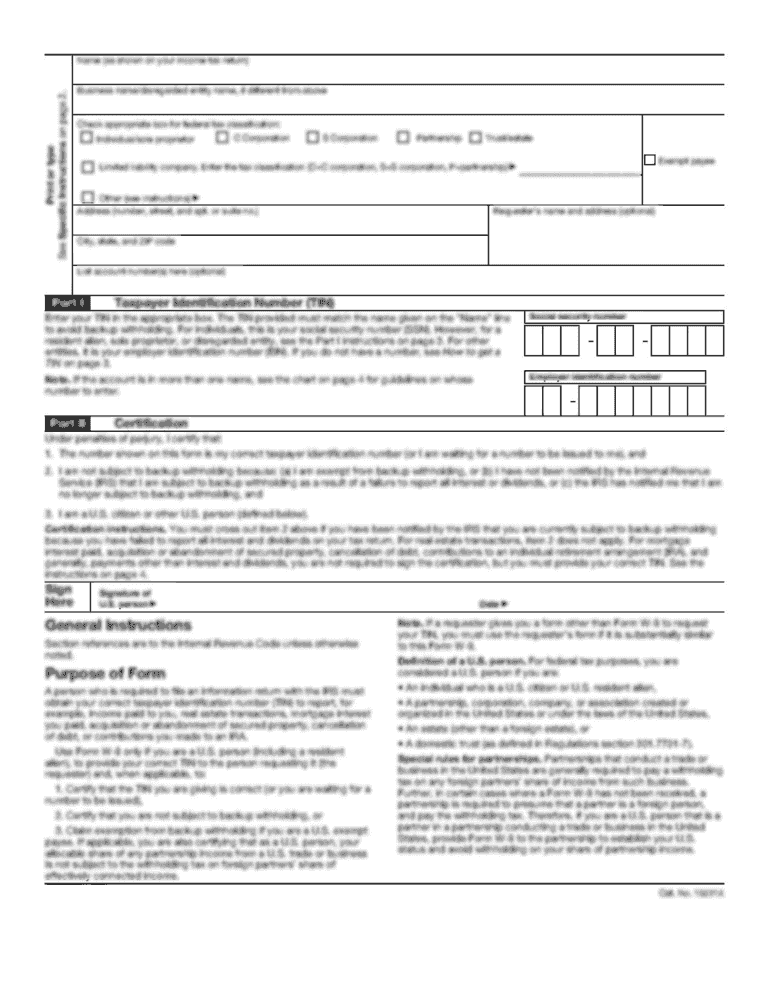

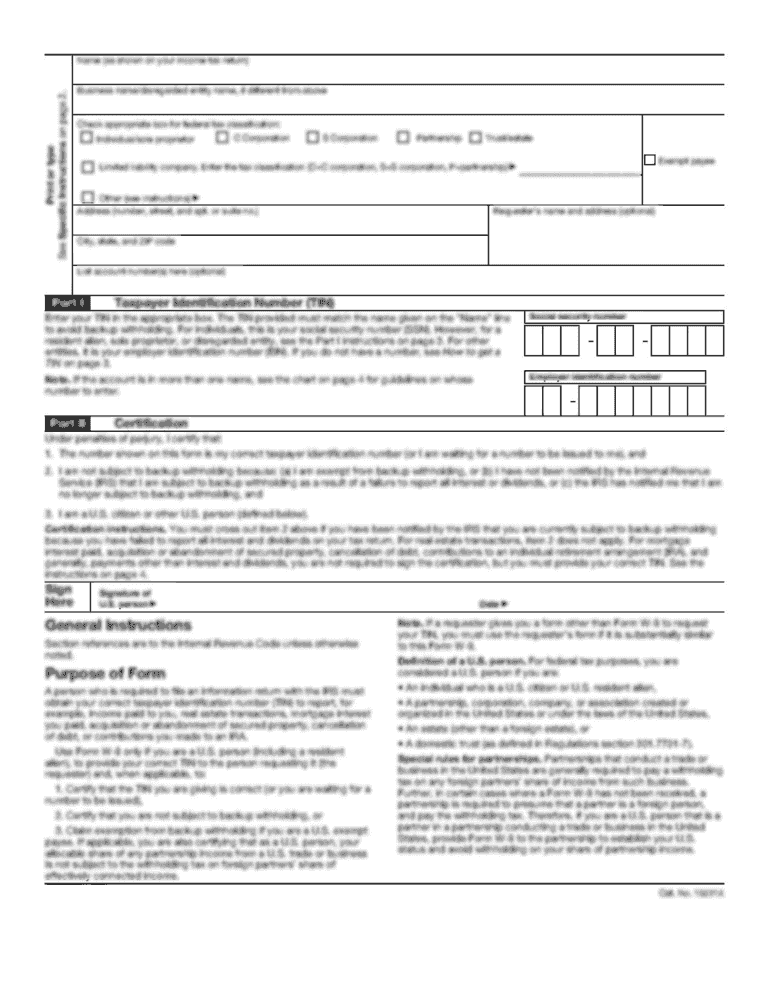

Get the free J-0101-15

Show details

Notice: This decision may be formally revised before it is published in the District of Columbia Register. Parties should promptly notify the Office Manager of any formal errors so that this Office

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your j-0101-15 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your j-0101-15 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing j-0101-15 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit j-0101-15. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out j-0101-15

How to fill out j-0101-15:

01

Begin by carefully reading the instructions provided with the j-0101-15 form. This will help you understand the purpose and requirements of the form.

02

Gather all the necessary information and documents needed to complete the j-0101-15 form. This might include personal information, financial records, or any other relevant details.

03

Start by filling out the basic information section of the form. This may include your name, address, contact information, and other personal details as required.

04

Follow the instructions provided on the form to complete each section accurately. Pay attention to any specific guidelines or fields that need to be filled in.

05

If there are any additional sections or attachments needed, ensure that you include them as per the instructions provided.

06

Review the filled-out form thoroughly for any errors or omissions. It is essential to ensure all the information provided is accurate and up to date.

07

Once you are confident that the form is complete and accurate, sign and date it as required.

08

Make a copy of the filled-out form for your records before submitting it.

09

Submit the j-0101-15 form as instructed, either by mail, online, or in person.

10

Follow up on the submission if necessary and keep a record of any correspondence related to the form.

Who needs j-0101-15:

01

Individuals or entities required to report specific information to a particular authority as mandated by law or regulation may need to fill out the j-0101-15 form.

02

