Get the free A A R N S B - Ohio National Road Association - ohionationalroad

Show details

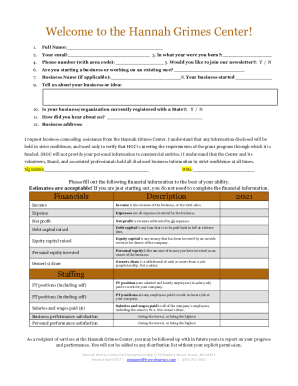

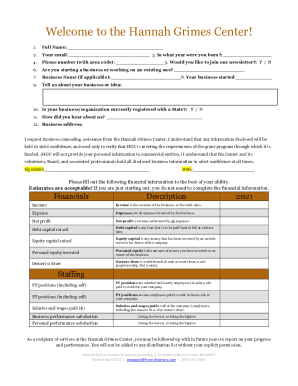

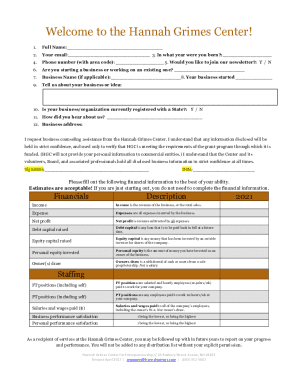

Ohio National Road Association Spring 2015 Byway Coordinators: Gerald Newton and Chris Harkness 20 South Second Street Newark, Ohio 43055 Phone: 7406705200 Email: NRA lcounty.com WWW.OHIONATIONALROAD.ORG

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your a a r n form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a a r n form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit a a r n online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit a a r n. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out a a r n

How to fill out an ARN:

01

Start by gathering all the necessary documents and information. This may include your personal identification, business details, and any other relevant documents required by the issuing authority.

02

Carefully read and understand the instructions provided with the ARN form. Make sure you are aware of any specific requirements or additional documents that may be needed.

03

Complete all sections of the ARN form accurately and honestly. Double-check all the information you provide to ensure it is correct and up to date. This may include your name, address, contact details, and any other requested information.

04

If there are any supporting documents or evidence required, ensure that you attach them securely with the ARN form. This may include identification documents, business licenses, or any other relevant paperwork.

05

Review the completed form and all the attached documents to ensure everything is in order and nothing is missing. Correct any errors or omissions before submitting.

06

Depending on the issuing authority, you may need to pay a fee for the ARN application. Make sure you include the required payment and follow the specified payment method.

07

Once you have filled out the ARN form and gathered all the necessary documents, submit them to the designated authority through the prescribed method. This may involve mailing the form, submitting it online, or physically visiting an office.

08

Keep a copy of the completed ARN form and all supporting documents for your records. It's essential to have a record of your application in case of any future reference or need for clarification.

Who needs an ARN:

01

Individuals or businesses involved in financial transactions or investments often require an ARN. This includes stockbrokers, mutual fund distributors, and financial advisors.

02

Importers and exporters who engage in international trade may need an ARN to comply with customs regulations and facilitate smoother transactions.

03

Governments and regulatory bodies may also require individuals or organizations to obtain an ARN to ensure compliance with specific laws and regulations.

Note: The specific requirements for an ARN may vary depending on the jurisdiction and purpose for which it is needed. It is always advisable to consult the relevant authority or seek professional advice to ensure accurate and up-to-date information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is a a r n?

An ARN (Account Reference Number) is a unique number assigned by an employer to each employee for tax purposes.

Who is required to file a a r n?

Employers are required to file ARN for each employee they have.

How to fill out a a r n?

To fill out an ARN, employers need to provide basic information about the employee such as name, address, PAN number, salary details, and taxes deducted.

What is the purpose of a a r n?

The purpose of an ARN is to keep track of an employee's tax liabilities and deductions for the financial year.

What information must be reported on a a r n?

Information such as employee's personal details, salary details, tax deducted, and any exemptions claimed must be reported on an ARN.

When is the deadline to file a a r n in 2024?

The deadline to file an ARN in 2024 is typically by the end of the financial year, which is March 31st.

What is the penalty for the late filing of a a r n?

The penalty for late filing of an ARN can vary, but typically includes a fine imposed by tax authorities.

Can I create an electronic signature for signing my a a r n in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your a a r n and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete a a r n on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your a a r n from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit a a r n on an Android device?

The pdfFiller app for Android allows you to edit PDF files like a a r n. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your a a r n online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.