Get the free Existing Client Corporate Account Application Form

Show details

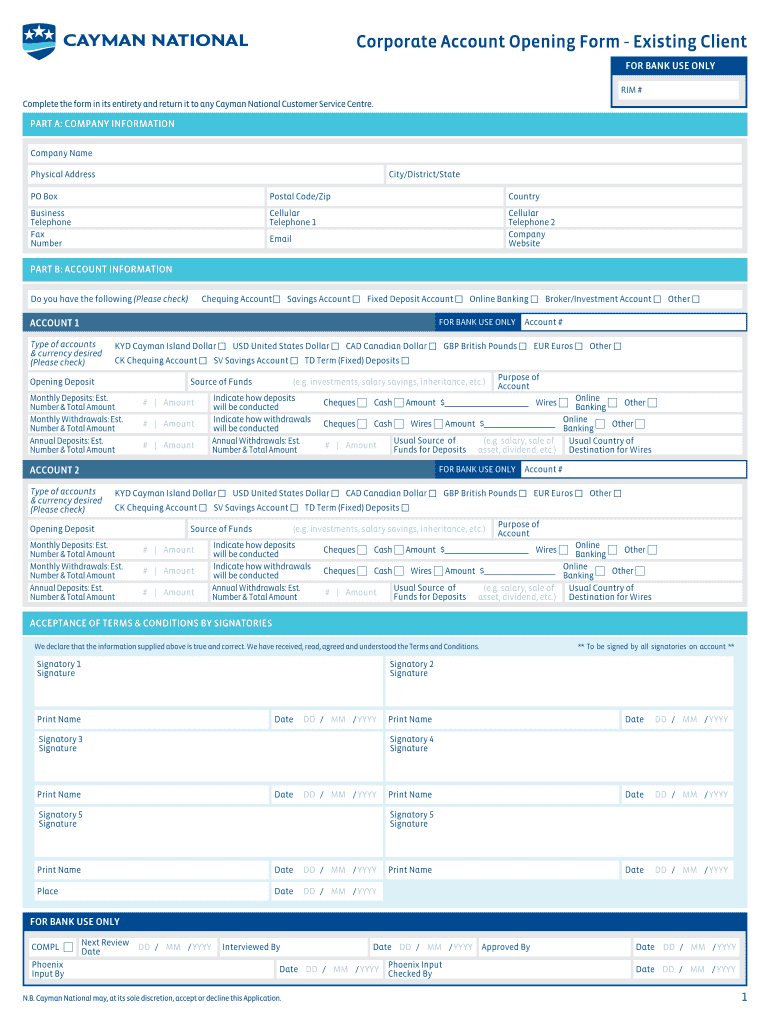

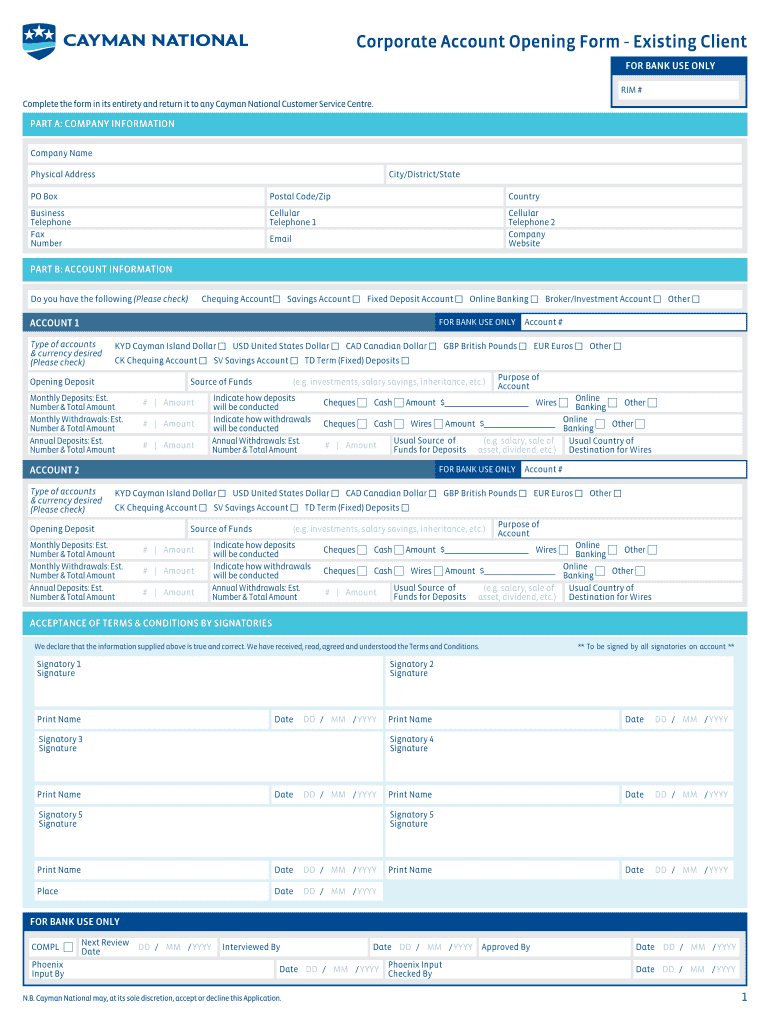

Corporate Account Opening Form Existing Client FOR BANK USE ONLY RIM # Complete the form in its entirety and return it to any Cayman National Customer Service Center. PART A: COMPANY INFORMATION Company

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your existing client corporate account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your existing client corporate account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing existing client corporate account online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit existing client corporate account. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out existing client corporate account

How to fill out an existing client corporate account:

01

Gather all the necessary documents and information. This may include the client's identification, proof of address, tax identification number, and any other relevant documents required by the bank or financial institution.

02

Contact the bank or financial institution where the corporate account is held. This can usually be done by phone or online. Provide them with the necessary information and let them know that you would like to fill out the existing client corporate account.

03

Follow the instructions provided by the bank or financial institution. They may ask you to fill out an application form or provide certain details through their online platform. Make sure to provide accurate and up-to-date information.

04

Review the terms and conditions of the corporate account. Understand the fees, interest rates, transaction limits, and any other relevant information before proceeding.

05

Double-check all the information you have provided to ensure accuracy. Any mistakes or inconsistencies could delay the account opening process.

06

Submit the completed application form or necessary information to the bank or financial institution. Some may require you to visit a physical branch while others may allow you to submit everything electronically.

07

Wait for the bank or financial institution to review your application and process the request. This may take a few days or weeks, depending on their internal procedures.

08

Once your existing client corporate account is approved and activated, you will receive confirmation from the bank or financial institution. They will also provide you with the necessary account details and instructions on how to access and manage the account.

Who needs an existing client corporate account:

01

Established businesses that need separate accounts for their corporate finances. This allows them to track income and expenses more efficiently and maintain transparency in financial operations.

02

Companies that deal with a significant number of financial transactions and need a designated account for managing their cash flow.

03