Employers or organizations responsible for providing certain data or statistics may be required to complete this form to comply with government or regulatory requirements.

03

The j-0101-15 form may be necessary for individuals or entities involved in specific legal processes, such as litigation or contractual agreements, where reporting or disclosure is mandatory.

04

Certain industries or professions might have specific obligations that require the completion of the j-0101-15 form, such as healthcare providers, financial institutions, or government agencies.

05

It is important to consult the relevant authorities, regulations, or legal counsel to determine if the j-0101-15 form is required in your specific situation. Compliance with laws and regulations is crucial to avoid penalties or legal consequences.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is j-0101-15?

J-0101-15 is a specific form used for reporting financial information to the relevant authorities.

Who is required to file j-0101-15?

Entities or individuals meeting certain criteria are required to file j-0101-15.

How to fill out j-0101-15?

J-0101-15 must be filled out accurately and completely, following the instructions provided on the form.

What is the purpose of j-0101-15?

The purpose of j-0101-15 is to provide necessary financial information to the authorities for proper record-keeping and monitoring.

What information must be reported on j-0101-15?

J-0101-15 requires reporting of specific financial information as outlined in the form.

When is the deadline to file j-0101-15 in 2024?

The deadline to file j-0101-15 in 2024 is typically on or before a specific date set by the authorities.

What is the penalty for the late filing of j-0101-15?

The penalty for the late filing of j-0101-15 may include fines or other consequences as determined by the authorities.

How can I edit j-0101-15 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like j-0101-15, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for the j-0101-15 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your j-0101-15 and you'll be done in minutes.

Can I edit j-0101-15 on an iOS device?

Create, modify, and share j-0101-15 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your j-0101-15 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.