Get the free Governmental 457b Plan Alternate Payee Distribution

Show details

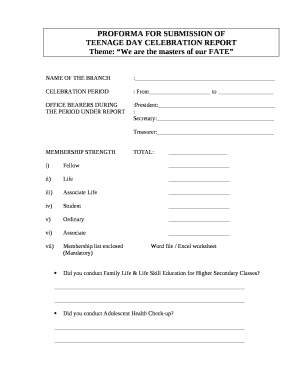

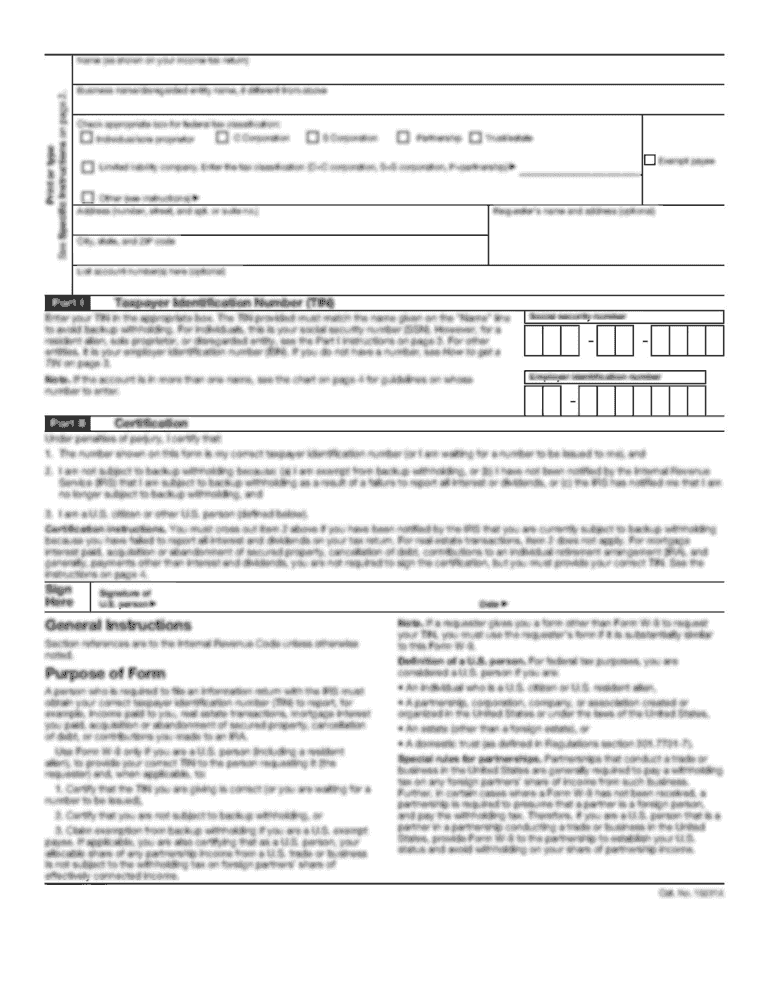

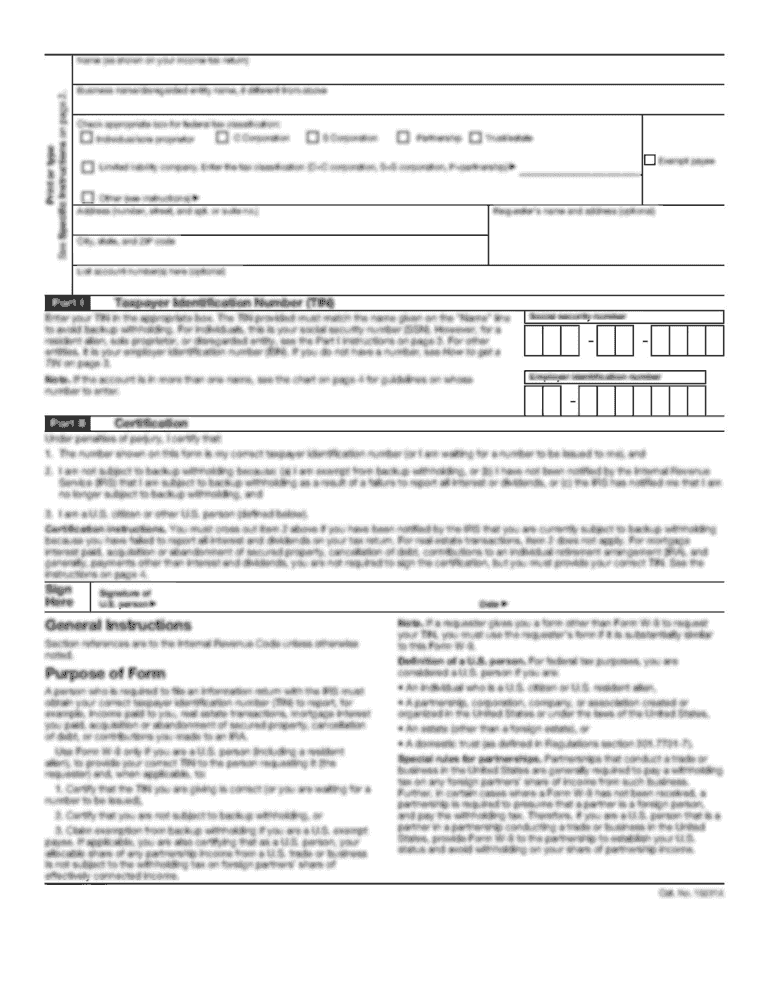

Alternate Payee Distribution Request Governmental 457(b) Plan Refer to the Alternate Payee Distribution Guide while completing this form. Use blue or black ink only. County of Tulane California Deferred

