Get the free Form G-17, Rev. 2004, Resale Certificate for Goods ... - CertCapture

Show details

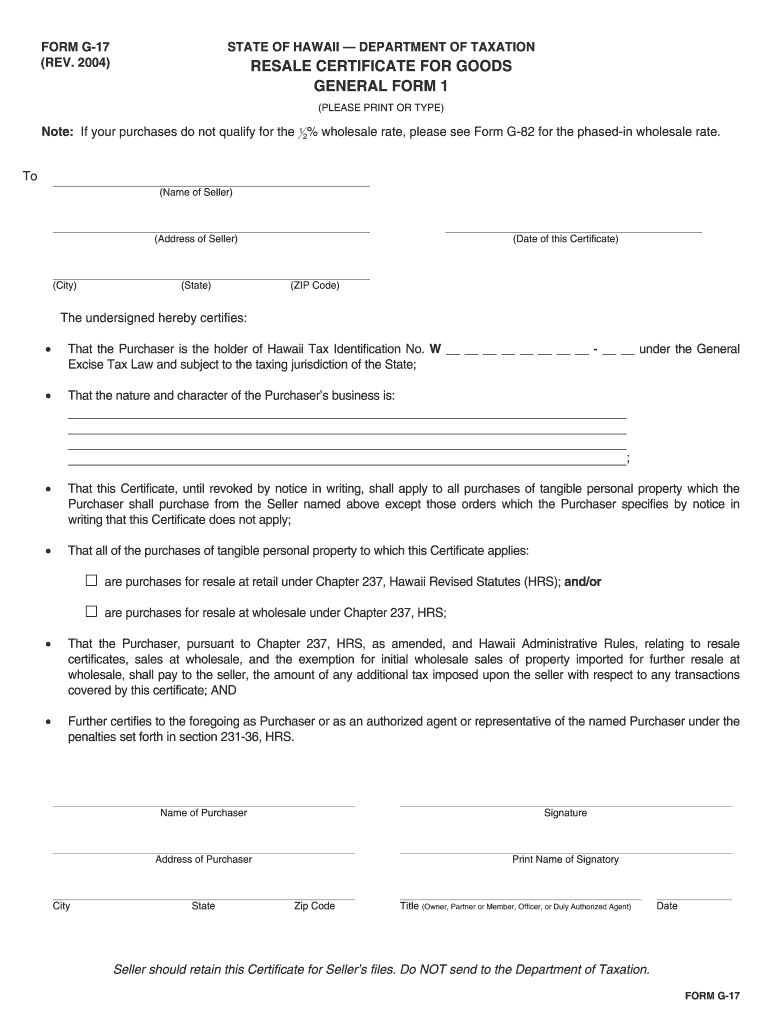

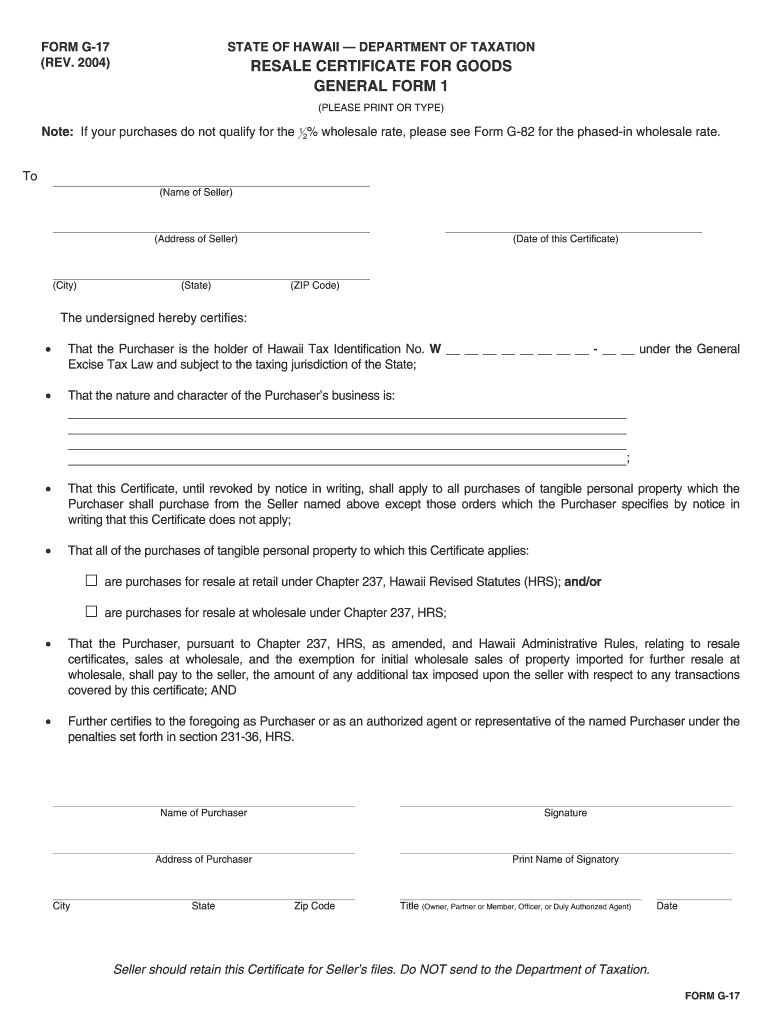

Clear Form G-17 (REV. 2004) STATE OF HAWAII DEPARTMENT OF TAXATION RESALE CERTIFICATE FOR GOODS GENERAL FORM 1 (PLEASE PRINT OR TYPE) Note: If your purchases do not qualify for the 12% wholesale rate,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form g-17 rev 2004 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form g-17 rev 2004 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form g-17 rev 2004 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form g-17 rev 2004. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

How to fill out form g-17 rev 2004

How to fill out form g-17 rev 2004?

01

Start by carefully reading the instructions provided with form g-17 rev 2004. This will give you a clear understanding of the information required and the steps involved in completing the form.

02

Begin by filling out the basic information section, which typically includes your name, contact details, and any other pertinent personal information requested.

03

Next, make sure to accurately provide the necessary details specific to the purpose of the form. This could involve providing financial information, employment history, or any other relevant information requested.

04

Double-check all the information you have entered to ensure accuracy and completeness. Mistakes or missing information could lead to delays or complications with the processing of your form.

05

Once you have reviewed and verified the accuracy of your entries, sign and date the form as required.

06

Finally, submit the completed form along with any supporting documents or fees required. Be sure to follow the instructions for submission as outlined in the form's guidelines.

Who needs form g-17 rev 2004?

01

Individuals who are required to report specific financial or employment information may need to complete form g-17 rev 2004. This could include individuals applying for certain types of loans, financial assistance, or government benefits.

02

Employers may also need to fill out form g-17 rev 2004 when reporting employee information for tax purposes or complying with specific reporting requirements.

