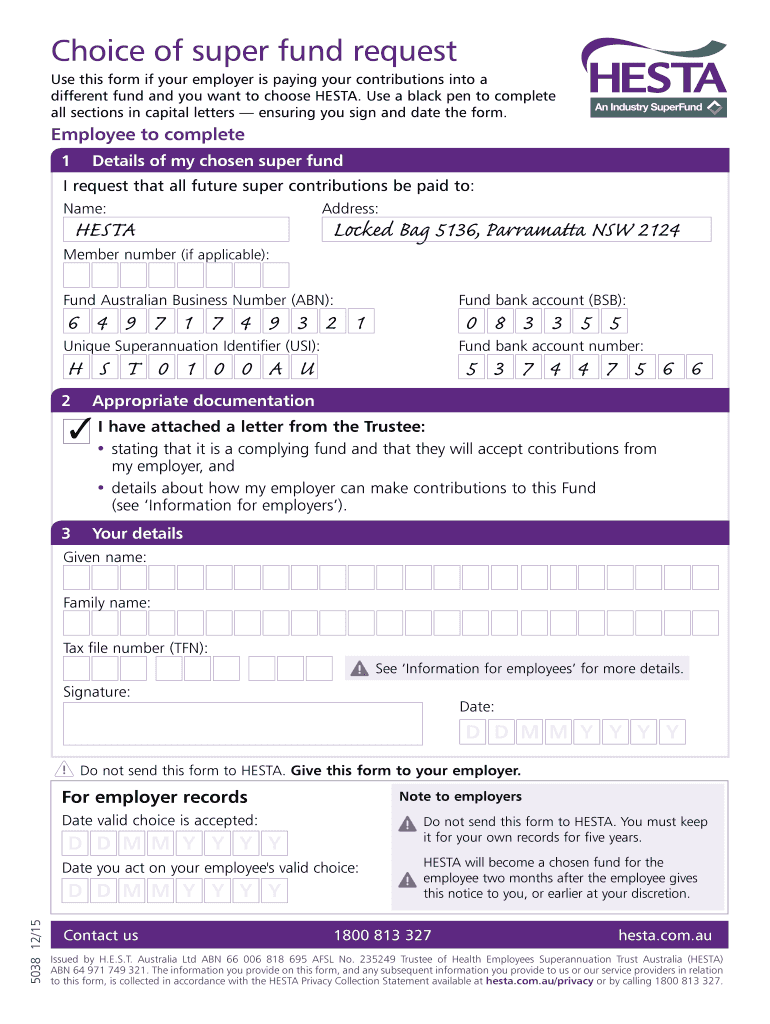

Choice of super fund request To have your super paid into VESTA complete this form and give it to your employer. More people in health and community services choose VESTA for their super Supports

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your choice of super fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your choice of super fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing choice of super fund online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit choice of super fund. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out choice of super fund

How to fill out choice of super fund:

01

Begin by obtaining the necessary form from your superannuation provider or employer. This form is often titled "Choice of Superannuation Fund" or something similar.

02

Provide your personal information, including your full name, date of birth, and contact details. Ensure that all information provided is accurate and up to date.

03

Indicate your current superannuation fund details, including the name of the fund and the account or member number. If you don't have an existing superannuation fund, leave this section blank.

04

Research and compare different superannuation funds to determine which one suits your needs. Take into account factors such as fees, investment options, performance, and insurance offerings.

05

Choose the superannuation fund that you would like to switch to or establish a new account with. Write down the name of the fund and any necessary details, such as the Unique Superannuation Identifier (USI) or Australian Business Number (ABN).

06

If you wish to transfer any superannuation balance from your existing fund to the new fund, indicate the amount or percentage you would like to transfer. This is typically optional and depends on your individual circumstances.

07

Consider seeking financial advice if you are unsure about which superannuation fund to choose or if you have complex financial situations. A financial advisor can provide personalized guidance based on your goals and circumstances.

Who needs choice of super fund:

01

Individuals who are starting their first job and need to select a superannuation fund. Choosing a suitable superannuation fund is an important decision that can impact your retirement savings in the long run.

02

Employees who have changed jobs or are considering switching superannuation funds. If you are not satisfied with the performance, fees, or services provided by your current fund, you may want to explore other options.

03

Self-employed individuals or small business owners who want to establish a superannuation fund for themselves. By choosing a suitable superannuation fund, you can take advantage of tax benefits and ensure your retirement savings are well-managed.

04

Individuals who are nearing retirement and want to consolidate their superannuation accounts. This can simplify your financial situation and potentially reduce unnecessary fees and charges.

Remember, it's essential to consider your individual circumstances and financial goals when choosing a superannuation fund. Taking the time to research and fill out the choice of super fund form accurately can set you on the right path towards a secure retirement.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is choice of super fund?

The choice of super fund is the selection of a specific superannuation fund by an employee for the employer to pay their super contributions into.

Who is required to file choice of super fund?

All employees who are eligible to choose their super fund are required to file choice of super fund.

How to fill out choice of super fund?

Employees can fill out the choice of super fund form provided by their employer, or submit their chosen super fund details online through the employer's preferred method.

What is the purpose of choice of super fund?

The purpose of choice of super fund is to allow employees to have control over where their employer contributes their superannuation payments.

What information must be reported on choice of super fund?

Employees must report their chosen super fund's ABN, USI, or SPIN, as well as their personal details to ensure accurate contributions.

When is the deadline to file choice of super fund in 2024?

The deadline to file choice of super fund in 2024 is typically 28 days after starting a new job or receiving the choice of fund form, but it's recommended to confirm with the employer.

What is the penalty for the late filing of choice of super fund?

The penalty for late filing of choice of super fund can result in the employer continuing to make contributions to the default fund, rather than the employee's chosen fund. This can affect the growth of the employee's superannuation savings.

How do I make changes in choice of super fund?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your choice of super fund to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an eSignature for the choice of super fund in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your choice of super fund and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I fill out choice of super fund on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your choice of super fund. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your choice of super fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.