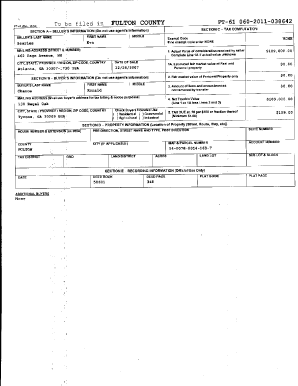

Get the free deed of gift georgia form

Get, Create, Make and Sign

How to edit deed of gift georgia online

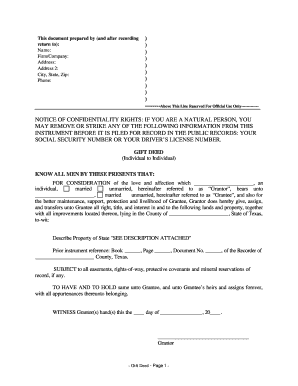

How to fill out deed of gift georgia

How to fill out georgia deed gift form:

Who needs georgia deed gift form:

Video instructions and help with filling out and completing deed of gift georgia

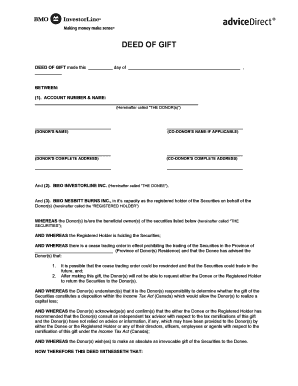

Instructions and Help about ga deed gift form

Hey there this is stuff from the art tips are blog and in this video I just want to give you a really quick overview of what a quitclaim deed is when it makes sense to use it and how you can put one together if that's something you want to do so a quick claim deed is essentially a document that is used to transfer the ownership of real estate from one person or entity to another person or entity and most of the time when people are buying houses and rental properties and other investments the most common type of deed that people use is called a warranty deed and that's a deed where the seller is essentially promising that they have totally free and clear title to the property, and they are conveying it to that new buyer and there's no title defects on records so nobody else has any ownership and it liens on the property or anything that would encroach they're totally unencumbered ownership of that particular property in the vast majority of cases when people are using warranty deeds there's also a title insurance policy involved, so essentially there's a third party who has reviewed the entire title history, and they're willing to back up the fact that the title is indeed free and clear and there are no encroachments or issues on that and that's why a lot of times sellers are comfortable making that promise because there's a title company that's going back them up if any mistakes were made with a quick claim deed the seller is not making any promises or guarantees of any kind regarding the title they're essentially just saying everything that I own of this property if anything I'm now transferring to you Mr. buyer so essentially if you as the seller have no idea if the title is clear or not this is the kind of deed that you would most likely want to use because you don't have to make any promises whether there are any issues that have come up in the past a lot of times people use quitclaim deeds when they're transferring properties between family members or in like divorce situations when one person is going to relinquish their ownership to the other person that's usually the kind of situation when quitclaim deeds get involved or in cases where the seller literally has no idea what's going on in the title history, and they're not getting a title policy they're not making any guarantees and usually as a result the buyer is paying a very, very low price and or they've done their own title research to verify that that title is free and clear so using quick clean beads a lot of times title companies really don't like that because it basically opens up this can of worms in a sense showing that hey somebody sold this property without making any promises, so it is actually possible for that to cause issues in the future and in the title even if it didn't actually create a cloud on the title a lot of times title companies and underwriters will look at that as an issue simply because there was no promise made in that transfer, so that's just something to...

Fill ga deed gift : Try Risk Free

People Also Ask about deed of gift georgia

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your deed of gift georgia online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.