.

Tax Refund If you receive a tax refund, the money is yours, no questions asked. A quick way to pay yourself without a raise. Tax refund money is usually taken out of the ...

Tax Refund If you receive a tax refund, the money is yours, no questions asked. A quick way to pay yourself without a raise. Tax refund money is usually taken out of the ...

Tax Refund If you receive a tax refund, the money is yours, no questions asked. A quick way to pay yourself without a raise. Tax refund money is usually taken out of the ...

Tax Refund If you receive a tax refund, the money is yours, no questions asked. A quick way to pay yourself without a raise. Tax refund money is usually taken out of the ...

Tax Refund If you receive a tax refund, the money is yours, no questions asked. A quick way to pay yourself without a raise. Tax refund money is usually taken out of the ...

Tax Refund If you receive a tax refund, the money is yours, no questions asked. A quick way to pay yourself without a raise. Tax refund money is usually taken out of the ...

Tax Refund If you receive a tax refund, the money is yours, no questions asked. A quick way to pay yourself without a raise. Tax refund money is usually taken out of the ...

Tax Reduction if Homeowner's Exemption Amount Is 40,000 or Less If your Modified Adjusted Gross Income (MAGI) is less than 40,000, and you are a homeowner, there is a reduced tax ...

Homeowner Savings Account (HSA) For most residents, the IRS allows an HSA for qualified health care and dental expenses for their dependents to be used for ...

Housing Opportunity Tax Credit (HOT) Qualified families are eligible for tax benefits under the Housing Opportunity Tax Credit. Qualified families include those ...

Housing Opportunity Tax Credit (HOT) Qualified families are eligible for tax benefits under the Housing Opportunity Tax Credit. Qualified families include those ...

Housing Opportunity Tax Credit (HOT) Qualified families are eligible for tax benefits under the Housing Opportunity Tax Credit. Qualified families include those ...

TX 5200 2011 free printable template

Show details

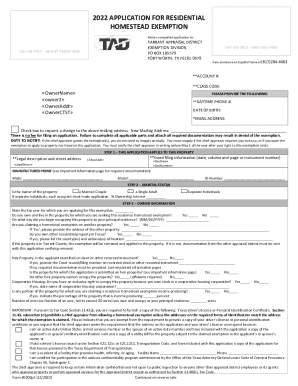

There is no fee for filing a homestead exemption Account PIDN FZYR FZVL XMPT State Code Home phone Work phone Date of Birth Failure to complete all applicable parts and attach all required documentation will result in denial of the exemption. An exemption can be granted only if the applicant brings himself fully within the statutes. Return application to Tarrant Appraisal District Exemption Division P. O. Box 185579 Fort Worth TX 76181-0579 817 284-4063 Application for Residential Homestead...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your fzyr 2011 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fzyr 2011 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fzyr 2011 form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fzyr 2011 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

TX 5200 Form Versions

Version

Form Popularity

Fillable & printabley

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fzyr form?

The fzyr form is a tax form used to report specific financial information to the tax authorities.

Who is required to file fzyr form?

All individuals and entities meeting certain criteria are required to file the fzyr form.

How to fill out fzyr form?

To fill out the fzyr form, you need to gather all the relevant financial information and complete the sections as instructed.

What is the purpose of fzyr form?

The purpose of the fzyr form is to provide the tax authorities with detailed financial information, which is used for various tax calculations and assessments.

What information must be reported on fzyr form?

The fzyr form typically requires reporting of income, expenses, deductions, and other financial details relevant to the tax calculations.

When is the deadline to file fzyr form in 2023?

The specific deadline to file the fzyr form in 2023 will be announced by the tax authorities and may vary depending on the jurisdiction.

What is the penalty for the late filing of fzyr form?

The penalty for the late filing of the fzyr form may vary depending on the applicable tax laws and regulations. It is advisable to consult with a tax professional or refer to the official guidelines provided by the tax authorities.

How can I modify fzyr 2011 form without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including fzyr 2011 form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for the fzyr 2011 form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your fzyr 2011 form in minutes.

Can I create an eSignature for the fzyr 2011 form in Gmail?

Create your eSignature using pdfFiller and then eSign your fzyr 2011 form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your fzyr 2011 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.