Get the free Australia Tax and Finance Week - Clariden Global

Show details

C L A R I D E N 21 22 October 2014 Shangri-La Hotel, Sydney Knowledge for the world business leaders Australia Tax and Finance Week Tax Risk Management and Dispute Resolution in Australia Faculty

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your australia tax and finance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your australia tax and finance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit australia tax and finance online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit australia tax and finance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out australia tax and finance

How to fill out Australia tax and finance?

01

Gather all necessary documentation: Start by collecting all relevant documents such as income statements, bank statements, investment reports, and any other financial records that will be required to complete your tax and finance forms accurately.

02

Understand the tax laws and regulations: Familiarize yourself with the Australian tax laws and regulations to ensure compliance. Research the specific deductions, exemptions, and credits that may apply to your situation. This knowledge will help you maximize your tax benefits and avoid any potential penalties.

03

Determine your filing status: Identify your filing status, whether you are a sole trader, individual taxpayer, business entity, or a foreign resident. This will determine the appropriate tax and finance forms to complete.

04

Complete the necessary forms: Use the information from your gathered documentation to complete the required tax and finance forms accurately. The Australian Taxation Office (ATO) provides a variety of forms catering to different situations, such as the Individual tax return, Business Activity Statement (BAS), and Company tax return. Check the ATO website or seek professional guidance to ensure you use the correct forms.

05

Report income and expenses: Provide accurate details of your income from various sources such as employment, investments, rental properties, or businesses. Include all eligible deductions, expenses, and credits in accordance with the tax laws. It is essential to keep detailed records to support your claims.

06

Consider professional assistance: If you find the process complex or have complex financial situations, consider seeking professional advice or utilizing the services of a tax agent or accountant. They can help ensure accurate and efficient completion of your tax and finance requirements.

Who needs Australia tax and finance?

01

Individuals: Every individual in Australia who earns taxable income, whether from employment, investments, or business activities, needs to file taxes and fulfill their financial obligations. This includes residents, non-residents, and foreign residents who meet certain criteria.

02

Sole traders and small businesses: If you operate a sole trader business or have a small business entity, you are required to comply with Australia tax and finance laws. This includes reporting income, expenses, and other obligations associated with operating a business.

03

Companies and organizations: Business entities, companies, partnerships, trusts, and other forms of organizations operating in Australia must meet their tax and finance obligations. This includes filing the necessary tax returns, maintaining accurate financial records, and paying the appropriate taxes.

In summary, filling out Australia tax and finance involves gathering documentation, understanding tax laws, completing the appropriate forms, reporting income and expenses accurately, and potentially seeking professional assistance. It is a legal requirement for individuals, businesses, and organizations operating in Australia to ensure compliance with tax and finance regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

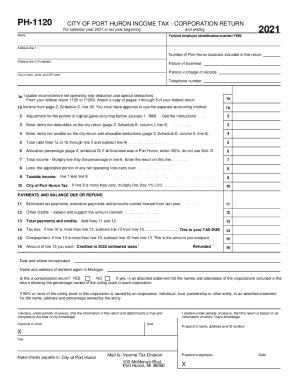

What is australia tax and finance?

Australia tax and finance refers to the system of taxation and financial regulations in Australia.

Who is required to file australia tax and finance?

Individuals and businesses in Australia are required to file their tax and finance information.

How to fill out australia tax and finance?

Australia tax and finance forms can be filled out online or through paper forms provided by the Australian Taxation Office.

What is the purpose of australia tax and finance?

The purpose of australia tax and finance is to fund government operations and services, as well as regulate financial activities in the country.

What information must be reported on australia tax and finance?

Information such as income, expenses, deductions, and credits must be reported on australia tax and finance forms.

When is the deadline to file australia tax and finance in 2024?

The deadline to file australia tax and finance in 2024 is typically on October 31st for individuals and May 31st for businesses.

What is the penalty for the late filing of australia tax and finance?

The penalty for late filing of australia tax and finance can vary, but typically includes fines and interest charges on any unpaid taxes.

How do I edit australia tax and finance online?

The editing procedure is simple with pdfFiller. Open your australia tax and finance in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I sign the australia tax and finance electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your australia tax and finance in minutes.

How can I fill out australia tax and finance on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your australia tax and finance. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your australia tax and finance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.