Get the free Lien Release - Restoration Roofing Consultants

Show details

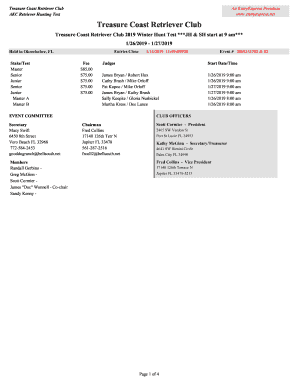

1612 Edinburgh Drive Euless, TX 76039 Office: 817.532.7238 LIEN RELEASE HOMEOWNER: ADDRESS: CONTRACT NUMBER: STATE OF: TEXAS COUNTY OF: I, being duly sworn, here by depose the state that I am a representative

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your lien release - restoration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lien release - restoration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lien release - restoration online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit lien release - restoration. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out lien release - restoration

How to fill out lien release - restoration:

01

Obtain the necessary forms: You'll need to get the lien release - restoration forms from the appropriate governing agency or department. This could be the local government, a state agency, or even a federal agency depending on the nature of the lien.

02

Gather required information: Before you start filling out the forms, make sure you have all the necessary information at hand. This may include details such as the lienholder's name and contact information, the property or asset related to the lien, any outstanding payments or debts, and the reason for the lien release - restoration.

03

Read and understand the instructions: Carefully review the instructions provided with the forms. Make sure you understand the process and any specific requirements or deadlines.

04

Fill out the forms accurately: Begin by entering your personal or business details as the party seeking the lien release - restoration. Then, provide all the relevant information about the lienholder, including their contact information and any identifying numbers or references.

05

Specify the property or asset: Clearly describe the property or asset that was originally subject to the lien. Include any specific details that may be required, such as the address, legal description, or identification numbers.

06

Explain the reason for lien release - restoration: Provide a detailed explanation of why the lien should be released or restored. This could be due to a completed payment plan, a negotiated settlement, a change in ownership, or any other relevant circumstances.

07

Attach supporting documents: If there are any supporting documents, such as payment receipts, legal agreements, or court judgments, make sure to attach them with your completed forms. These documents can provide evidence or additional context for the lien release - restoration request.

08

Review and submit the forms: Before submitting the forms, review them carefully to ensure all the information is accurate and complete. If possible, have someone else review them as well to catch any errors or omissions. Once you are satisfied, submit the completed forms to the appropriate governing agency or department.

Who needs lien release - restoration?

01

Property owners: If you own a property that had a lien placed on it, you may need a lien release - restoration to clear the title or regain full ownership rights.

02

Contractors and subcontractors: Construction professionals who have placed a lien on a property due to unpaid bills or other issues may need a lien release - restoration once the outstanding amounts are settled.

03

Buyers and sellers: When buying or selling real estate or other assets, it is crucial to ensure any existing liens are properly released or restored to avoid legal complications.

04

Financial institutions: Lenders who have placed a lien on a borrower's property as collateral for a loan may need a lien release - restoration once the loan is fully repaid or other conditions are met.

05

Legal professionals: Attorneys or legal experts handling cases involving property liens may facilitate the lien release - restoration process on behalf of their clients.

Remember to consult with an attorney or seek professional advice specific to your situation to ensure you comply with all necessary laws and regulations when filling out a lien release - restoration.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lien release - restoration?

Lien release-restoration is a legal document that removes or restores a lien that has been placed on a property or asset.

Who is required to file lien release - restoration?

The party who placed the lien or the party who had the lien placed on their property or asset is required to file lien release-restoration.

How to fill out lien release - restoration?

To fill out lien release-restoration, the party must provide information about the lien, the property or asset, and may need to have it notarized.

What is the purpose of lien release - restoration?

The purpose of lien release-restoration is to officially remove or restore a lien on a property or asset, indicating that the debt or obligation has been satisfied.

What information must be reported on lien release - restoration?

Information such as the property or asset details, the lien details, and any relevant parties involved must be reported on lien release-restoration.

When is the deadline to file lien release - restoration in 2024?

The deadline to file lien release-restoration in 2024 is usually determined by the specific circumstances of the lien and the agreement between the parties involved.

What is the penalty for the late filing of lien release - restoration?

The penalty for the late filing of lien release-restoration may vary depending on the jurisdiction, but it could result in fines, penalties, or legal consequences.

How do I edit lien release - restoration online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your lien release - restoration to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the lien release - restoration in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your lien release - restoration and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I fill out lien release - restoration on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your lien release - restoration. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your lien release - restoration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.