Get the free Form 3Y - 20 November 2007 - Willy Strothottedoc

Show details

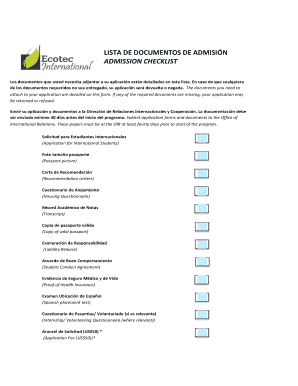

Appendix 3Y Change of Directors Interest Notice Rule 3.19A.2 Appendix 3Y Change of Directors Interest Notice Information or documents not available now must be given to ASX as soon as available. Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 3y - 20 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 3y - 20 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 3y - 20 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 3y - 20. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

How to fill out form 3y - 20

How to fill out form 3y - 20:

01

Start by carefully reading the instructions provided on the form. Make sure you understand the purpose and requirements of this particular form.

02

Gather all the necessary information and documents that are needed to complete the form accurately. This may include personal identification, financial information, or any other relevant details.

03

Fill in your personal details in the appropriate sections of the form. This typically includes your name, address, contact information, and any other requested personal information.

04

Follow the instructions on how to calculate and fill in the value for the expression "3y - 20". Substitute the value of y into the expression and solve it to determine the final value.

05

Double-check your entries and ensure that all the required fields are completed. Review your answers for accuracy and make any necessary corrections before proceeding.

06

If there are any additional sections or questions on the form, make sure to answer them accordingly and provide any supporting documents if needed.

07

Review the completed form one last time to ensure all information is accurate and complete. Make a copy of the form for your own records if necessary.

08

Submit the filled-out form by the designated method mentioned in the instructions. This may involve mailing it, submitting it online, or personally delivering it to the appropriate recipient.

Who needs form 3y - 20:

01

Individuals who are required to provide documentation or information involving the expression "3y - 20" may need to fill out this form. This could be in various contexts such as financial calculations, mathematical evaluations, or any situation that involves the specific equation.

02

Students or individuals studying mathematics or related fields might encounter this form as an exercise or assignment. It could be used to practice solving equations involving variables, specifically in the form of "3y - 20".

03

Professionals working in specific industries where the "3y - 20" equation is relevant, such as finance or engineering, may use this form as a means of collecting data or performing calculations related to their work.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 3y - 20?

Form 3y - 20 is a tax form used to report income and expenses.

Who is required to file form 3y - 20?

Individuals or businesses that meet the income threshold set by the tax authorities.

How to fill out form 3y - 20?

Form 3y - 20 can be filled out electronically or manually, following the instructions provided by the tax authorities.

What is the purpose of form 3y - 20?

The purpose of form 3y - 20 is to accurately report income and expenses for tax purposes.

What information must be reported on form 3y - 20?

Income sources, expenses, deductions, and other relevant financial information.

When is the deadline to file form 3y - 20 in 2024?

The deadline to file form 3y - 20 in 2024 is April 15th.

What is the penalty for the late filing of form 3y - 20?

The penalty for late filing of form 3y - 20 is a monetary fine imposed by the tax authorities.

How can I manage my form 3y - 20 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your form 3y - 20 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete form 3y - 20 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your form 3y - 20, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I fill out form 3y - 20 on an Android device?

Use the pdfFiller Android app to finish your form 3y - 20 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your form 3y - 20 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.