03

Additionally, individuals or organizations involved in certain legal or financial transactions may need to complete this form as part of their documentation or compliance process.

It is important to note that the specific need for form g-17 rev 2004 can vary depending on the jurisdiction and the specific circumstances. Therefore, it is always advisable to consult the instructions provided with the form or seek professional advice if you are unsure about whether you need to fill out this form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form g-17 rev resale?

Form G-17 Rev Resale is a form used to report resale activity for tax purposes.

Who is required to file form g-17 rev resale?

Any individual or entity engaged in resale activity is required to file Form G-17 Rev Resale.

How to fill out form g-17 rev resale?

Form G-17 Rev Resale can be filled out by providing the necessary information about the resale activity, including details about the items being resold.

What is the purpose of form g-17 rev resale?

The purpose of Form G-17 Rev Resale is to report resale activity to the relevant tax authorities for tax compliance.

What information must be reported on form g-17 rev resale?

Information such as the description of the items being resold, the quantity, the sale price, and the buyer's information must be reported on Form G-17 Rev Resale.

When is the deadline to file form g-17 rev resale in 2023?

The deadline to file Form G-17 Rev Resale in 2023 is April 15th.

What is the penalty for the late filing of form g-17 rev resale?

The penalty for the late filing of Form G-17 Rev Resale is a fine of $100 per day, up to a maximum of $5,000.

Can I create an eSignature for the form g-17 rev 2004 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your form g-17 rev 2004 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I fill out form g-17 rev 2004 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your form g-17 rev 2004. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete form g-17 rev 2004 on an Android device?

Use the pdfFiller mobile app to complete your form g-17 rev 2004 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your form g-17 rev 2004 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.