IRS W-2 Authorization Form 2014-2024 free printable template

Show details

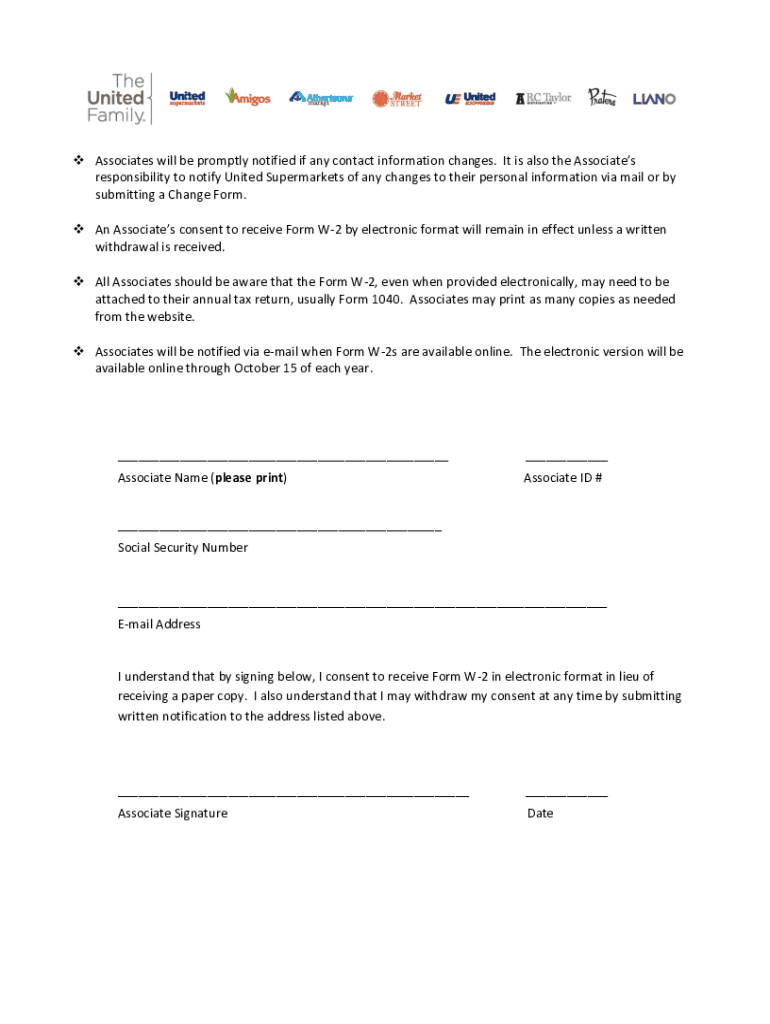

Online W2 Authorization Form The United Family is required by the IRS to furnish all Associates with a Form W2 for each calendar year. The Form W2 details the Associates compensation and tax withholding

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your internal revenue service online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your internal revenue service online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing internal revenue service online online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit w 2 authorization form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out internal revenue service online

01

To fill out the Internal Revenue Service online, you need to visit the official website of the IRS.

02

Once you're on the website, navigate to the section or form that you need to fill out. The IRS provides detailed instructions and guidance for each form on their website.

03

Read through the instructions carefully, ensuring that you have all the necessary documents and information readily available. This may include your social security number, income statements, and any other relevant financial documents.

04

Begin filling out the form by entering the required information accurately and completely. Double-check all the details to minimize errors.

05

Depending on the form, you may also need to answer specific questions or provide additional details related to your income, deductions, credits, or any other relevant information.

06

Once you have completed all the required sections of the form, review your answers thoroughly. Ensure that all the information is correct and there are no mistakes or omissions.

07

If the form requires signatures, electronically sign or submit the document as per the provided instructions. Some forms may require you to print, sign, and mail them to the IRS.

08

After submitting the form online or mailing it, you may receive a confirmation or acknowledgment from the IRS. Keep this for your records and to track the progress of your submission.

09

It is important to note that not everyone needs to use the Internal Revenue Service online. Typically, individuals or businesses who are required to file tax returns, claim tax credits, report income, or fulfill other tax obligations need to utilize the IRS online services. However, specific eligibility or requirements may vary depending on your unique circumstances. It is crucial to consult the IRS guidelines or seek professional advice to determine whether you need to use the online service.

Fill how to get my albertsons w2 : Try Risk Free

People Also Ask about internal revenue service online

How do I make my payment to the IRS?

How do I talk to a real live person at the IRS?

How do I send electronically documents to the IRS?

Can you upload documents to IRS?

Can I make IRS payment over the phone?

How do I send my tax documents securely?

How do I call the IRS outside the US?

Can I send a PDF of my tax return to the IRS?

How do I ask the IRS for a question?

What is the best way to talk to IRS?

How do I speak directly to someone at the IRS?

How do I contact the IRS from Canada?

How do I pay 2022 estimated taxes?

