Get the free Karo 100

Show details

Karo 100

Anniversary Recipe Favorites

classic and new recipes from Karo, the brand that has played

a sweet role in Americas kitchens for 100 years.

Karo corn syrup, a beloved staple in Americas kitchens,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your karo 100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your karo 100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit karo 100 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit karo 100. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

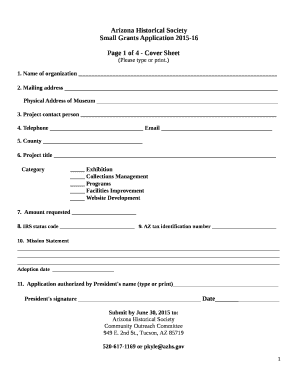

How to fill out karo 100

How to fill out karo 100:

01

Start by carefully reading the instructions provided with the karo 100 form. It is important to understand the requirements and purpose of the form before proceeding.

02

Gather all the necessary information and documents that are required to fill out the karo 100 form. This may include personal information, financial details, or any other relevant information based on the purpose of the form.

03

Ensure that all the information provided is accurate and up-to-date. Double-check the spellings, numbers, and any other crucial details to avoid any errors or discrepancies.

04

Follow the format and instructions given on the karo 100 form. Different sections or fields may have specific guidelines or formats for you to fill out. Pay close attention to these details to ensure compliance.

05

If you encounter any questions or sections on the karo 100 form that you are unsure of, seek guidance from the appropriate authorities or seek professional advice.

06

Once you have filled out all the required sections of the karo 100 form, review it one final time to make sure everything is complete and accurate.

07

Sign and date the form as instructed. Some forms may require additional signatures or witness signatures, so be sure to follow the instructions provided.

08

Make a copy of the filled-out karo 100 form for your record purposes before submitting it as required.

Who needs karo 100:

01

Individuals or businesses who need to report certain financial transactions or activities to the relevant authorities may need to fill out karo 100.

02

If you are involved in taxable activities, such as earning income from a business, capital gains, or foreign investments, you may be required to file karo 100.

03

Karo 100 might be required by individuals or entities involved in cross-border transactions, international trade, or other financial operations that need to be documented and reported.

04

It is essential to consult with professionals such as tax advisors, accountants, or legal experts to determine if you fall into the category of individuals or businesses that need to fill out karo 100.

05

Different jurisdictions or countries may have specific rules and regulations regarding when and how karo 100 needs to be filled out. It is crucial to be aware of the legal requirements in your specific jurisdiction to ensure compliance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

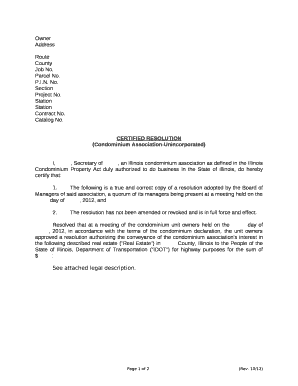

What is karo 100?

Karo 100 is a tax form used in Pakistan to report income earned from business or profession.

Who is required to file karo 100?

Any individual or business entity that earns income from business or profession in Pakistan is required to file karo 100.

How to fill out karo 100?

Karo 100 can be filled out manually or electronically on the Federal Board of Revenue (FBR) website.

What is the purpose of karo 100?

The purpose of karo 100 is to report income earned from business or profession and pay the corresponding taxes.

What information must be reported on karo 100?

Information such as total income, deductions, tax liability, and any other relevant financial details must be reported on karo 100.

When is the deadline to file karo 100 in 2024?

The deadline to file karo 100 in 2024 is typically on or before September 30th.

What is the penalty for the late filing of karo 100?

The penalty for the late filing of karo 100 is a fine of 1% of the tax due for each day the return is late, up to a maximum of 50% of the tax due.

How do I modify my karo 100 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your karo 100 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I modify karo 100 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including karo 100. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I sign the karo 100 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your karo 100 in minutes.

Fill out your karo 100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.