Corporations that require credit or loan facilities for their business operations. Holding a corporate account helps them establish a banking relationship and access various financial products and services.

04

Businesses that have multiple stakeholders or partners who require access to the company's financial information and transactions. An existing client corporate account provides a centralized platform for collaboration and oversight.

05

Companies that engage in international trade or have global operations may need an existing client corporate account to manage their cross-border transactions more effectively.

Note: The specific requirements and benefits of an existing client corporate account may vary depending on the bank or financial institution you choose. It is recommended to research different options and consult with professionals before making a decision.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is existing client corporate account?

Existing client corporate account refers to the financial account owned by a corporation that has been in existence for a period of time.

Who is required to file existing client corporate account?

Any corporation that has an existing client corporate account is required to file it with the relevant authorities.

How to fill out existing client corporate account?

The existing client corporate account can be filled out by providing all relevant financial information, asset details, and any other required information.

What is the purpose of existing client corporate account?

The purpose of existing client corporate account is to keep track of the financial activities and assets of the corporation.

What information must be reported on existing client corporate account?

The existing client corporate account must report all financial transactions, asset values, liabilities, and any other relevant financial information.

When is the deadline to file existing client corporate account in 2024?

The deadline to file existing client corporate account in 2024 is typically by the end of the fiscal year, but it may vary depending on jurisdiction.

What is the penalty for the late filing of existing client corporate account?

The penalty for the late filing of existing client corporate account may vary depending on jurisdiction, but it could include fines, interest charges, or other penalties.

Can I sign the existing client corporate account electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your existing client corporate account in minutes.

How do I edit existing client corporate account straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing existing client corporate account.

How do I complete existing client corporate account on an Android device?

Use the pdfFiller mobile app and complete your existing client corporate account and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your existing client corporate account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.