Get the free Term Life Insurance Enrollment Form Hiland Dairy Foods

Show details

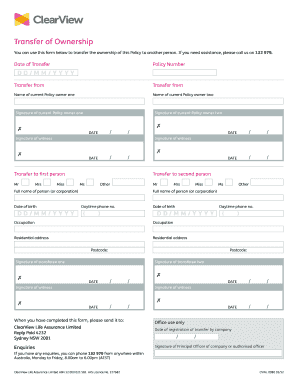

Term Life Insurance Enrollment Form Hartford Life Policy No. GL674320 Class 001 Hi land Dairy Foods Company Initial Employee Name (Last name, first, middle initial) Change Reinstatement Social Security

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your term life insurance enrollment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your term life insurance enrollment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing term life insurance enrollment online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit term life insurance enrollment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

How to fill out term life insurance enrollment

How to Fill Out Term Life Insurance Enrollment:

01

Gather necessary information: Before filling out the enrollment form, gather all the relevant information required. This may include personal details such as name, address, contact information, age, gender, and medical history.

02

Understand the coverage options: Familiarize yourself with the different coverage options available under term life insurance. This may include choosing the appropriate policy length, coverage amount, and any additional riders or benefits you may need.

03

Research and compare insurance providers: It is essential to research and compare different insurance providers to find the one that offers the best terms and premiums for your needs. Consider their reputation, customer service, financial stability, and any discounts or special programs they may offer.

04

Obtain quotes and make a decision: Request quotes from the shortlisted insurance providers based on your specific requirements. Compare the premiums, policy features, and coverage limits to make an informed decision about which provider to choose.

05

Complete the enrollment form: Once you have chosen the insurance provider, complete the enrollment form accurately and thoroughly. Provide all the necessary information, double-check for any errors or omissions, and ensure you sign the form where applicable.

06

Submit the enrollment form: After filling out the form, submit it to the insurance provider through the preferred method indicated by the company. This could include mailing the form, submitting it online through their website, or contacting their customer service for further instructions.

07

Pay the premium: Once your enrollment form is processed, the insurance company will provide you with the premium amount and payment options. Pay the premium promptly to ensure your coverage is activated and to secure your term life insurance policy.

Who Needs Term Life Insurance Enrollment:

01

Individuals with dependents: Term life insurance is particularly important for individuals who have dependents, such as a spouse, children, or aging parents. It provides financial protection and peace of mind that your loved ones will be taken care of in case of your untimely death.

02

Breadwinners or primary income earners: If you are the primary earner in your family, term life insurance can replace your income and help your family maintain their lifestyle if something were to happen to you. It can cover expenses such as mortgage payments, children's education, and daily living costs.

03

Business owners or key employees: Business owners or key employees who are crucial to the success of a company may consider term life insurance. It can protect the business by providing funds to cover expenses, pay off debts, or find a replacement in the event of the insured's death.

04

Individuals with financial obligations: If you have significant financial obligations, such as outstanding debts, loans, or a mortgage, term life insurance can ensure these financial burdens do not fall onto your loved ones in case of your passing.

05

Those looking for affordable coverage: Term life insurance is generally more affordable compared to other types of life insurance policies. If you are looking for cost-effective coverage for a specific period, term life insurance might be the ideal choice.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is term life insurance enrollment?

Term life insurance enrollment is the process of signing up for a specific term life insurance policy.

Who is required to file term life insurance enrollment?

Individuals who want to secure a term life insurance policy are required to file term life insurance enrollment.

How to fill out term life insurance enrollment?

To fill out term life insurance enrollment, individuals must provide personal information, choose a coverage amount and term length, and sign the necessary forms.

What is the purpose of term life insurance enrollment?

The purpose of term life insurance enrollment is to secure financial protection for loved ones in case of the policyholder's death during the term of the policy.

What information must be reported on term life insurance enrollment?

Information such as personal details, beneficiaries, coverage amount, payment frequency, and term length must be reported on term life insurance enrollment.

When is the deadline to file term life insurance enrollment in 2024?

The deadline to file term life insurance enrollment in 2024 is typically determined by the insurance provider or employer offering the policy.

What is the penalty for the late filing of term life insurance enrollment?

The penalty for the late filing of term life insurance enrollment can include a delay in coverage start date or a higher premium cost.

How do I execute term life insurance enrollment online?

pdfFiller has made it easy to fill out and sign term life insurance enrollment. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I sign the term life insurance enrollment electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your term life insurance enrollment.

Can I create an electronic signature for signing my term life insurance enrollment in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your term life insurance enrollment and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your term life insurance enrollment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.