Get the free leave salary format

Show details

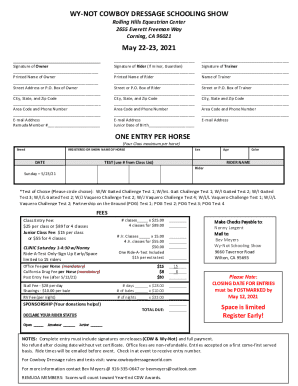

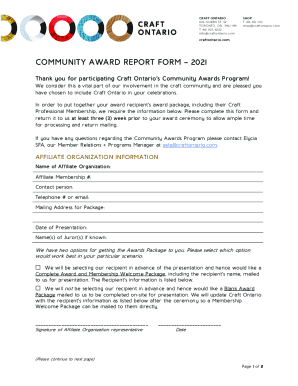

SAIF BELHASA GROUP OF COMPANIES LEAVE SALARY FORM Group Company Name Dear Sir Date //. Kindly do the needful to release my leave salary for personal reasons. Yours Sincerely Sign Name Branch Employee No Designation Department ACCOUNTANT S REMARKS Date of Joining Monthly salary Leave Salary for the period of Eligibility Other Remarks If Any Chief Accountant H. R Coordinator-SBGC Approved by Chairman Note - Amount to be transferred in 20 working days from the date of submission if eligible....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your leave salary format form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your leave salary format form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing leave salary format online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit leave salary format in word. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out leave salary format

To fill out the leave salary format, follow these steps:

01

Start by entering your personal information at the top of the form, including your name, employee ID, and contact details.

02

Specify the period for which you are requesting leave salary. This can be done by entering the start and end dates of your leave.

03

Next, provide details about the type of leave you are taking, such as annual leave, sick leave, or unpaid leave. Indicate the number of days/hours you are entitled to or have taken.

04

If you are eligible for any additional benefits during your leave, mention them in the appropriate section. This could include travel allowances, medical coverage, or other entitlements specified in your employment contract.

05

In case you have taken any previous leaves during the specified period, mention them separately and provide the necessary details (dates, leave type, duration).

06

Calculate the total amount of leave salary you are entitled to receive. This can be determined by multiplying your daily rate by the number of days you have taken or are entitled to. Include any additional benefits or allowances, if applicable.

07

Finally, don't forget to sign and date the form.

Everyone who is eligible for leave salary, regardless of their employment status or industry, needs a leave salary format. This includes employees in both the public and private sectors, freelancers, and contractors. The leave salary format ensures transparency, accuracy, and proper documentation of leave entitlements and payouts.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is leave salary format in?

Leave salary is typically paid in the same format as regular salary. This includes payment through direct deposit, paper checks, or other salary payment methods depending on the employer’s policy.

Who is required to file leave salary format in?

Employers are required to file leave salary format with the local labor department. The specific requirements vary by state.

When is the deadline to file leave salary format in in 2023?

The deadline to file leave salary format in 2023 is typically March 31 of the same year.

How to fill out leave salary format in?

To fill out a leave salary format, follow these steps:

1. Personal Information: Start by providing your personal details such as your full name, employee number, designation, department, and contact information. This information helps in uniquely identifying you and ensuring accurate processing of your leave salary.

2. Leave Details: Specify the leave period for which you are claiming the salary. This includes the start and end dates of the leave and the total number of days you are taking leave.

3. Salary Information: Enter your monthly salary amount, which is typically mentioned in your employment contract or pay slip. If you have any additional components in your salary structure, such as allowances or bonuses, clearly mention those as well.

4. Calculation: Calculate the amount of leave salary you are entitled to by multiplying your daily salary rate by the number of days of leave taken. This can be calculated by dividing your monthly salary by the total number of working days in a month. Alternatively, if your organization has a predefined formula for leave salary calculation, apply that formula to determine the amount.

5. Deductions: If there are any deductions to be made from your leave salary, such as taxes or loan repayments, make sure to subtract these amounts from the calculated leave salary. Clearly mention the deductions and provide an explanation if required.

6. Net Leave Salary: Subtract the deductions from the calculated leave salary to arrive at the net leave salary amount. This is the final amount you are eligible to receive as leave salary.

7. Date and Signature: Indicate the date of filling out the form and sign it to authenticate the information provided. If required, you can also mention any supporting documents attached to the form, such as medical certificates or leave application.

It is important to note that the format for filling out leave salary may vary depending on your organization's policies and guidelines. Make sure to follow any specific instructions provided by your HR department while filling out the form.

What is the purpose of leave salary format in?

The purpose of a leave salary format is to provide clarity and transparency in payment calculations for employees who are on leave. It outlines the method and calculation used by the employer to determine the salary amount an employee will receive during their time off. This format helps both employees and employers to understand how the leave salary is calculated, ensuring fair and consistent payment practices.

What information must be reported on leave salary format in?

The information that must be reported on a leave salary format includes:

1. Employee details: Name, employee ID, department, designation, and joining date.

2. Leave period: Start and end dates of the leave period for which the salary is being calculated.

3. Total leave days: The number of days the employee has availed of leave during the specified period.

4. Basic salary: The employee's basic salary for the leave period, which may include any applicable allowances or benefits.

5. Leave balance: The remaining leave balance of the employee after deducting the leave days taken during the period.

6. Leave encashment: If the company policy allows employees to encash unused leave days, the number of days being encashed, and the corresponding amount.

7. Deductions: Any deductions to be made from the leave salary, such as income tax, provident fund contributions, or any outstanding loans or advances.

8. Gross salary: The total leave salary before any deductions or taxes.

9. Net salary: The final amount the employee will receive after deducting any applicable deductions or taxes.

10. Payment details: The mode of payment, such as bank transfer or cheque, and the payment date.

11. Signature and approval: The signature of the authorized person, such as the HR manager or supervisor, who is responsible for approving the leave salary.

What is the penalty for the late filing of leave salary format in?

The penalty for the late filing of leave salary format may vary depending on the specific rules and regulations of the organization or country.

In some cases, there may be a fine imposed on the employee who fails to file the leave salary format on time. The amount of the fine can vary, and it is typically deducted from the employee's salary.

Additionally, there may be potential consequences such as a delay in receiving the leave salary or a negative impact on future leave approvals.

It is advisable to consult with the relevant HR department or supervisor to understand the specific penalties or consequences for late filing of leave salary format in your organization.

How can I send leave salary format to be eSigned by others?

When you're ready to share your leave salary format in word, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete leave salary request form online?

With pdfFiller, you may easily complete and sign leave salary payment format online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit leave salary application form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign leave salary form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your leave salary format online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Leave Salary Request Form is not the form you're looking for?Search for another form here.

Keywords relevant to leave salary application format

Related to leave salary format

If you believe that this page should be taken down, please follow our DMCA take down process

here

.