Get the free Third Circuit Upholds Tax

Show details

Third Circuit Upholds Tax

Group To Damage Award

Robert W. Wood

How and when we are paid, whether for services

or property, can influence the amount of tax we

have to pay.

That seems so obvious that

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your third circuit upholds tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your third circuit upholds tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing third circuit upholds tax online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit third circuit upholds tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

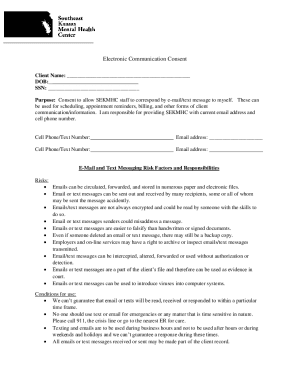

How to fill out third circuit upholds tax

To fill out the third circuit upholds tax, you can follow these steps:

01

Begin by gathering all the necessary documents and information required for filling out the tax form. This may include details of income, expenses, deductions, and any other relevant financial information.

02

Carefully review the instructions provided with the tax form. Understanding the specific requirements and guidelines will help ensure accurate completion.

03

Start by entering your personal information, such as your name, address, and social security number, in the appropriate sections of the tax form.

04

Move on to reporting your income. This typically includes wages, salaries, tips, self-employment earnings, and any other sources of income. Fill in the relevant fields and make sure to include all necessary attachments, such as W-2 or 1099 forms.

05

Proceed to claim any deductions or credits you qualify for. These could include deductions for mortgage interest, education expenses, medical expenses, or any other applicable deductions outlined in the tax form instructions.

Regarding who needs the third circuit upholds tax, it is generally applicable to individuals or businesses within the jurisdiction of the third circuit court. This includes several states such as Pennsylvania, New Jersey, and Delaware. Specifically, those who have a tax obligation within this jurisdiction may need to fill out and submit the third circuit upholds tax form. It is important to consult with a tax professional or refer to the specific guidelines provided by the relevant authorities to determine if you are required to file this form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is third circuit upholds tax?

The third circuit upholds tax is a tax regulation enforced by the third circuit court of appeals.

Who is required to file third circuit upholds tax?

Individuals, businesses, and organizations operating within the jurisdiction of the third circuit court of appeals are required to file third circuit upholds tax.

How to fill out third circuit upholds tax?

To fill out the third circuit upholds tax, you need to obtain the relevant forms from the court's website or office, provide the requested information accurately, and submit the completed forms along with any required documentation.

What is the purpose of third circuit upholds tax?

The purpose of the third circuit upholds tax is to generate revenue for the jurisdiction of the third circuit court of appeals and support the functioning of the court.

What information must be reported on third circuit upholds tax?

The specific information that must be reported on the third circuit upholds tax forms may vary, but generally it includes details of income, expenses, deductions, and any other relevant financial information.

When is the deadline to file third circuit upholds tax in 2023?

The deadline to file third circuit upholds tax in 2023 is typically April 15th, but it is always advisable to check for any updates or extensions provided by the court.

What is the penalty for the late filing of third circuit upholds tax?

The penalty for the late filing of third circuit upholds tax may vary depending on the specific rules and regulations of the court. It is recommended to consult the court's guidelines or consult a tax professional for accurate information.

How do I make edits in third circuit upholds tax without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit third circuit upholds tax and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for the third circuit upholds tax in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your third circuit upholds tax in seconds.

How do I edit third circuit upholds tax on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign third circuit upholds tax on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your third circuit upholds tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.