Get the free Retailing in the Czech Republic 2008. Verdict Research

Show details

THINK RETAIL THINK VERDICT Retailing in the Czech Republic 2008 First phase of retail development successfully completed, tougher times ahead Published: July 2008 Reference Code: BFVT0045 Report Price:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your retailing in form czech form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retailing in form czech form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing retailing in form czech online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit retailing in form czech. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

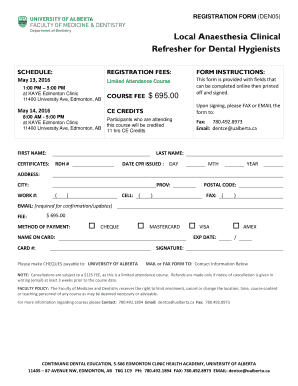

How to fill out retailing in form czech

How to fill out retailing in form Czech:

01

Start by obtaining the required form from the appropriate authority or organization.

02

Carefully read the instructions or guidelines provided along with the form to understand the specific requirements and instructions for filling it out correctly.

03

Begin by providing your personal information, such as your full name, address, contact details, and any other requested details.

04

Follow the provided format to enter information regarding your retailing activities. This may include details such as the name and address of your retail business, the nature of your retailing activities, the products or services you offer, and any other relevant information.

05

Double-check all the information you have entered to ensure accuracy and completeness.

06

If there are any additional sections or attachments required, make sure to provide them as instructed.

07

If you come across any ambiguous or confusing sections, seek guidance from the appropriate authority or organization to ensure you provide the correct information.

08

Once you have completed filling out the form, review it once again to ensure everything is filled out accurately and legibly.

09

Submit the completed form through the designated process or to the appropriate authority or organization.

Who needs retailing in form Czech:

01

Individuals or businesses involved in retail activities in the Czech Republic.

02

Retailers who need to provide information about their retail business operations, products, services, or other relevant details.

03

Anyone required by the authorities or organizations to report their retailing activities in the Czech Republic using a prescribed form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

