Get the free Personal savings account application form - First Citizens Bank ...

Show details

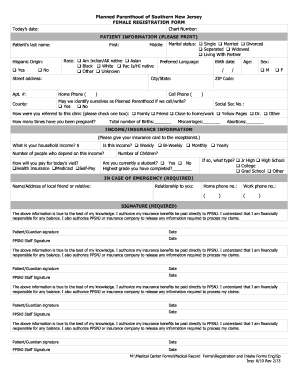

Personal Bank Account Application Form This application may be used to open (2) different accounts provided the account mandates, signatories and statement of purpose are the same for both. The completion

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your personal savings account application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal savings account application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal savings account application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal savings account application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

How to fill out personal savings account application

01

To fill out a personal savings account application, first gather all necessary documents and information. This includes your identification documents, such as a driver's license or passport, as well as your social security number, address, and contact information.

02

Next, find a bank or financial institution that offers personal savings accounts. Research different options and choose the one that best fits your needs and preferences.

03

Visit the bank's website or go to a branch in person to obtain the application form. Some banks also offer the option to fill out the application online.

04

Carefully read through the application form and instructions provided. Ensure that you understand all the terms and conditions, fees, and features associated with the savings account.

05

Fill in your personal information accurately and neatly. Double-check that all the details are correct before proceeding.

06

If required, provide details about your employment or source of income. Some financial institutions may ask for this information to comply with regulations.

07

Depending on the institution, you may need to make an initial deposit to open the savings account. Be prepared to provide the necessary funds through cash, check, or electronic transfer.

08

Review the application form once again to verify that you have completed all sections correctly. Make sure you have signed where necessary.

09

Submit the application form to the bank or financial institution. If you are submitting the application in person, hand it over to a bank representative. If online, follow the instructions for submitting the application electronically.

10

After submitting the application, wait for the bank to process your request. This may take a few days. If the application is approved, you will receive confirmation of your new personal savings account.

Who needs personal savings account application?

01

Individuals who want to save money for various purposes, such as emergencies, big life events, or long-term financial goals, may need a personal savings account application.

02

People who prefer to have a separate account to separate their savings from their regular expenses and transactions may find a personal savings account beneficial.

03

Those who want to earn interest on their savings can utilize a personal savings account to grow their funds over time.

04

Parents or guardians who want to open a savings account for their children's future education or financial security may require a personal savings account application.

05

Individuals who are planning for retirement and want to have a dedicated account to save funds for their post-work years may opt for a personal savings account.

06

People who want to teach themselves or their children about financial responsibility and money management can use a personal savings account as a learning tool.

Overall, anyone with a desire to save money and achieve their financial goals can benefit from completing a personal savings account application.

Fill form : Try Risk Free

People Also Ask about personal savings account application

Can I open a savings account online at First Citizens?

How do I apply for a savings account?

Can I set up a savings account online?

What forms do you need to open a savings account?

How to set up a savings account with First Citizens bank?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is personal savings account application?

A personal savings account application is a form or process through which an individual can apply for a savings account at a financial institution. This application typically requires personal information such as the applicant's name, contact details, identification documents, and sometimes employment details. The purpose of such an application is to establish a savings account where individuals can deposit and accumulate money over time, earning interest on their savings. This account can be used for various financial goals like emergency funds, future investments, or any personal saving objectives.

Who is required to file personal savings account application?

Any individual who wants to open a personal savings account would be required to file a personal savings account application.

How to fill out personal savings account application?

Filling out a personal savings account application typically involves the following steps:

1. Obtain the application form: Contact your desired bank or financial institution and request an application form for a personal savings account. Many institutions also provide online application options.

2. Provide personal information: Start by supplying your basic personal details, including your full name, date of birth, Social Security number, contact information (address, phone number, email), and employment details (employer name and address, occupation, etc.).

3. Choose the type of account: Specify the type of savings account you wish to open. Common options include a regular savings account, high-yield savings account, money market account, or certificates of deposit (CD). Ensure you understand the terms, fees, and interest rates associated with each type of account before making a decision.

4. Deposit amount: Indicate the amount you plan to deposit into the account as an initial deposit. Some banks have minimum deposit requirements, so ensure your chosen amount meets the criteria.

5. Account ownership: Determine how the account will be owned. Individuals can have single ownership, joint ownership with another person (e.g., spouse or family member), or open a minor or trust account.

6. Beneficiary designation: If desired, designate a beneficiary who will inherit the account in the event of your death. This step is optional; you can also skip it if you prefer.

7. Review terms and disclosures: Carefully read and understand the terms and conditions, account rules, and any associated fees or charges. Be aware of minimum balance requirements, monthly service fees, transaction limitations, and any penalties for early withdrawal.

8. Signature and date: Sign and date the application form where indicated. Your signature confirms that you have read and agreed to abide by the terms and conditions mentioned.

9. Gather supporting documentation: Prepare any necessary supporting documents, such as identification proof (e.g., driver's license, passport), Social Security card, employment verification, or proof of address (utility bills, bank statements).

10. Submit the application: Once you have completed the application form and gathered the required documents, submit them to the bank or financial institution through the provided channels. This may include mailing the physical form or submitting it online through their website.

It's always recommended to carefully review the application form and provide accurate and up-to-date information. If you have any doubts or questions, it's advisable to reach out to the bank's customer support or visit a branch for assistance.

What is the purpose of personal savings account application?

The purpose of a personal savings account application is to allow individuals to apply for and open a savings account at a bank or financial institution. This application typically collects necessary personal and financial information from the applicant, such as name, address, social security number, employment details, income, and other relevant data. The application process helps the bank or financial institution verify the applicant's identity, assess their eligibility to open a savings account, and ensure compliance with regulatory requirements. Once approved, the applicant can start depositing money into the savings account, earn interest, and save funds for future goals or emergencies.

What information must be reported on personal savings account application?

When applying for a personal savings account, you typically need to provide the following information:

1. Personal Information: Full name, date of birth, Social Security number, and contact information (address, email, phone number).

2. Identification: Valid identification documents such as a driver's license, passport, or government-issued ID.

3. Employment Details: Current employment status, employer's name, business address, phone number, and job title.

4. Financial Information: An estimate of your annual income, sources of income (such as employment, investments), and the amount of money you plan to deposit.

5. Existing Bank Account Information: Details about any existing bank accounts you may have, including the name of the institution, account number, and balance.

6. Citizenship or Residency Status: Information regarding your citizenship or residency status, including your country of citizenship, legal status, and, if applicable, your Alien Registration Number.

7. Beneficiary Designation: If desired, information about the individual(s) you wish to designate as beneficiaries for your savings account in the event of your death.

It's important to note that the specific requirements may vary depending on the financial institution and country. It is recommended to directly contact the bank or financial institution where you intend to open the account for detailed information about their application process and required information.

What is the penalty for the late filing of personal savings account application?

The penalty for the late filing of a personal savings account application can vary depending on the policies of the specific bank or financial institution. In some cases, there may be no penalty at all, but in other instances, there may be a fee or a loss of potential interest earnings. It is best to check with the bank or financial institution directly to understand their specific policies and any associated penalties.

How can I manage my personal savings account application directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your personal savings account application and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I fill out personal savings account application using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign personal savings account application and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete personal savings account application on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your personal savings account application, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your personal savings account application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.