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your governmental 457b plan alternate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your governmental 457b plan alternate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit governmental 457b plan alternate online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit governmental 457b plan alternate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out governmental 457b plan alternate

How to fill out governmental 457b plan alternate:

01

Gather all necessary information: To fill out a governmental 457b plan alternate, you will need to collect important details such as your personal information, employment information, and specific plan details provided by your employer.

02

Understand the eligibility requirements: Determine if you are eligible to participate in the governmental 457b plan alternate. Eligibility criteria may include factors such as employment status (full-time, part-time, temporary), length of service, or job position. Check with your employer or the plan administrator for specific eligibility requirements.

03

Review plan documents: Familiarize yourself with the plan documents, including the official plan guide or summary plan description. These documents outline the rules and regulations of the governmental 457b plan alternate, contribution limits, investment options, and any additional benefits or features.

04

Complete the enrollment form: Fill out the enrollment form provided by your employer or plan administrator accurately and legibly. Provide all required information, including personal details, employment information, and any beneficiary allocation if applicable.

05

Determine your contribution amount: Decide how much you would like to contribute to the governmental 457b plan alternate. Take into consideration any employer matching contributions or other retirement plans you may be enrolled in. Be aware of the annual contribution limit set by the Internal Revenue Service (IRS) for 457b plans.

06

Choose investment options: Select the investment options that align with your risk tolerance and long-term financial goals. Most governmental 457b plans offer a variety of investment options, such as mutual funds, target-date funds, or fixed-income funds. Consider seeking professional financial advice if needed.

07

Designate beneficiaries: Determine who will receive the funds in your governmental 457b plan alternate in the event of your death. Designate primary and contingent beneficiaries by providing their full names, Social Security numbers, and the percentage of the benefit they should receive.

08

Submit the completed forms: Once you have filled out the enrollment form and any other required documents, submit them to your employer or plan administrator following their specified instructions. Ensure that all sections are complete and that you keep a copy for your records.

Who needs governmental 457b plan alternate?

01

Employees of state and local governments: Governmental 457b plans are designed for employees working in state and local governmental organizations, such as public schools, hospitals, police departments, or fire departments.

02

Employees seeking tax advantages: Individuals who are looking to save for retirement while enjoying potential tax advantages may opt for a governmental 457b plan alternate. Contributions to these plans are typically made on a pre-tax basis, potentially reducing taxable income.

03

Those looking for additional retirement savings: If you have maximized your contributions to other retirement accounts, such as 401(k) or IRA, and still want to save more for retirement, a governmental 457b plan alternate can provide an additional savings opportunity.

04

Employees seeking flexible retirement withdrawals: Governmental 457b plans offer flexibility in withdrawal options. Participants can access their funds penalty-free at retirement age, even if they are still working. This flexibility can be beneficial for individuals who may choose to work beyond traditional retirement age.

Note: It is essential to consult with a financial advisor or tax professional to fully understand the rules, advantages, and implications of participating in a governmental 457b plan alternate.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is governmental 457b plan alternate?

Governmental 457b plan alternate refers to an alternative plan setup by state and local governments to provide retirement benefits to their employees.

Who is required to file governmental 457b plan alternate?

State and local government entities are required to file governmental 457b plan alternate.

How to fill out governmental 457b plan alternate?

To fill out governmental 457b plan alternate, entities need to provide detailed information about the plan and its participants.

What is the purpose of governmental 457b plan alternate?

The purpose of governmental 457b plan alternate is to allow government employees to save for retirement in a tax-advantaged manner.

What information must be reported on governmental 457b plan alternate?

Information such as plan details, participant contributions, investment options, and distributions must be reported on governmental 457b plan alternate.

When is the deadline to file governmental 457b plan alternate in 2024?

The deadline to file governmental 457b plan alternate in 2024 is usually by the end of the fiscal year.

What is the penalty for the late filing of governmental 457b plan alternate?

The penalty for late filing of governmental 457b plan alternate can vary, but typically includes fines or interest on the amount due.

Can I create an electronic signature for the governmental 457b plan alternate in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your governmental 457b plan alternate in seconds.

How can I edit governmental 457b plan alternate on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing governmental 457b plan alternate right away.

Can I edit governmental 457b plan alternate on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share governmental 457b plan alternate from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your governmental 457b plan alternate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.