Get the free VAT Declaration - Business Juice - businessjuice co

Show details

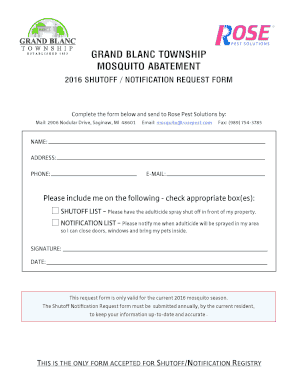

VAT Declaration CERTIFICATE TO SUPPLIER OF NATURAL GAS IN RESPECT OF PREMISES QUALIFYING FOR VAT AT 5% Crown Gas & Powers Customer Reference Number:. Customer Name:. Address of qualifying premises:.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your vat declaration - business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat declaration - business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vat declaration - business online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vat declaration - business. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out vat declaration - business

How to fill out VAT declaration - business?

01

Gather all relevant information and documents: Before filling out the VAT declaration, make sure you have all the necessary information and documents ready. This may include your business's sales and purchase records, invoices, receipts, and any other relevant financial documents.

02

Understand the guidelines: Familiarize yourself with the guidelines and regulations for filling out the VAT declaration. These guidelines can usually be found on your country's tax authority website or through professional advice. It is important to follow these guidelines to ensure accurate and compliant reporting.

03

Determine the reporting period: Determine the reporting period for which you are filling out the VAT declaration. This could be monthly, quarterly, or annually, depending on your country's requirements.

04

Complete the necessary sections: The VAT declaration typically consists of various sections that require specific information. Fill out the sections related to your business's sales, expenses, VAT liability, and any other applicable information. Be sure to input accurate numbers and double-check your calculations to avoid errors.

05

Include supporting documents: Attach relevant supporting documents, such as invoices or receipts, to validate the information you have provided in the VAT declaration. This can help tax authorities verify the accuracy of your reported figures.

06

Review and cross-check: Before submitting your VAT declaration, diligently review all the information you have entered. Double-check for any mistakes, discrepancies, or missing data. It is crucial to ensure the accuracy of your declaration to avoid penalties or audits.

Who needs VAT declaration - business?

01

VAT-registered businesses: Any business that is registered for VAT and meets the annual turnover threshold specified by the tax authority must file a VAT declaration. The turnover threshold can vary between countries.

02

Businesses engaged in taxable activities: VAT declarations are required for businesses engaged in taxable activities, such as selling goods or services subject to VAT. It is important to determine the VAT regulations in your specific industry to understand if your business is required to file a declaration.

03

Businesses trading internationally: If your business engages in import/export activities or trades with other countries, VAT declarations may be necessary. Different rules and compliance requirements may apply when dealing with international transactions.

Please note that this is general information, and it is important to consult with a tax professional or your local tax authority for specific guidance on how to fill out VAT declarations and who is required to do so in your jurisdiction.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify vat declaration - business without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including vat declaration - business, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I sign the vat declaration - business electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your vat declaration - business.

How do I edit vat declaration - business straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing vat declaration - business.

Fill out your vat declaration - business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.