How do I send an electronic fax to the IRS?

Can you chat online with an IRS agent?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is internal revenue service online?

The Internal Revenue Service (IRS) Online is a website provided by the IRS that allows taxpayers to access their own tax records, make payments, and view tax-related information. It also provides information about filing taxes, payment options, tax credits, and other tax-related topics.

How to fill out internal revenue service online?

1. Go to the Internal Revenue Service (IRS) website and select the Online Services tab.

2. Create an account using your Social Security number, filing status, and contact information.

3. Select the form you need to file and follow the instructions to complete the form.

4. Once you are finished, submit the form electronically.

5. Print a copy of the form for your records.

What is the penalty for the late filing of internal revenue service online?

The penalty for filing taxes late is generally 5% of the unpaid taxes for each month or part of a month that a return is late, up to a maximum of 25%. In addition, if a return is more than 60 days late, the minimum penalty is the smaller of $135 or 100% of the unpaid tax.

Who is required to file internal revenue service online?

Individuals, corporations, partnerships, estates, and trusts are required to file with the Internal Revenue Service (IRS) online. Additionally, any taxpayer whose annual gross income exceeds a certain threshold must file their federal tax return online. The threshold may vary each year and is determined by factors such as filing status and age. It is recommended to consult the IRS website or a tax professional for specific filing requirements.

What is the purpose of internal revenue service online?

The purpose of the Internal Revenue Service (IRS) online services is to facilitate the filing, payment, and management of federal taxes for individuals and businesses. The IRS online platform provides various services and features, such as:

1. Filing Tax Returns: Taxpayers can electronically file their federal tax returns through the IRS website using tools like Free File or fillable forms.

2. Payment of Taxes: Individuals and businesses can make tax payments online securely, including estimated tax payments, installment agreements, and tax due payments.

3. Taxpayer Account Management: Taxpayers can access their account information, view tax transcripts, check refund status, update personal information, and request payment plans or other assistance.

4. Tax Tools and Calculators: The IRS online portal offers tax tools and calculators to help taxpayers estimate withholdings, calculate penalties, and determine eligibility for various tax credits and deductions.

5. Tax Law Guidance and Resources: Taxpayers can access tax forms, publications, instructions, and other resources to understand tax laws, deductions, credits, and reporting requirements.

6. Communication and Support: The IRS online services provide channels for secure electronic communication with the IRS, such as submitting inquiries, responding to notices, or requesting tax assistance.

Overall, the purpose of the IRS online services is to enhance taxpayer convenience, streamline tax-related processes, provide resources and guidance, and ensure compliance with federal tax laws.

What information must be reported on internal revenue service online?

When using the Internal Revenue Service (IRS) online services, certain information must be reported, which can vary depending on the specific service being used. Here are some examples of the type of information that may need to be reported:

1. Personal Information: Basic personal details such as your name, social security number (SSN), date of birth, and contact information may be required to set up an account or access certain services.

2. Income Information: Reporting income is a central requirement for most tax-related services. This includes information related to wages, salary, self-employment earnings, investment income, rental income, and any other sources of income that need to be reported for tax purposes.

3. Deductions and Credits: If you are filing a tax return, you may need to report deductions and credits that you are eligible for. This can include deductions like mortgage interest, student loan interest, medical expenses, and education-related expenses. It may also include tax credits for child and dependent care, education, energy-efficient home improvements, and earned income, among others.

4. Bank and Financial Information: If you are setting up direct deposit for a tax refund or making online payments, you may need to provide your bank account details, including the routing number and account number, along with any other required financial information.

5. Tax Withholding Information: If you are an employee, you may need to report your tax withholding information, such as the number of allowances claimed on Form W-4, to ensure accurate payroll tax calculations.

6. Business Information: If you are a business owner, you may need to provide additional information such as your Employer Identification Number (EIN), business income and expenses, and any other relevant details related to your business operations.

It's important to note that the specific information required can vary depending on the purpose of using an IRS online service. Each service or form may have its own unique requirements. It is recommended to review the specific instructions provided by the IRS for the service or form you are utilizing to ensure accurate reporting.

When is the deadline to file internal revenue service online in 2023?

The specific deadline for filing taxes online with the Internal Revenue Service (IRS) for the year 2023 has not been determined yet. Typically, the tax filing deadline for most individuals is April 15th each year. However, it is advisable to check the official IRS website or consult a tax professional to get the accurate deadline information for the specific tax year.

How do I edit internal revenue service online in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your w 2 authorization form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit internal revenue service w2 form on an iOS device?

You certainly can. You can quickly edit, distribute, and sign how to get w2 from albertsons on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I edit when does albertsons send out w2 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share albertsons former employee w2 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your internal revenue service online online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Internal Revenue Service w2 Form is not the form you're looking for?Search for another form here.

Keywords relevant to albertsons w2 form

Related to albertsons w2 import code

If you believe that this page should be taken down, please follow our DMCA take down process

here

.