Get the free Chapters 3 and 13

Show details

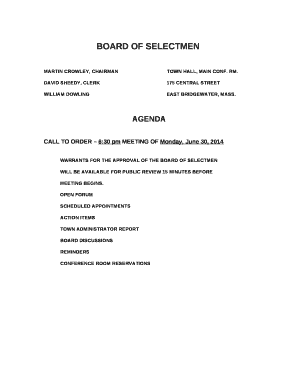

Chapters 3 and 13 Financial Statement and Cash Flow Analysis Balance Sheet AssetsLiabilities and Shareholders Equity Cash Inventory Accounts ReceivableAccounts Payable Notes Payable Accrued WagesProperty

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your chapters 3 and 13 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapters 3 and 13 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapters 3 and 13 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit chapters 3 and 13. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

How to fill out chapters 3 and 13

How to fill out chapters 3 and 13:

01

Start by reviewing the objectives and requirements for each chapter. This will help you understand what information needs to be included and how it should be organized.

02

Gather all the necessary data and research relevant to chapters 3 and 13. This may involve conducting literature reviews, collecting survey data, or analyzing existing data sets.

03

Create an outline for each chapter, breaking down the main sections and subsections. This will provide a structured framework for organizing your content.

04

Begin writing each section, ensuring that you provide clear and concise explanations of the key concepts and findings. Use appropriate citations and references to support your arguments and claims.

05

Include any necessary tables, figures, or diagrams to visually represent your data and findings. Make sure these visuals are properly labeled and explained in the text.

06

Review and revise your chapters to ensure they flow smoothly and coherently. Check for any inconsistencies, grammatical errors, or technical inaccuracies.

07

Proofread your work to eliminate any typos or formatting issues. Pay attention to details such as page numbers, headings, and citations.

Who needs chapters 3 and 13:

01

Researchers: Chapters 3 and 13 are typically included in academic dissertations or research papers. Researchers need to fill out these chapters to provide a comprehensive overview of their methods, data analysis, and findings.

02

Students: In certain academic disciplines, such as social sciences or business studies, students may be required to fill out chapters 3 and 13 as part of their research projects or thesis.

03

Professionals: Individuals working on industry reports or other research-intensive projects may also need to fill out chapters 3 and 13. These chapters help present the methodology, data analysis, and conclusions of their research.

Overall, anyone undertaking a research or data-driven project in academia or professional settings would require chapters 3 and 13 to effectively communicate their methods and findings.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is chapters 3 and 13?

Chapters 3 and 13 refer to specific sections of a legal document or regulation.

Who is required to file chapters 3 and 13?

Entities or individuals specified in the respective document or regulation are required to file chapters 3 and 13.

How to fill out chapters 3 and 13?

Chapters 3 and 13 must be filled out according to the instructions provided in the document or regulation.

What is the purpose of chapters 3 and 13?

The purpose of chapters 3 and 13 is to provide specific information or regulate certain activities.

What information must be reported on chapters 3 and 13?

Chapters 3 and 13 may require reporting of relevant data, compliance information, or other specifics.

When is the deadline to file chapters 3 and 13 in 2024?

The deadline to file chapters 3 and 13 in 2024 is typically specified in the document or regulation.

What is the penalty for the late filing of chapters 3 and 13?

Penalties for late filing of chapters 3 and 13 may include fines, late fees, or other consequences as outlined in the document or regulation.

How do I edit chapters 3 and 13 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your chapters 3 and 13 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out chapters 3 and 13 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign chapters 3 and 13 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete chapters 3 and 13 on an Android device?

Use the pdfFiller app for Android to finish your chapters 3 and 13. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your chapters 3 and 13 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.