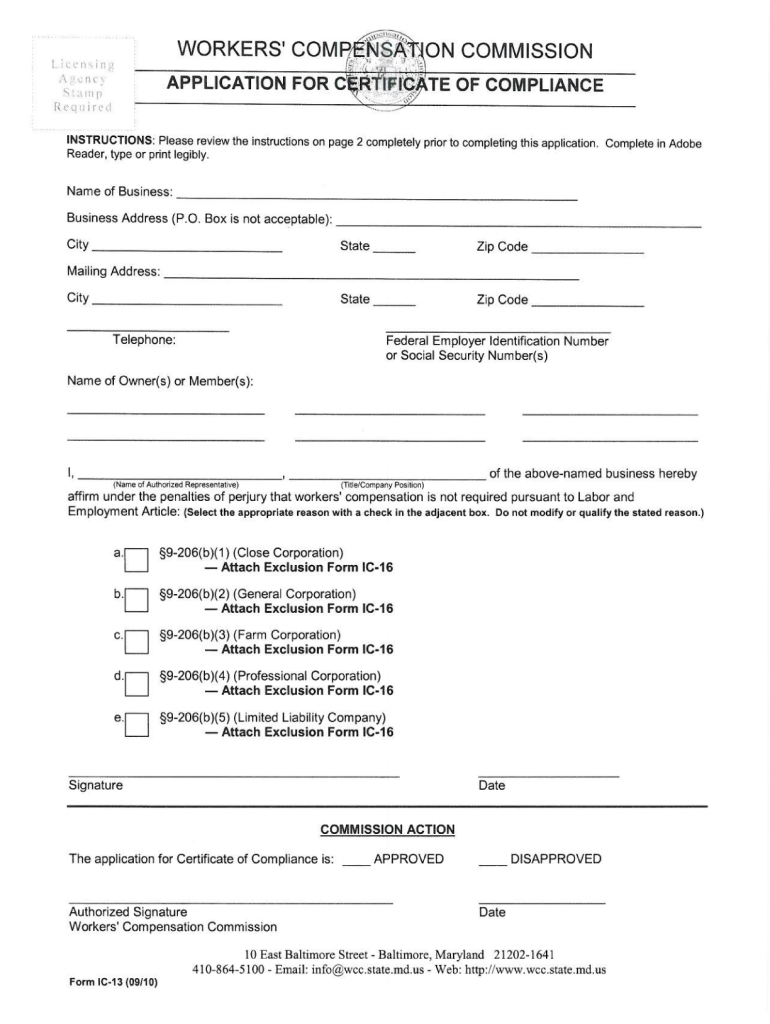

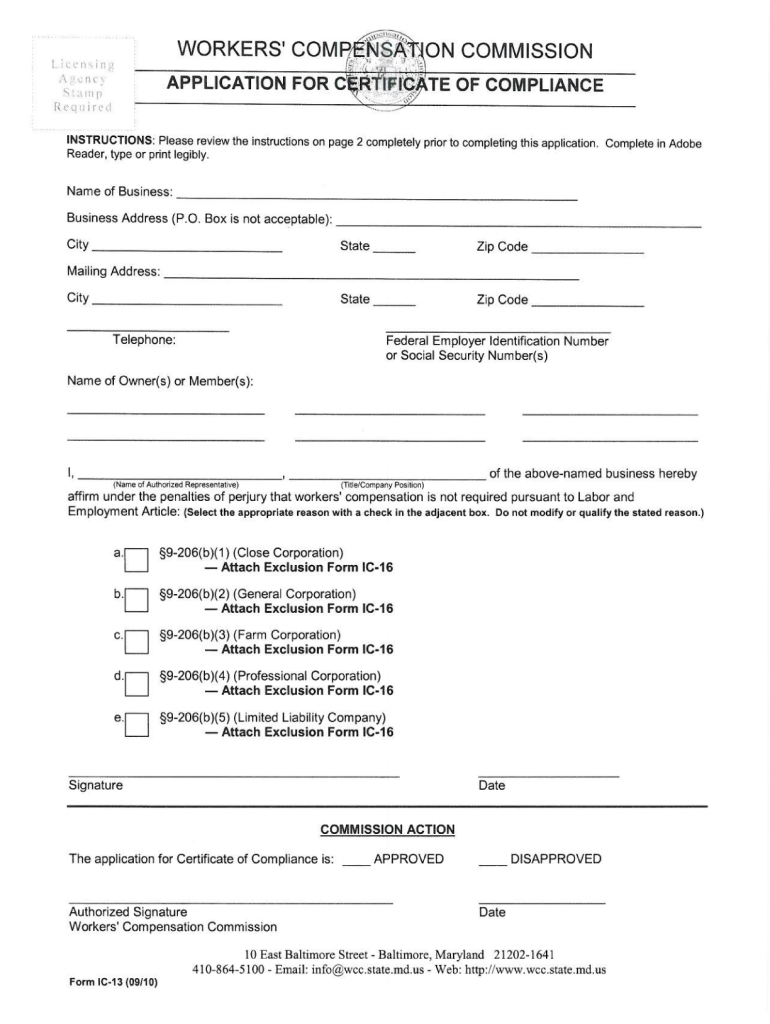

MD IC-13 2010-2024 free printable template

Get, Create, Make and Sign

How to edit maryland worker compliance online

How to fill out maryland worker compliance form

How to Fill Out Maryland Worker Compliance:

Who Needs Maryland Worker Compliance:

Video instructions and help with filling out and completing maryland worker compliance

Instructions and Help about maryland 13 compensation certificate form

Hello Welcome to the public election compliance seminar I'm Jared Remains with the MarylandState Board of Elections and with me is David Crow from the Department of Finance at Montgomery County Government Jared Remains The public election fund of Montgomery County has multiple resources at your disposal for candidates for the public and for other stakeholders to know more about the program We recommend you constantly use these vital resources in learning about it There's the summary guide which was published in June 2017 and the Montgomery County program website which is listed here on the slide David Crow This program covers ten offices that are eligible to participate in the program The County Executive's office for At-Large Council seats and five District Councils seats Jared Remains The first steps to participate is that you have to register a public finance committee through the Maryland CampaignReporting System also known as MDC RIS And at the time of registration you have to file a notice to participate The following slide here shows the document sin which you will be filling out at the time of registration This will all redone through the program, and you'd only have to enter it in once The Notice intent The Statement of Organization The Appointment of Chairman and Treasure rand some other important legal notices The Statement of Organization along with the Appointment of Chairman and Treasurer will be used when you open up your bank account The Notice of Intent lets the state and the county know your intent to participate in the program Once approved by the State Board of Elections an email will be sent to all the committee members — candidate there Chair and the Treasurer If you do not receive this email within 24 hours please let us know It's important that you may have to look in your spam folder for such emails If you do please make sure that the State Board of Elections ISA safe sender Once the email is received the three members will receive temporary passwords to log in to MDC RIS You will each then choose your own unique password We do not keep passwords If you forget your password use the 'Trouble Logging In' feature on the program David Crow Upon filing an Intent to Participate in the public election fund program a campaign must establish a publicly funded campaign account to handle all activity during the publicly funded campaign All the bank accounts associated with the campaign must be frozen or closed during this time period Jared Remains If at any point during your campaign you have to edit your registration

Fill form 13 compensation certificate form : Try Risk Free

People Also Ask about maryland worker compliance

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your maryland worker compliance form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.