Get the free Employer of Independent

Show details

Winter 2011Highlights

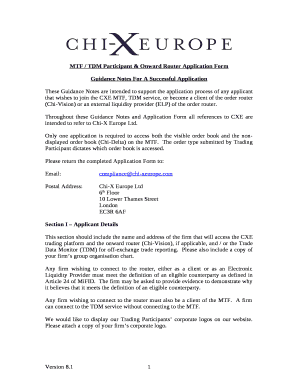

Employer of Independent

Contractor Not Liable for

Independent Contractors

Negligence

The Nevada Supreme Court confirmed

that an entity that hires an independent

contractor is

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your employer of independent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer of independent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employer of independent online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit employer of independent. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

How to fill out employer of independent

How to fill out employer of independent:

01

Gather all necessary information: Before starting the process, make sure you have all the required information at hand. This may include your personal information, such as name, address, and contact details, as well as any relevant business details, such as your company's name, address, and tax identification number.

02

Identify the correct form: The specific form you need to fill out for the employer of independent will depend on your country's laws and regulations. Make sure you identify the correct form to avoid any errors or delays in the process. You can usually find these forms on government websites or by contacting the appropriate authorities.

03

Complete the form accurately: Carefully fill out all sections of the form, providing accurate and up-to-date information. Double-check your entries to ensure there are no mistakes or missing details. If you are unsure about any section, seek assistance from a qualified professional or contact the relevant government agency for guidance.

04

Attach supporting documents: Some countries or regions may require additional supporting documents to be submitted along with the employer of independent form. These may include proof of identity, proof of business registration, financial statements, or other relevant documents. Make sure you include all necessary documents to avoid any delays or complications in processing your application.

05

Submit the form: Once you have completed the form and attached all required documents, submit it to the appropriate government agency or tax authority. Follow the instructions provided to ensure your submission is received and processed correctly. Keep copies of all submitted documents for your records.

Who needs employer of independent?

01

Self-employed individuals: Those who work for themselves and operate their own businesses may need to fill out an employer of independent form to comply with tax and labor regulations.

02

Freelancers: Professionals who offer their services on a contract basis, such as freelance writers, designers, or consultants, may be required to fill out an employer of independent form to document their working relationship with clients.

03

Contractors: Individuals who are hired to perform specific tasks or projects for a company or organization may need to complete an employer of independent form to establish their status as an independent contractor rather than an employee.

Remember to check with your local authorities or consult a qualified professional to determine if you need to fill out an employer of independent form and to understand the specific requirements and regulations in your area.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is employer of independent?

Employer of independent refers to a situation where a business hires an independent contractor to perform work.

Who is required to file employer of independent?

Employers who hire independent contractors are required to file employer of independent.

How to fill out employer of independent?

Employers can fill out employer of independent forms by providing information about the independent contractor, the work performed, and payments made.

What is the purpose of employer of independent?

The purpose of employer of independent is to report payments made to independent contractors for tax and regulatory purposes.

What information must be reported on employer of independent?

Information such as the contractor's name, address, taxpayer identification number, and amount paid must be reported on employer of independent forms.

When is the deadline to file employer of independent in 2024?

The deadline to file employer of independent in 2024 is typically January 31st.

What is the penalty for the late filing of employer of independent?

The penalty for late filing of employer of independent can vary, but may include fines or interest fees on the overdue amount.

Where do I find employer of independent?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific employer of independent and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit employer of independent in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing employer of independent and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I complete employer of independent on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your employer of independent from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your employer of independent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.