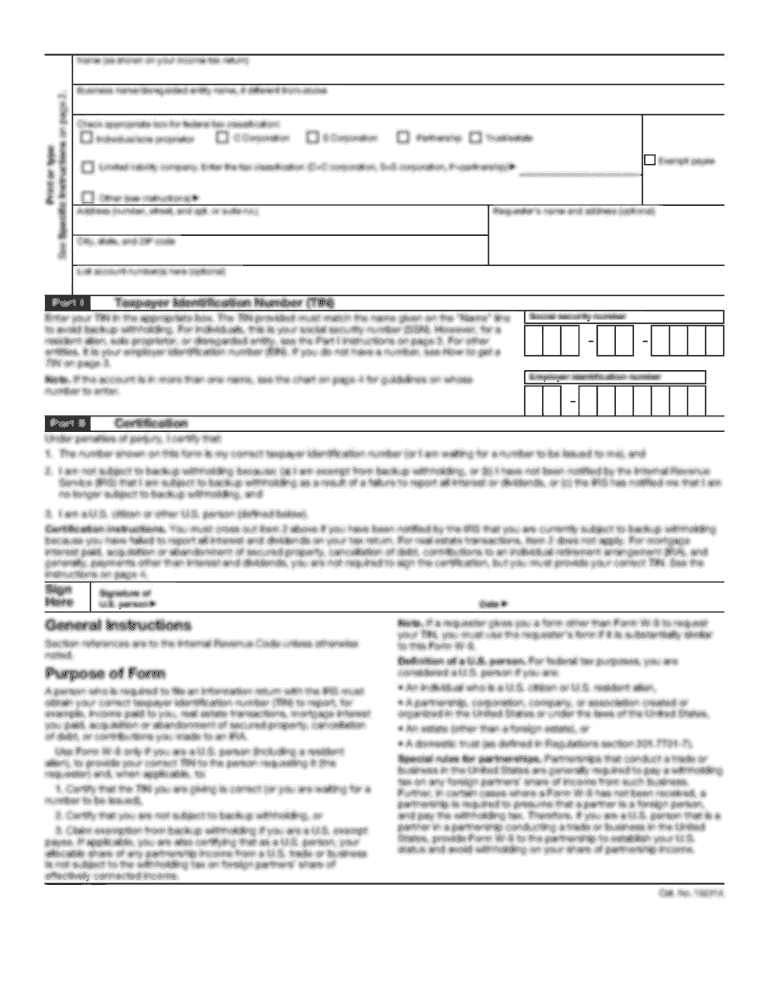

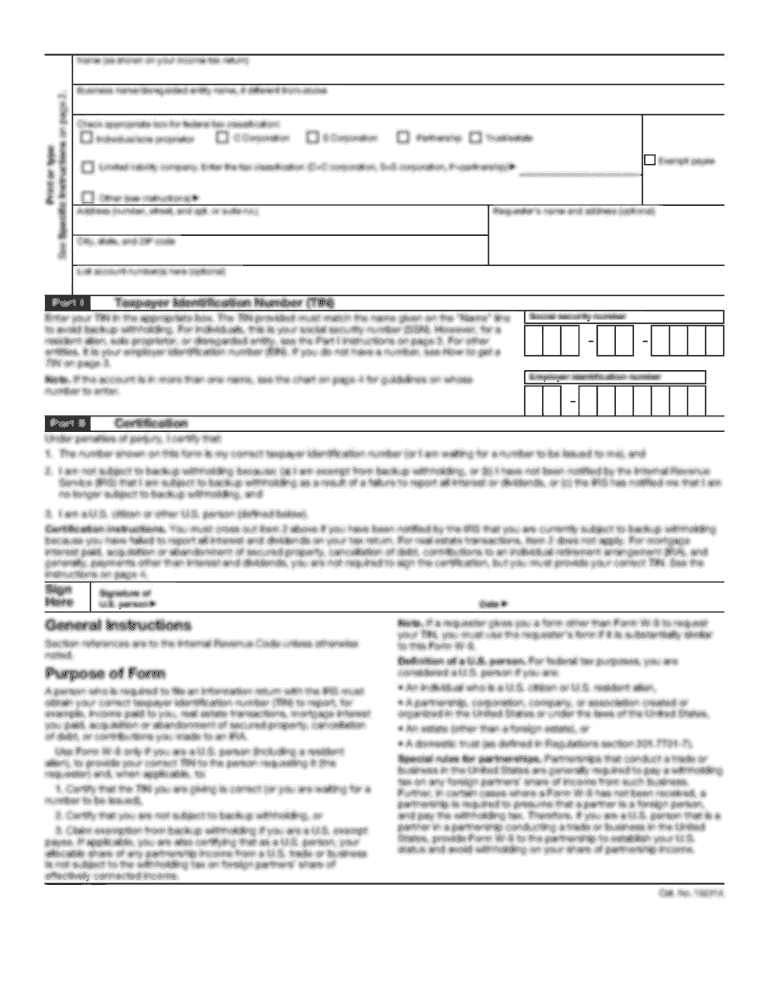

What is retailing in form czech?

Retailing in form Czech refers to the process of reporting retail sales activity in the Czech Republic.

Who is required to file retailing in form czech?

Any individual or business engaged in retail sales in the Czech Republic is required to file retailing in form Czech.

How to fill out retailing in form czech?

To fill out form Czech for retailing, you need to provide information about your retail sales activity, including the products or services sold, the sales amounts, and any other required details. The form can typically be submitted online or in paper format.

What is the purpose of retailing in form czech?

The purpose of retailing in form Czech is to track and monitor retail sales activity in the country for tax and statistical purposes.

What information must be reported on retailing in form czech?

The information that must be reported on form Czech for retailing includes the sales amounts, the types of products or services sold, any applicable VAT amounts, and any other required details as specified by the tax authorities.

When is the deadline to file retailing in form czech in 2023?

The deadline to file retailing in form Czech in 2023 has not been specified. Please consult the official website or the tax authorities for the specific deadline.

What is the penalty for the late filing of retailing in form czech?

The penalty for the late filing of retailing in form Czech can vary depending on the specific circumstances and the tax authorities' regulations. It may include fines, interest charges, or other penalties. It is advisable to file the form on time to avoid any potential penalties.

Where do I find retailing in form czech?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the retailing in form czech in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the retailing in form czech electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your retailing in form czech and you'll be done in minutes.

Can I edit retailing in form czech on an iOS device?

Create, modify, and share retailing in form czech using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your retailing in form czech online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.