Get the free Gasoline/special fuel tax refund permit application - FormSend

Show details

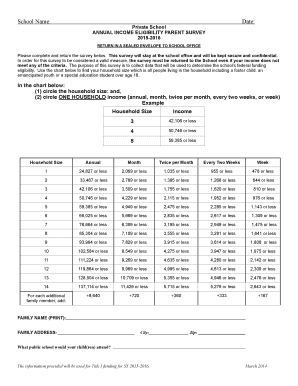

DR 7189 (02/24/05) COLORADO DEPARTMENT OF REVENUE DENVER, CO 80261-0016 (303) 205-8205 27 DEPARTMENTAL USE ONLY GASOLINE/SPECIAL FUEL TAX REFUND PERMIT APPLICATION Registration/Permit Number (Department

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gasolinespecial fuel tax refund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gasolinespecial fuel tax refund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gasolinespecial fuel tax refund online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gasolinespecial fuel tax refund. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out gasolinespecial fuel tax refund

How to fill out gasolinespecial fuel tax refund:

01

Gather all necessary documentation, such as receipts and invoices for fuel purchases.

02

Determine your eligibility for the refund by checking the specific criteria set by your local tax authority.

03

Complete the required forms, accurately entering all relevant information, such as your personal details, business information (if applicable), and fuel expenditure.

04

Attach copies of the supporting documents to the completed forms, ensuring that they are organized and easily identifiable.

05

Verify that all information provided is correct and sign the forms, acknowledging the accuracy of the information provided.

06

Submit the completed forms and supporting documents to the appropriate tax authority according to their guidelines and deadlines.

07

Keep copies of all submitted documents for your records and for potential future reference.

Who needs gasolinespecial fuel tax refund:

01

Individuals or businesses that have purchased gasoline or special fuel for eligible purposes, such as agricultural, commercial, or industrial activities.

02

Those who meet the specific criteria outlined by their local tax authority, which may include factors such as fuel usage, type of operation, or specific industry regulations.

03

Individuals or businesses seeking to recover a portion of the taxes paid on gasoline or special fuel in order to reduce operating costs or comply with tax regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gasolinespecial fuel tax refund?

The gasoline special fuel tax refund is a refund of the taxes paid on gasoline or special fuels that are used for certain purposes, such as off-highway business use, farming, or other specified non-highway uses.

Who is required to file gasolinespecial fuel tax refund?

Individuals, businesses, farmers, and other entities who use gasoline or special fuels for eligible non-highway purposes are required to file for the gasolinespecial fuel tax refund.

How to fill out gasolinespecial fuel tax refund?

To fill out the gasolinespecial fuel tax refund, you need to complete the appropriate tax forms provided by the tax authority. These forms usually require information such as the amount of fuel used for eligible purposes, proof of purchase, and other relevant details.

What is the purpose of gasolinespecial fuel tax refund?

The purpose of the gasolinespecial fuel tax refund is to provide a refund for the taxes paid on gasoline or special fuels that are not used on public highways but for specific purposes as outlined by the tax authority.

What information must be reported on gasolinespecial fuel tax refund?

The gasolinespecial fuel tax refund typically requires the reporting of information such as the amount of fuel purchased and used for eligible purposes, support documentation for the claims made, and any other details as required by the tax authority.

When is the deadline to file gasolinespecial fuel tax refund in 2023?

The deadline to file the gasolinespecial fuel tax refund in 2023 may vary depending on the tax authority and jurisdiction. It is recommended to consult the official guidelines or contact the tax authority directly to determine the specific deadline.

What is the penalty for the late filing of gasolinespecial fuel tax refund?

The penalties for the late filing of the gasolinespecial fuel tax refund can vary depending on the tax authority and jurisdiction. Common penalties may include late filing fees, interest on the outstanding amount, and potential legal consequences. It is advisable to consult the official guidelines or seek professional advice for accurate information regarding penalties.

How do I complete gasolinespecial fuel tax refund online?

With pdfFiller, you may easily complete and sign gasolinespecial fuel tax refund online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit gasolinespecial fuel tax refund online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your gasolinespecial fuel tax refund to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit gasolinespecial fuel tax refund in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing gasolinespecial fuel tax refund and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Fill out your gasolinespecial fuel tax refund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.