Get the free EMPLOYER39S BASIC REPORT OF INJURY Michigan

Show details

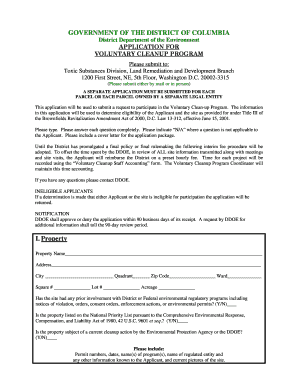

EMPLOYER IS BASIC REPORT OF INJURY Michigan Department of Energy, Labor & Economic Growth Workers Compensation Agency PO Box 30016, Lansing, MI 48909 An employer shall report immediately to the agency

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your employer39s basic report of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer39s basic report of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employer39s basic report of online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit employer39s basic report of. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

How to fill out employer39s basic report of

How to Fill Out Employer's Basic Report:

01

Gather necessary information: Before filling out the employer's basic report, make sure you have all the required information at hand. This includes the employer's name, address, and contact information, employee details such as their names, social security numbers, and wages.

02

Identify the reporting period: Determine the reporting period for which the report is being filled out. This typically includes the start and end dates of the reporting period.

03

Complete employee information: In the employer's basic report, provide the required details for each employee. This may include their name, social security number, wages, hours worked, and any other relevant information.

04

Calculate and report taxes: Determine the appropriate taxes that need to be reported for each employee. This may include income tax, social security tax, and Medicare tax. Calculate the amounts accurately and report them in the designated sections of the report.

05

Provide other required information: Apart from employee details and taxes, the employer's basic report may have sections for other information. This may include additional compensation, benefits, deductions, and any other relevant data. Fill out these sections accurately.

Who needs Employer's Basic Report:

The employer's basic report is typically required by government agencies, such as the Internal Revenue Service (IRS) in the United States, or other tax authorities in different countries. It serves as a record of wages paid to employees and taxes withheld. Employers use this report to ensure compliance with tax laws and provide necessary information for tax calculations.

Overall, anyone responsible for managing employee payroll and tax obligations needs the employer's basic report. This includes business owners, human resources professionals, payroll administrators, and accountants, among others. Compliance with reporting requirements is crucial to avoid penalties and maintain accurate tax records.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is employer's basic report of?

Employer's basic report is a document that summarizes employment information such as wages, hours worked, and employee demographics.

Who is required to file employer's basic report of?

Employers with a certain number of employees are required to file employer's basic report.

How to fill out employer's basic report of?

Employers can fill out employer's basic report by providing accurate and detailed employment information for each employee.

What is the purpose of employer's basic report of?

The purpose of employer's basic report is to track and monitor employment trends, ensure compliance with labor laws, and allocate resources effectively.

What information must be reported on employer's basic report of?

Employer's basic report must include information such as employee wages, hours worked, benefits provided, and demographic data.

When is the deadline to file employer's basic report of in 2024?

The deadline to file employer's basic report in 2024 is usually by the end of the first quarter.

What is the penalty for the late filing of employer's basic report of?

The penalty for the late filing of employer's basic report may include fines or legal action by regulatory agencies.

How do I make changes in employer39s basic report of?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your employer39s basic report of and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I fill out employer39s basic report of on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your employer39s basic report of. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out employer39s basic report of on an Android device?

Use the pdfFiller app for Android to finish your employer39s basic report of. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your employer39s basic report of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.